Direct indexing offers personalized portfolio customization by allowing investors to buy individual securities that mirror an index, optimizing tax efficiency and control over holdings. Exchange-Traded Funds (ETFs) provide diversification through a single investment vehicle with lower costs and high liquidity but less customization. Explore deeper insights comparing direct indexing and ETFs to optimize your investment strategy.

Why it is important

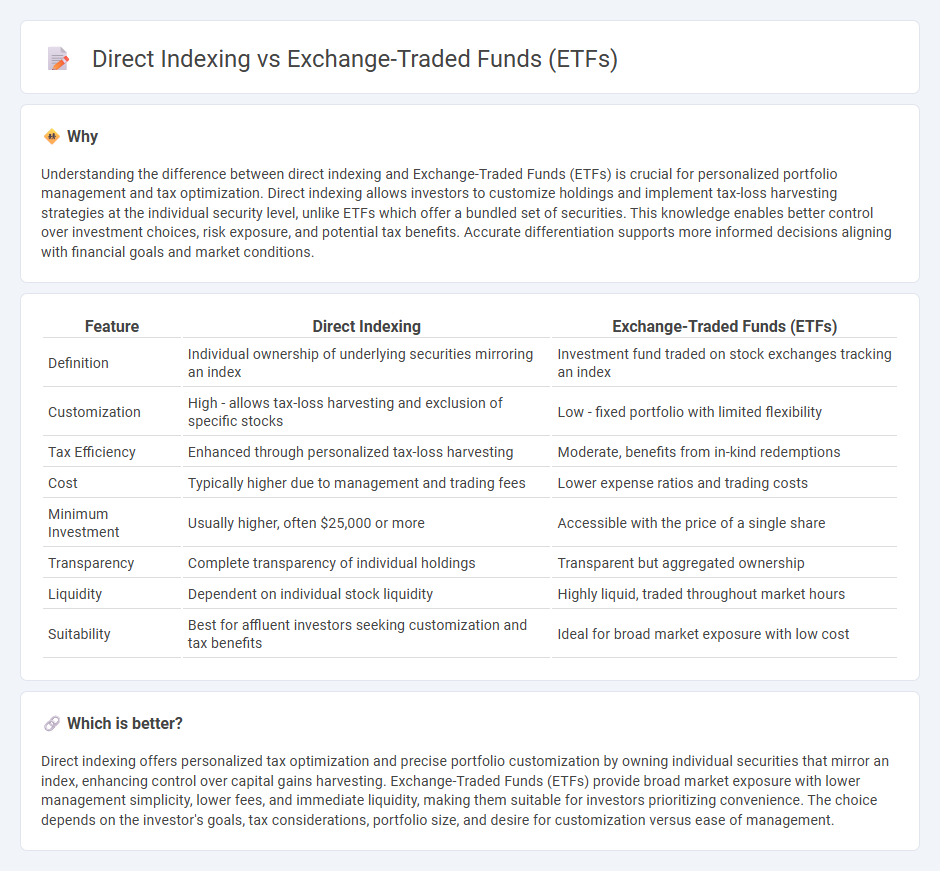

Understanding the difference between direct indexing and Exchange-Traded Funds (ETFs) is crucial for personalized portfolio management and tax optimization. Direct indexing allows investors to customize holdings and implement tax-loss harvesting strategies at the individual security level, unlike ETFs which offer a bundled set of securities. This knowledge enables better control over investment choices, risk exposure, and potential tax benefits. Accurate differentiation supports more informed decisions aligning with financial goals and market conditions.

Comparison Table

| Feature | Direct Indexing | Exchange-Traded Funds (ETFs) |

|---|---|---|

| Definition | Individual ownership of underlying securities mirroring an index | Investment fund traded on stock exchanges tracking an index |

| Customization | High - allows tax-loss harvesting and exclusion of specific stocks | Low - fixed portfolio with limited flexibility |

| Tax Efficiency | Enhanced through personalized tax-loss harvesting | Moderate, benefits from in-kind redemptions |

| Cost | Typically higher due to management and trading fees | Lower expense ratios and trading costs |

| Minimum Investment | Usually higher, often $25,000 or more | Accessible with the price of a single share |

| Transparency | Complete transparency of individual holdings | Transparent but aggregated ownership |

| Liquidity | Dependent on individual stock liquidity | Highly liquid, traded throughout market hours |

| Suitability | Best for affluent investors seeking customization and tax benefits | Ideal for broad market exposure with low cost |

Which is better?

Direct indexing offers personalized tax optimization and precise portfolio customization by owning individual securities that mirror an index, enhancing control over capital gains harvesting. Exchange-Traded Funds (ETFs) provide broad market exposure with lower management simplicity, lower fees, and immediate liquidity, making them suitable for investors prioritizing convenience. The choice depends on the investor's goals, tax considerations, portfolio size, and desire for customization versus ease of management.

Connection

Direct indexing enables investors to own individual securities that mimic the composition of an index, offering personalized tax management and customization, while Exchange-Traded Funds (ETFs) provide a pooled investment vehicle that replicates index performance with liquidity and low expense ratios. Both strategies aim to track market indexes efficiently, but direct indexing offers greater control over specific tax lots and exclusion of certain stocks, which ETFs cannot deliver. The connection lies in their shared objective of index-based investing, catering to different investor preferences in terms of customization, tax efficiency, and cost.

Key Terms

Diversification

Exchange-Traded Funds (ETFs) provide instant diversification by pooling assets from multiple investors to replicate the performance of an index, reducing individual stock risk efficiently. Direct indexing allows investors to own a customized portfolio of individual stocks mirroring an index, enabling personalized tax-loss harvesting and sector weighting strategies. Explore the benefits of each approach to determine which diversification method aligns best with your investment goals.

Tax efficiency

Exchange-Traded Funds (ETFs) offer tax efficiency through in-kind creation and redemption mechanisms, minimizing capital gains distributions. Direct indexing allows investors to tailor portfolios and utilize tax-loss harvesting on individual securities, potentially enhancing tax outcomes beyond ETFs. Explore detailed strategies to optimize tax efficiency between ETFs and direct indexing for your investment goals.

Customization

Exchange-Traded Funds (ETFs) offer broad market exposure through pre-built portfolios, whereas direct indexing allows investors to customize holdings by purchasing individual securities that replicate an index. Direct indexing provides advanced tax-loss harvesting opportunities and personalized thematic or ESG preferences that ETFs cannot match due to their fixed compositions. Discover how customization impacts portfolio strategy and investor outcomes by exploring further details on direct indexing advantages.

Source and External Links

Exchange-Traded Fund (ETF) - Investor.gov - ETFs are exchange-traded investment products registered with the SEC, pooling money from many investors to invest in a diversified portfolio, and are traded on stock exchanges like stocks but can be more tax efficient than mutual funds.

What is an ETF (Exchange-Traded Fund)? - Charles Schwab - ETFs combine the trading flexibility of stocks with the diversification of mutual funds, allow affordable access to various asset classes, and usually have lower costs and greater tax efficiency.

Exchange-traded fund - Wikipedia - Most ETFs are index funds that track specific market or economic indices by holding the same securities in the same proportions, providing investors exposure to broad or specialized markets like the S&P 500, NASDAQ-100, or international indices.

dowidth.com

dowidth.com