Retail algorithmic trading leverages advanced computer algorithms to execute trades at high speeds based on predefined strategies, offering precision and efficiency unmatched by manual methods. Copy trading allows investors to replicate the trades of experienced traders in real time, making it accessible for those with limited market knowledge. Discover how these innovative approaches can transform your investment portfolio by exploring their unique advantages.

Why it is important

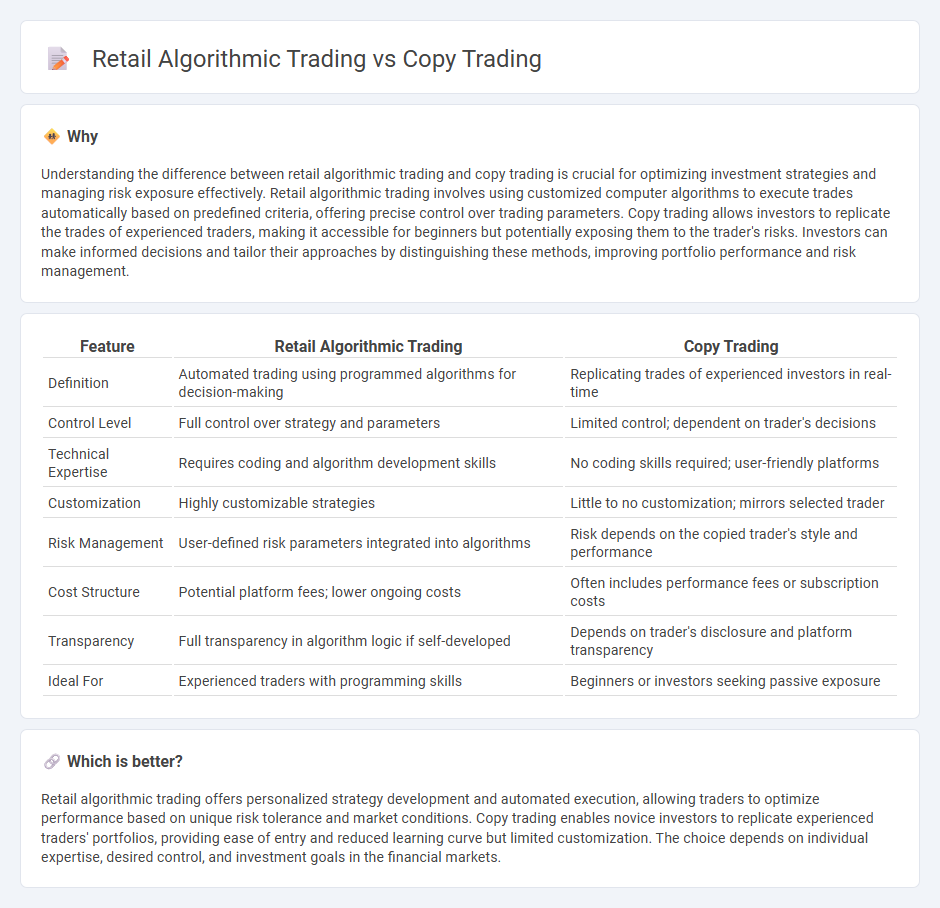

Understanding the difference between retail algorithmic trading and copy trading is crucial for optimizing investment strategies and managing risk exposure effectively. Retail algorithmic trading involves using customized computer algorithms to execute trades automatically based on predefined criteria, offering precise control over trading parameters. Copy trading allows investors to replicate the trades of experienced traders, making it accessible for beginners but potentially exposing them to the trader's risks. Investors can make informed decisions and tailor their approaches by distinguishing these methods, improving portfolio performance and risk management.

Comparison Table

| Feature | Retail Algorithmic Trading | Copy Trading |

|---|---|---|

| Definition | Automated trading using programmed algorithms for decision-making | Replicating trades of experienced investors in real-time |

| Control Level | Full control over strategy and parameters | Limited control; dependent on trader's decisions |

| Technical Expertise | Requires coding and algorithm development skills | No coding skills required; user-friendly platforms |

| Customization | Highly customizable strategies | Little to no customization; mirrors selected trader |

| Risk Management | User-defined risk parameters integrated into algorithms | Risk depends on the copied trader's style and performance |

| Cost Structure | Potential platform fees; lower ongoing costs | Often includes performance fees or subscription costs |

| Transparency | Full transparency in algorithm logic if self-developed | Depends on trader's disclosure and platform transparency |

| Ideal For | Experienced traders with programming skills | Beginners or investors seeking passive exposure |

Which is better?

Retail algorithmic trading offers personalized strategy development and automated execution, allowing traders to optimize performance based on unique risk tolerance and market conditions. Copy trading enables novice investors to replicate experienced traders' portfolios, providing ease of entry and reduced learning curve but limited customization. The choice depends on individual expertise, desired control, and investment goals in the financial markets.

Connection

Retail algorithmic trading leverages pre-programmed strategies to automate trade executions, enabling individual investors to participate efficiently in financial markets. Copy trading connects to this by allowing investors to replicate the trades of successful algorithmic traders, fostering accessible portfolio diversification and strategy adoption. Both approaches utilize technology-driven solutions to democratize trading and enhance decision-making processes in retail finance.

Key Terms

Copy Trading: Signal Provider

Copy trading allows investors to automatically replicate trades from experienced signal providers, leveraging their expertise without needing advanced market knowledge. Signal providers employ sophisticated strategies and real-time data analytics to generate high-probability trading signals that followers can seamlessly mirror. Discover more about how choosing the right signal provider can enhance your copy trading success.

Retail Algorithmic Trading: Backtesting

Retail algorithmic trading leverages backtesting to evaluate trading strategies using historical market data, enhancing decision-making accuracy without risking actual capital. This process identifies the effectiveness and potential risks of algorithms before deployment in live markets, optimizing performance and minimizing unexpected losses. Explore more about how backtesting transforms retail algorithmic trading strategies for consistent profitability.

Both: Risk Management

Copy trading allows investors to mimic the trades of experienced traders, potentially reducing individual risk through diversification but exposing them to the original trader's mistakes. Retail algorithmic trading relies on automated strategies that can execute trades with precision and speed, minimizing emotional bias but requiring robust risk controls to manage market volatility and system failures. Explore more to understand how risk management techniques vary between these two trading approaches.

Source and External Links

Copy trading - Wikipedia - Copy trading enables individuals to automatically copy positions opened and managed by selected traders, linking a portion of the copier's funds to the leader's account, allowing trades to be replicated proportionally and offering a form of delegated portfolio management.

Copy Trading | Copy the Best Traders in 2025 - Copy trading allows a trader (the copier) to automatically replicate the trades of a more experienced trader (the lead), providing a hands-off approach for beginners by leveraging expert strategies with options for customization based on performance and risk tolerance.

What is Copy Trading, How Does it Work ... - Copy trading is an investment method where the trades of chosen experienced traders are automatically copied in real time, with customizable capital allocation and risk settings, suitable for novices and busy traders.

dowidth.com

dowidth.com