Buy Now Pay Later (BNPL) integration offers consumers flexible, interest-free installment payments at checkout, enhancing purchasing power and increasing conversion rates for retailers. Point of Sale (POS) financing integration provides access to larger loan amounts with longer repayment terms but may involve interest charges and credit checks, suitable for higher-ticket purchases. Explore the advantages and ideal applications of each financing method to optimize your retail strategy.

Why it is important

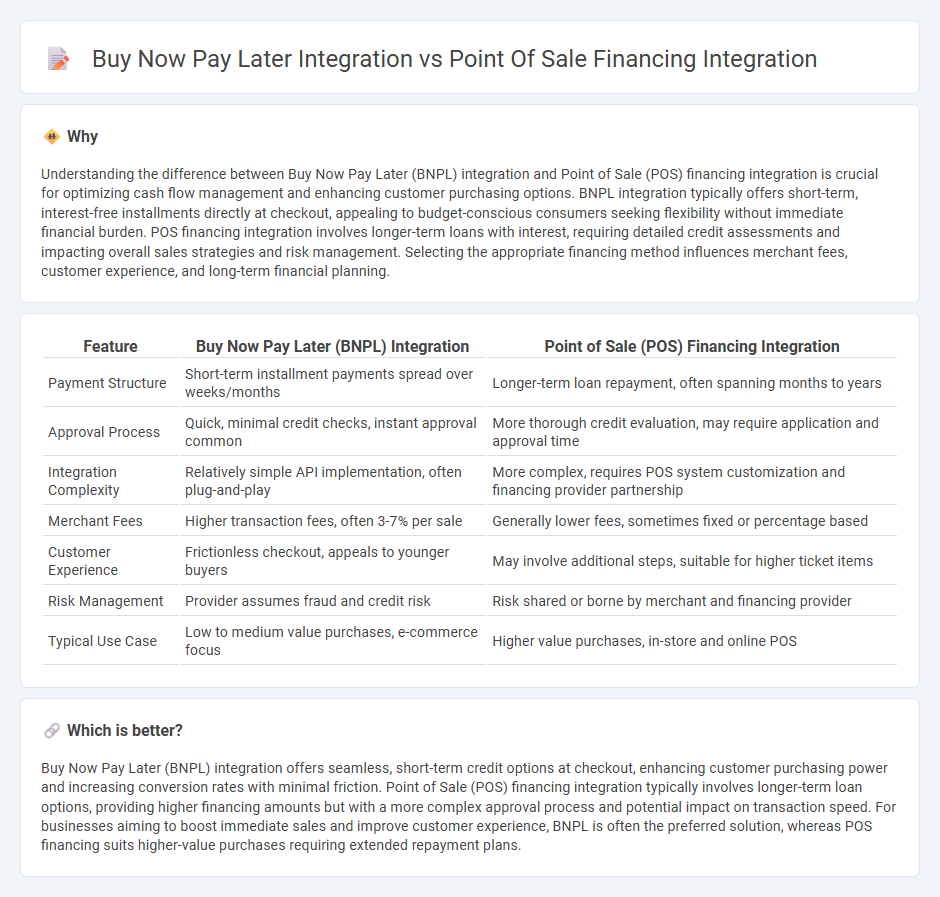

Understanding the difference between Buy Now Pay Later (BNPL) integration and Point of Sale (POS) financing integration is crucial for optimizing cash flow management and enhancing customer purchasing options. BNPL integration typically offers short-term, interest-free installments directly at checkout, appealing to budget-conscious consumers seeking flexibility without immediate financial burden. POS financing integration involves longer-term loans with interest, requiring detailed credit assessments and impacting overall sales strategies and risk management. Selecting the appropriate financing method influences merchant fees, customer experience, and long-term financial planning.

