Sovereign debt restructuring involves renegotiating the terms of a country's debt to restore financial stability and avoid default, often including extended maturities or reduced interest rates. In contrast, liquidation refers to the process of selling off assets to repay creditors, typically resulting in a loss of sovereign control and economic turmoil. Explore the critical differences and implications of these two approaches to managing sovereign debt crises.

Why it is important

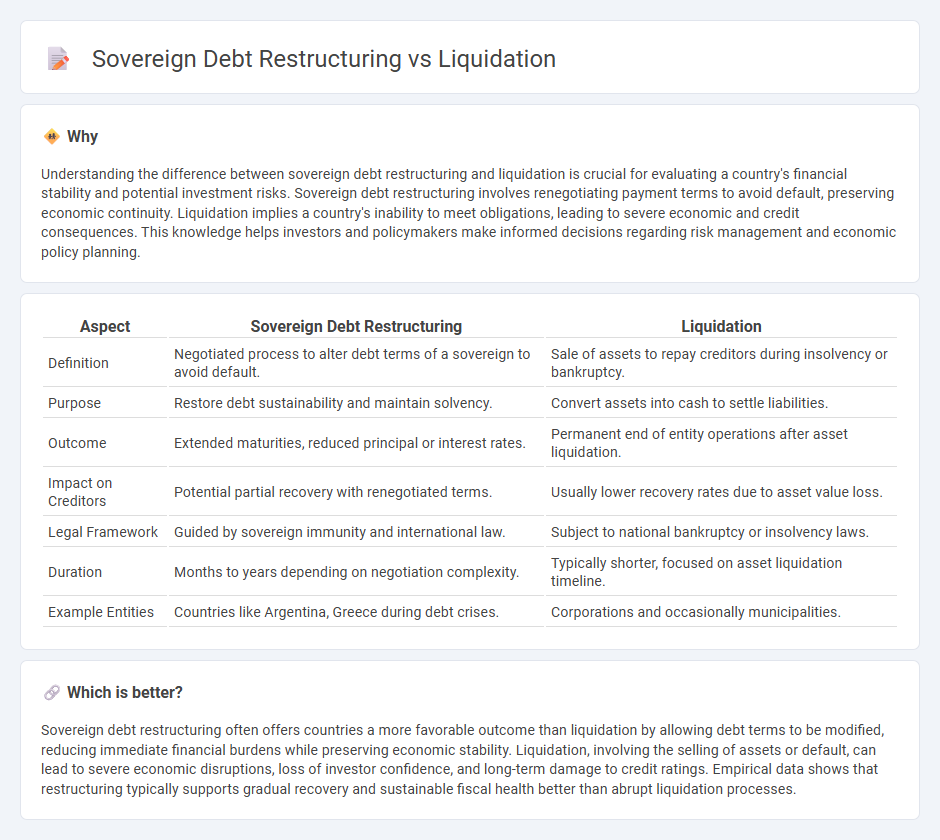

Understanding the difference between sovereign debt restructuring and liquidation is crucial for evaluating a country's financial stability and potential investment risks. Sovereign debt restructuring involves renegotiating payment terms to avoid default, preserving economic continuity. Liquidation implies a country's inability to meet obligations, leading to severe economic and credit consequences. This knowledge helps investors and policymakers make informed decisions regarding risk management and economic policy planning.

Comparison Table

| Aspect | Sovereign Debt Restructuring | Liquidation |

|---|---|---|

| Definition | Negotiated process to alter debt terms of a sovereign to avoid default. | Sale of assets to repay creditors during insolvency or bankruptcy. |

| Purpose | Restore debt sustainability and maintain solvency. | Convert assets into cash to settle liabilities. |

| Outcome | Extended maturities, reduced principal or interest rates. | Permanent end of entity operations after asset liquidation. |

| Impact on Creditors | Potential partial recovery with renegotiated terms. | Usually lower recovery rates due to asset value loss. |

| Legal Framework | Guided by sovereign immunity and international law. | Subject to national bankruptcy or insolvency laws. |

| Duration | Months to years depending on negotiation complexity. | Typically shorter, focused on asset liquidation timeline. |

| Example Entities | Countries like Argentina, Greece during debt crises. | Corporations and occasionally municipalities. |

Which is better?

Sovereign debt restructuring often offers countries a more favorable outcome than liquidation by allowing debt terms to be modified, reducing immediate financial burdens while preserving economic stability. Liquidation, involving the selling of assets or default, can lead to severe economic disruptions, loss of investor confidence, and long-term damage to credit ratings. Empirical data shows that restructuring typically supports gradual recovery and sustainable fiscal health better than abrupt liquidation processes.

Connection

Sovereign debt restructuring involves renegotiating the terms of a country's outstanding debt to improve its repayment capacity and avoid default, while liquidation refers to the process of selling off a country's assets to meet debt obligations in extreme cases. Both concepts are interconnected as restructuring often aims to prevent liquidation by providing a feasible repayment plan, thereby stabilizing the nation's financial position. Effective sovereign debt management requires balancing restructuring efforts to maintain investor confidence and avoiding liquidation's disruptive economic consequences.

Key Terms

Insolvency

Insolvency plays a crucial role in differentiating liquidation from sovereign debt restructuring, as liquidation involves the complete winding up of a debtor's assets to satisfy creditors, whereas restructuring seeks to renegotiate terms to restore solvency and debt sustainability. Sovereign debt restructuring typically employs mechanisms like debt rescheduling, haircuts, or swaps to avoid insolvency while maintaining economic stability. Explore detailed strategies and case studies to understand the nuanced approaches in managing sovereign insolvency risks.

Haircut

Haircut in sovereign debt restructuring refers to the percentage reduction in the debt's face value that creditors agree to accept, often crucial for restoring fiscal sustainability. Liquidation involves selling off assets to repay debt, typically without negotiated haircuts, potentially leading to greater losses for creditors. Explore more on how haircuts impact the recovery rates and negotiation strategies in sovereign debt crises.

Collective Action Clauses (CACs)

Collective Action Clauses (CACs) are critical tools in sovereign debt restructuring, enabling a supermajority of bondholders to agree on modifications that become binding for all holders, thereby preventing holdout creditors from derailing agreements. In contrast, liquidation procedures typically involve asset sales to repay creditors, which is less applicable to sovereign debt due to the non-collateralized nature of state obligations. Explore more to understand how CACs enhance debt sustainability and stabilize financial markets during restructuring processes.

Source and External Links

Liquidation - Wikipedia - Liquidation is the accounting process to end a company by redistributing its assets and property, involving winding-up in various forms and possible legal actions against misconduct before dissolution.

LIQUIDATION Definition & Meaning - Dictionary.com - Liquidation is the process of realizing assets and discharging liabilities to conclude a business or estate.

liquidation | Wex | US Law | LII / Legal Information Institute - Liquidation means converting assets to cash and distributing it, especially when winding up a business, and can also refer to settling debts or damages to a cash value.

dowidth.com

dowidth.com