Basis trading exploits price discrepancies between spot and futures markets to generate profits through arbitrage opportunities. Market making involves continuously quoting buy and sell prices to provide liquidity while capturing the bid-ask spread as revenue. Explore the key differences and strategies behind basis trading and market making to optimize your financial market approach.

Why it is important

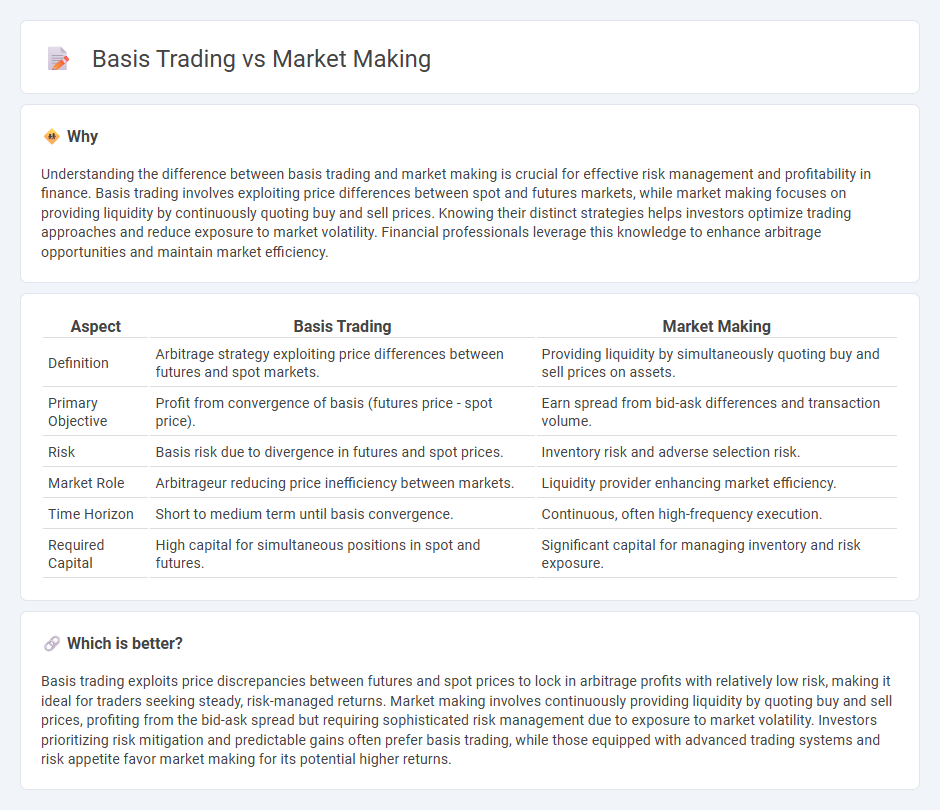

Understanding the difference between basis trading and market making is crucial for effective risk management and profitability in finance. Basis trading involves exploiting price differences between spot and futures markets, while market making focuses on providing liquidity by continuously quoting buy and sell prices. Knowing their distinct strategies helps investors optimize trading approaches and reduce exposure to market volatility. Financial professionals leverage this knowledge to enhance arbitrage opportunities and maintain market efficiency.

Comparison Table

| Aspect | Basis Trading | Market Making |

|---|---|---|

| Definition | Arbitrage strategy exploiting price differences between futures and spot markets. | Providing liquidity by simultaneously quoting buy and sell prices on assets. |

| Primary Objective | Profit from convergence of basis (futures price - spot price). | Earn spread from bid-ask differences and transaction volume. |

| Risk | Basis risk due to divergence in futures and spot prices. | Inventory risk and adverse selection risk. |

| Market Role | Arbitrageur reducing price inefficiency between markets. | Liquidity provider enhancing market efficiency. |

| Time Horizon | Short to medium term until basis convergence. | Continuous, often high-frequency execution. |

| Required Capital | High capital for simultaneous positions in spot and futures. | Significant capital for managing inventory and risk exposure. |

Which is better?

Basis trading exploits price discrepancies between futures and spot prices to lock in arbitrage profits with relatively low risk, making it ideal for traders seeking steady, risk-managed returns. Market making involves continuously providing liquidity by quoting buy and sell prices, profiting from the bid-ask spread but requiring sophisticated risk management due to exposure to market volatility. Investors prioritizing risk mitigation and predictable gains often prefer basis trading, while those equipped with advanced trading systems and risk appetite favor market making for its potential higher returns.

Connection

Basis trading exploits price differences between futures contracts and their underlying assets, creating opportunities for arbitrage. Market making provides liquidity in these markets by continuously quoting buy and sell prices, facilitating smoother price convergence. Both strategies rely on efficient price discovery and risk management to capitalize on price inefficiencies.

Key Terms

Liquidity

Market making enhances liquidity by continuously providing buy and sell quotes, enabling smoother price discovery and tighter spreads across financial markets. Basis trading exploits price differentials between spot and futures markets, contributing to liquidity by arbitraging discrepancies and aligning prices. Explore the distinct mechanisms and impacts of both strategies to better understand their role in market liquidity.

Spread

Market making involves continuously quoting bid and ask prices to capture the bid-ask spread as profit, providing liquidity to the market. Basis trading exploits differences between the spot price and futures price of an asset, aiming to profit from the convergence of these prices before contract expiration. Explore further to understand how spread dynamics influence risk and profitability in both strategies.

Arbitrage

Market making involves continuously providing buy and sell quotes to capture the bid-ask spread, generating consistent profits by facilitating liquidity. Basis trading exploits price differences between spot and futures markets to arbitrage the basis, locking in riskless returns by capitalizing on temporal or spatial price inefficiencies. Explore more about how these arbitrage strategies enhance trading efficiency and risk management.

Source and External Links

Mastering the Market Maker Trading Strategy | EPAM SolutionsHub - Market makers earn profits primarily through the bid-ask spread by buying securities at a lower bid price and selling at a higher ask price, managing inventory to capitalize on price movements, and analyzing order flow to anticipate market changes while providing liquidity and complying with regulations.

Market Making and Mean Reversion - CIS UPenn - Market making involves quoting both buy and sell prices to profit from the spread without holding large net positions, thus providing liquidity to markets like foreign exchange and stock exchanges where firms act as official or unofficial market makers.

Market Maker - Definition, Role, How They Work - A market maker is a firm or individual that continuously provides bids and asks for securities, profiting from the bid-ask spread and taking on inventory risk while maintaining market liquidity in various assets including stocks and real estate.

dowidth.com

dowidth.com