Comparison Table

| Feature | Buy Now Pay Later (BNPL) Integration | Point of Sale (POS) Financing Integration |

|---|---|---|

| Payment Structure | Short-term installment payments spread over weeks/months | Longer-term loan repayment, often spanning months to years |

| Approval Process | Quick, minimal credit checks, instant approval common | More thorough credit evaluation, may require application and approval time |

| Integration Complexity | Relatively simple API implementation, often plug-and-play | More complex, requires POS system customization and financing provider partnership |

| Merchant Fees | Higher transaction fees, often 3-7% per sale | Generally lower fees, sometimes fixed or percentage based |

| Customer Experience | Frictionless checkout, appeals to younger buyers | May involve additional steps, suitable for higher ticket items |

| Risk Management | Provider assumes fraud and credit risk | Risk shared or borne by merchant and financing provider |

| Typical Use Case | Low to medium value purchases, e-commerce focus | Higher value purchases, in-store and online POS |

Which is better?

Buy Now Pay Later (BNPL) integration offers seamless, short-term credit options at checkout, enhancing customer purchasing power and increasing conversion rates with minimal friction. Point of Sale (POS) financing integration typically involves longer-term loan options, providing higher financing amounts but with a more complex approval process and potential impact on transaction speed. For businesses aiming to boost immediate sales and improve customer experience, BNPL is often the preferred solution, whereas POS financing suits higher-value purchases requiring extended repayment plans.

Connection

Buy Now Pay Later (BNPL) integration and Point of Sale (POS) financing integration are connected through their shared goal of enhancing consumer purchasing power by offering flexible payment options directly at checkout. Both systems leverage real-time credit evaluation and seamless API integration with POS terminals to provide instant approval and financing solutions. This connection improves conversion rates and average order values by allowing consumers to spread payments without disrupting the transaction flow.

Key Terms

Merchant Acquisition

Point of Sale (POS) financing integration enhances merchant acquisition by offering flexible, upfront payment solutions directly within the checkout process, increasing average transaction values and customer retention. Buy Now Pay Later (BNPL) integration attracts merchants by providing consumer-friendly installment options that boost conversion rates and reduce cart abandonment. Explore how these financing methods impact merchant growth and profitability in greater detail.

Credit Risk Assessment

Point of Sale (POS) financing integration involves real-time credit risk assessment that evaluates the borrower's creditworthiness before approving installment payments, leveraging detailed credit scores and financial data to minimize default risk. Buy Now Pay Later (BNPL) platforms typically conduct a lighter, quicker credit evaluation, often relying on alternative data and affordability checks without in-depth credit bureau consultation, leading to varying risk exposure. Explore more about how these credit risk assessment methods impact merchant partnerships and customer experiences.

Consumer Checkout Experience

Point of Sale (POS) financing integration offers consumers a seamless credit option embedded directly within the checkout process, enabling immediate approval and flexible payment plans that enhance convenience and purchasing power. Buy Now Pay Later (BNPL) integration simplifies transactions by allowing shoppers to split payments into interest-free installments, improving affordability without upfront costs or lengthy credit checks. Explore how each financing solution can transform your consumer checkout experience by enhancing payment flexibility and boosting conversion rates.

Source and External Links

6 POS Financing Solutions for Your Point of Sale - POS financing integration involves embedding multiple lenders into the point of sale via a waterfall financing model, enabling higher approval rates and diverse financing options tailored to customer needs, simplifying merchant management on a unified platform.

ChargeAfter: Embedded Financing & Consumer Finance ... - ChargeAfter offers an embedded lending platform that seamlessly integrates multiple lenders into POS systems, standardizing lending processes across channels and maximizing approvals with real-time lender matching and waterfall lending technology.

Point of Sale (POS) Lending Software - LendFoundry's POS lending software provides merchants and lenders with real-time credit decisioning, automated compliance, and flexible payment options, with API-driven integration into retail POS and e-commerce platforms to deliver instant financing at checkout.

dowidth.com

dowidth.com