Altcoin staking offers passive income through blockchain network participation, while options trading involves strategic contracts with potential for high returns and risks. Understanding the volatility, liquidity, and market dynamics of each can enhance financial decision-making in cryptocurrency investments. Explore these methods further to identify the best fit for your financial goals.

Why it is important

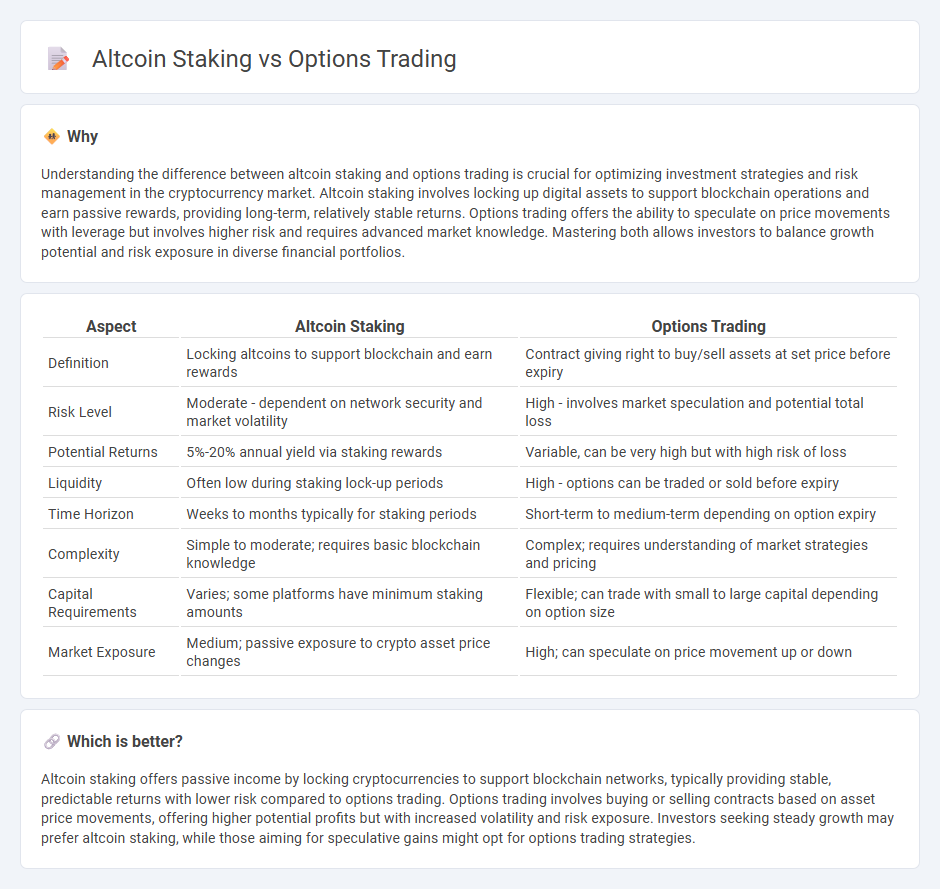

Understanding the difference between altcoin staking and options trading is crucial for optimizing investment strategies and risk management in the cryptocurrency market. Altcoin staking involves locking up digital assets to support blockchain operations and earn passive rewards, providing long-term, relatively stable returns. Options trading offers the ability to speculate on price movements with leverage but involves higher risk and requires advanced market knowledge. Mastering both allows investors to balance growth potential and risk exposure in diverse financial portfolios.

Comparison Table

| Aspect | Altcoin Staking | Options Trading |

|---|---|---|

| Definition | Locking altcoins to support blockchain and earn rewards | Contract giving right to buy/sell assets at set price before expiry |

| Risk Level | Moderate - dependent on network security and market volatility | High - involves market speculation and potential total loss |

| Potential Returns | 5%-20% annual yield via staking rewards | Variable, can be very high but with high risk of loss |

| Liquidity | Often low during staking lock-up periods | High - options can be traded or sold before expiry |

| Time Horizon | Weeks to months typically for staking periods | Short-term to medium-term depending on option expiry |

| Complexity | Simple to moderate; requires basic blockchain knowledge | Complex; requires understanding of market strategies and pricing |

| Capital Requirements | Varies; some platforms have minimum staking amounts | Flexible; can trade with small to large capital depending on option size |

| Market Exposure | Medium; passive exposure to crypto asset price changes | High; can speculate on price movement up or down |

Which is better?

Altcoin staking offers passive income by locking cryptocurrencies to support blockchain networks, typically providing stable, predictable returns with lower risk compared to options trading. Options trading involves buying or selling contracts based on asset price movements, offering higher potential profits but with increased volatility and risk exposure. Investors seeking steady growth may prefer altcoin staking, while those aiming for speculative gains might opt for options trading strategies.

Connection

Altcoin staking and options trading intersect as both involve capital allocation strategies aimed at generating passive income and managing risk in cryptocurrency markets. Staking altcoins secures blockchain networks while earning rewards, which can serve as collateral or liquidity for options trading, enhancing portfolio flexibility. Options trading on cryptocurrency assets enables investors to hedge against price volatility, complementing the steady returns from altcoin staking and optimizing overall financial strategies.

Key Terms

Derivatives

Options trading involves contracts granting the right to buy or sell an asset at a predetermined price, primarily used for hedging and speculative strategies in financial markets. Altcoin staking requires holding and locking cryptocurrencies to support blockchain operations, earning rewards but lacking leverage and derivative contract benefits. Explore deeper insights into derivatives to understand their strategic advantages over staking opportunities.

Yield

Options trading offers potentially high-yield returns through strategic buying and selling of contracts based on underlying assets, with returns influenced by market volatility and timing. Altcoin staking provides a steady, passive income stream by locking up tokens to support blockchain networks, often offering annual percentage yields (APYs) that vary significantly by coin and platform risk. Explore detailed comparisons and yield optimization strategies to make informed investment decisions.

Volatility

Options trading involves capitalizing on market volatility to profit from price fluctuations within a specific timeframe, making it a high-risk, high-reward strategy. Altcoin staking offers more stability by earning rewards through holding and supporting blockchain networks, with returns less sensitive to short-term price volatility. Explore deeper insights into how volatility impacts these investment strategies to optimize your portfolio.

Source and External Links

Options | FINRA.org - Options are contracts giving investors the right to buy or sell a stock without owning it, where profits depend on movements of the underlying asset relative to the strike price, and can be initiated by buying or selling calls or puts with exit by doing the reverse transaction.

Options Trading: Step-by-Step Guide for Beginners - NerdWallet - Options trading involves buying or selling contracts that allow you to buy or sell stock at a set price by a certain date, requiring an options trading account and knowledge of strike prices and advanced strategies to profit from price movements.

Option (finance) - Wikipedia - Options are contracts giving the holder the right to buy or sell an asset at a strike price before expiration, commonly used as speculative or hedging tools, with examples like long call options where profit occurs if the underlying asset's price rises above the strike plus premium paid.

dowidth.com

dowidth.com