Decentralized autonomous organization (DAO) treasuries leverage blockchain technology to enable transparent, automated management of collective funds governed by smart contracts. In contrast, Community chests typically operate as centralized funds managed by elected representatives or committees within local organizations, focusing on philanthropic allocations and community projects. Explore the distinct financial mechanisms and governance models to understand which structure best aligns with your organizational goals.

Why it is important

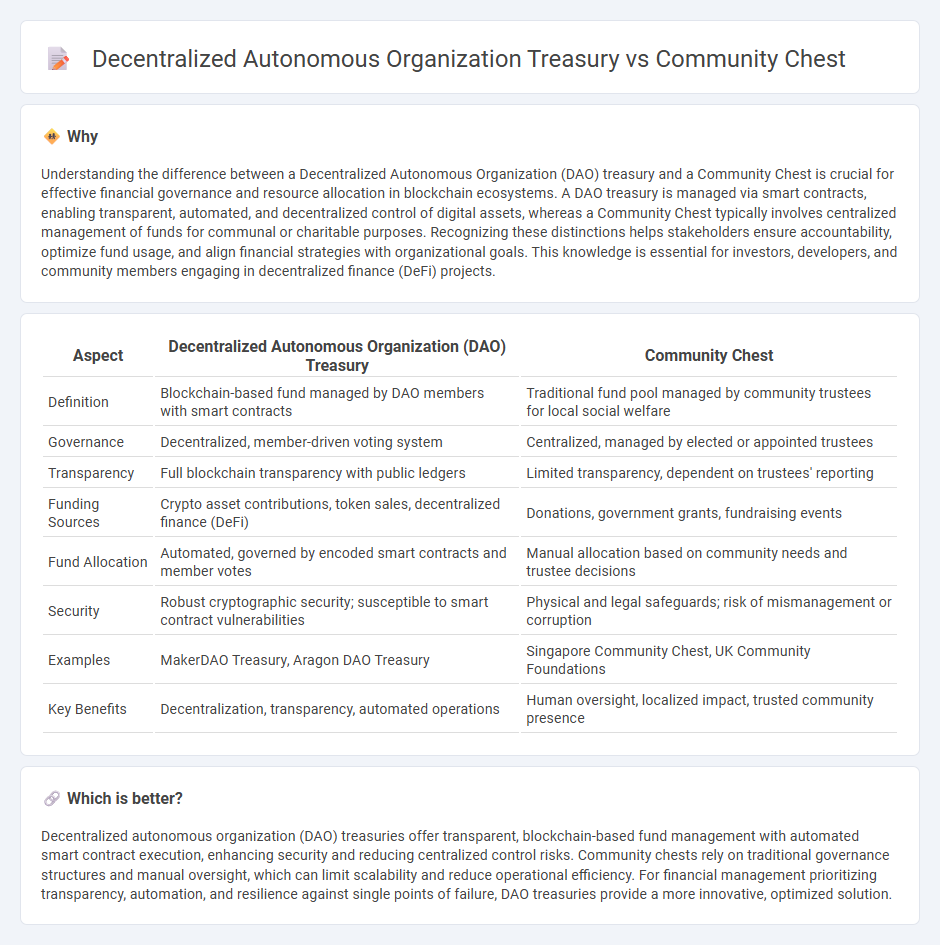

Understanding the difference between a Decentralized Autonomous Organization (DAO) treasury and a Community Chest is crucial for effective financial governance and resource allocation in blockchain ecosystems. A DAO treasury is managed via smart contracts, enabling transparent, automated, and decentralized control of digital assets, whereas a Community Chest typically involves centralized management of funds for communal or charitable purposes. Recognizing these distinctions helps stakeholders ensure accountability, optimize fund usage, and align financial strategies with organizational goals. This knowledge is essential for investors, developers, and community members engaging in decentralized finance (DeFi) projects.

Comparison Table

| Aspect | Decentralized Autonomous Organization (DAO) Treasury | Community Chest |

|---|---|---|

| Definition | Blockchain-based fund managed by DAO members with smart contracts | Traditional fund pool managed by community trustees for local social welfare |

| Governance | Decentralized, member-driven voting system | Centralized, managed by elected or appointed trustees |

| Transparency | Full blockchain transparency with public ledgers | Limited transparency, dependent on trustees' reporting |

| Funding Sources | Crypto asset contributions, token sales, decentralized finance (DeFi) | Donations, government grants, fundraising events |

| Fund Allocation | Automated, governed by encoded smart contracts and member votes | Manual allocation based on community needs and trustee decisions |

| Security | Robust cryptographic security; susceptible to smart contract vulnerabilities | Physical and legal safeguards; risk of mismanagement or corruption |

| Examples | MakerDAO Treasury, Aragon DAO Treasury | Singapore Community Chest, UK Community Foundations |

| Key Benefits | Decentralization, transparency, automated operations | Human oversight, localized impact, trusted community presence |

Which is better?

Decentralized autonomous organization (DAO) treasuries offer transparent, blockchain-based fund management with automated smart contract execution, enhancing security and reducing centralized control risks. Community chests rely on traditional governance structures and manual oversight, which can limit scalability and reduce operational efficiency. For financial management prioritizing transparency, automation, and resilience against single points of failure, DAO treasuries provide a more innovative, optimized solution.

Connection

Decentralized Autonomous Organization (DAO) treasury manages collective funds through blockchain-based smart contracts, ensuring transparent and secure allocation of resources. Community chests in DAOs function as communal funds sourced from member contributions, grants, or project revenues, facilitating decentralized decision-making for budget distribution. Both systems enhance financial governance by enabling stakeholder participation in managing and deploying assets within the decentralized ecosystem.

Key Terms

Collective Fund Management

Community chests centralize fund management to support local projects through pooled donations and grants, ensuring transparent allocation within specific communities. Decentralized Autonomous Organization (DAO) treasuries leverage blockchain technology for autonomous fund governance, enabling token holders to vote on resource distribution with enacted smart contracts. Explore the efficiencies and challenges of each approach to understand their impact on decentralized collective fund management.

Governance Structure

Community chests operate under centralized governance frameworks, often managed by elected representatives or designated committees to oversee fund allocation and welfare programs. Decentralized Autonomous Organization (DAO) treasuries rely on blockchain-based protocols where token holders participate in decision-making through transparent voting mechanisms, ensuring democratized control and automated execution of financial operations. Explore further to understand how governance structures impact transparency and stakeholder engagement in these financial entities.

Transparency

Community chests typically operate with transparent fund allocation processes, often governed by local committees or associations, ensuring clear tracking of donations and expenditures. Decentralized Autonomous Organization (DAO) treasuries leverage blockchain technology to enable immutable, real-time visibility of all transactions without centralized control, enhancing accountability through smart contracts. Explore how these financial models differ in advancing transparency within community governance.

Source and External Links

Community Chest (organization) - Wikipedia - Community Chest refers to charitable endowment funds pooled by communities for philanthropic giving; first founded in 1913 in Cleveland, Ohio, it evolved into what is now United Way in the U.S., with some local groups still retaining the name.

Community Chest - Wikipedia - Originally a box for holding valuables requiring multiple keys to prevent embezzlement, "Community Chest" also refers to several organizations worldwide focused on charity, as well as the famous cards in the board game Monopoly.

Community Chest -- Monopoly GO Help Center - In the game Monopoly GO, Community Chest is a feature where players team up with friends to unlock prizes weekly, representing a gamified evolution of the classic Community Chest concept.

dowidth.com

dowidth.com