Decentralized exchanges (DEXs) offer peer-to-peer trading with no central authority, enhancing security and user control over private keys, while custodial wallets store users' assets on centralized platforms with managed security protocols. DEXs facilitate greater privacy and reduce risks of hacking associated with centralized custody, but custodial wallets provide user-friendly interfaces and quicker recovery options. Explore the key differences and benefits of decentralized exchanges and custodial wallets to optimize your digital asset management.

Why it is important

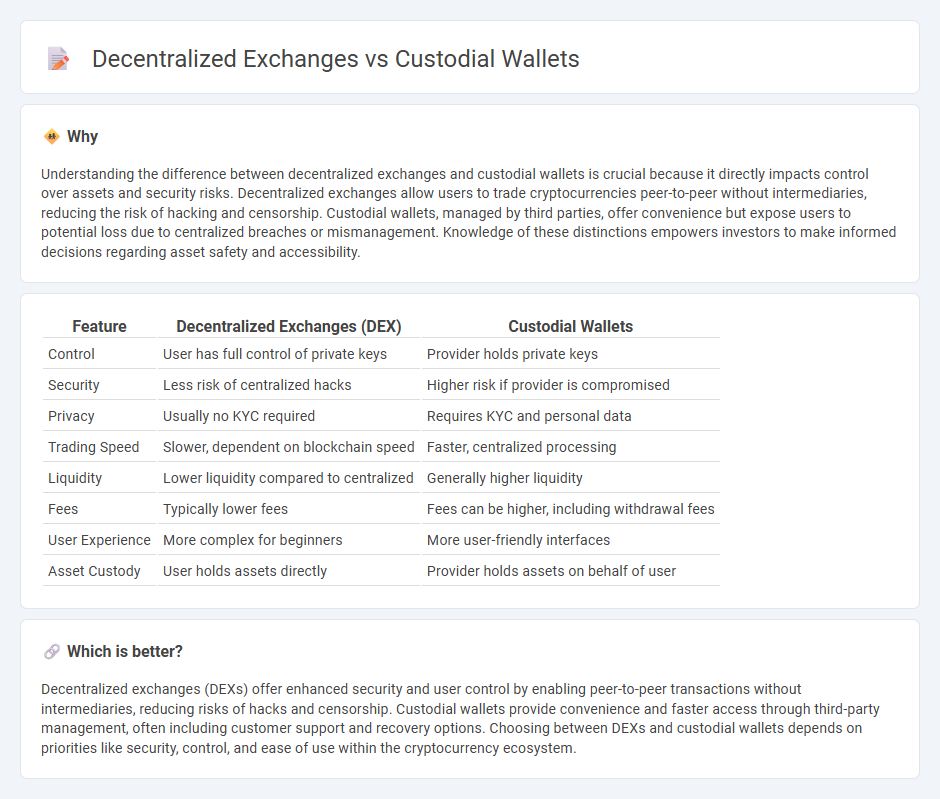

Understanding the difference between decentralized exchanges and custodial wallets is crucial because it directly impacts control over assets and security risks. Decentralized exchanges allow users to trade cryptocurrencies peer-to-peer without intermediaries, reducing the risk of hacking and censorship. Custodial wallets, managed by third parties, offer convenience but expose users to potential loss due to centralized breaches or mismanagement. Knowledge of these distinctions empowers investors to make informed decisions regarding asset safety and accessibility.

Comparison Table

| Feature | Decentralized Exchanges (DEX) | Custodial Wallets |

|---|---|---|

| Control | User has full control of private keys | Provider holds private keys |

| Security | Less risk of centralized hacks | Higher risk if provider is compromised |

| Privacy | Usually no KYC required | Requires KYC and personal data |

| Trading Speed | Slower, dependent on blockchain speed | Faster, centralized processing |

| Liquidity | Lower liquidity compared to centralized | Generally higher liquidity |

| Fees | Typically lower fees | Fees can be higher, including withdrawal fees |

| User Experience | More complex for beginners | More user-friendly interfaces |

| Asset Custody | User holds assets directly | Provider holds assets on behalf of user |

Which is better?

Decentralized exchanges (DEXs) offer enhanced security and user control by enabling peer-to-peer transactions without intermediaries, reducing risks of hacks and censorship. Custodial wallets provide convenience and faster access through third-party management, often including customer support and recovery options. Choosing between DEXs and custodial wallets depends on priorities like security, control, and ease of use within the cryptocurrency ecosystem.

Connection

Decentralized exchanges (DEXs) enable peer-to-peer cryptocurrency trading without intermediaries, relying on smart contracts for secure, trustless transactions. Custodial wallets store users' private keys and assets on centralized platforms, offering ease of use but increased counterparty risk. The connection between DEXs and custodial wallets lies in asset accessibility; users often transfer tokens from custodial wallets to non-custodial wallets or directly interact with DEXs for decentralized trading, balancing security and convenience.

Key Terms

Private Keys

Custodial wallets store private keys on behalf of users, granting the service provider control over asset access and security, whereas decentralized exchanges (DEXs) allow users to retain ownership of their private keys, ensuring full control and reducing the risk of centralized hacks. The fundamental difference lies in trust; custodial wallets require users to trust third parties for key management, while DEXs leverage blockchain technology to enable peer-to-peer transactions without intermediaries. Explore further to understand how private key management influences security and user autonomy in cryptocurrency trading.

Centralization

Custodial wallets rely on third-party providers to hold and manage users' private keys, increasing centralization risks such as potential hacks and lack of user control. Decentralized exchanges (DEXs) operate without intermediaries, enabling peer-to-peer trades directly on the blockchain and promoting user sovereignty and security. Explore how centralization impacts control, security, and transparency between custodial wallets and decentralized exchanges.

Peer-to-Peer Trading

Custodial wallets hold users' private keys and facilitate asset management but rely on centralized servers, impacting security and control in Peer-to-Peer (P2P) trading. Decentralized exchanges (DEXs) enable direct asset swaps between users without intermediaries, enhancing privacy and reducing counterparty risk in P2P transactions. Explore the benefits and challenges of each to understand how they shape the future of Peer-to-Peer trading.

Source and External Links

What Is a Custodial Wallet - 21 Analytics - A custodial wallet is a cryptocurrency wallet where a third party, like a crypto exchange or financial institution, holds and manages the private keys, so the user does not have full control over the wallet.

Custodial vs. non-custodial wallets: Who holds your crypto? - Kraken - Custodial wallets involve trusting a third party to manage your private keys and keep your cryptocurrency safe, offering convenience especially for beginners, but also entail risks if the custodian's security is compromised.

Custodial vs non-custodial wallets: What's the difference? - MoonPay - Custodial wallets give a third party permission to hold your private keys and typically feature backup services and easy interfaces, but they require complete trust in the custodian's security and reliability.

dowidth.com

dowidth.com