Sovereign debt restructuring involves renegotiating the terms of a country's existing debt to achieve more manageable repayment conditions without resorting to legal insolvency proceedings. Bankruptcy, on the other hand, is a formal legal declaration of inability to repay debts, which sovereign nations typically avoid due to the absence of an international bankruptcy court. Explore the complexities and implications of these approaches for global financial stability.

Why it is important

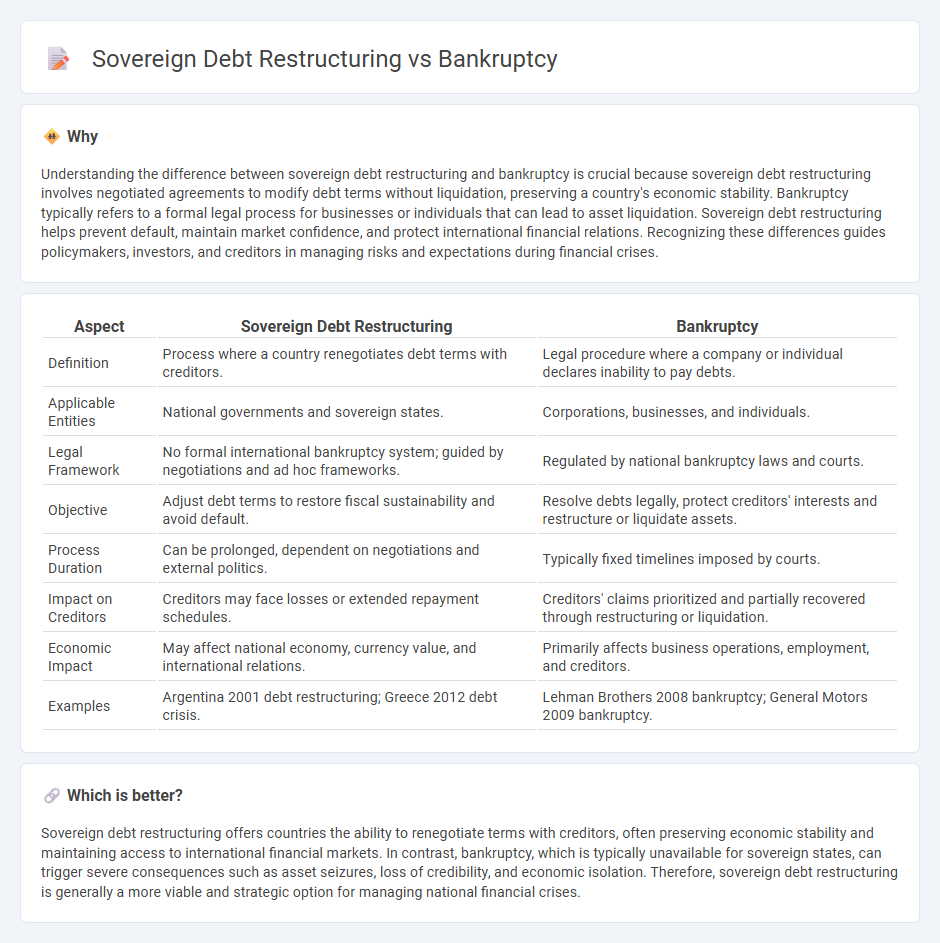

Understanding the difference between sovereign debt restructuring and bankruptcy is crucial because sovereign debt restructuring involves negotiated agreements to modify debt terms without liquidation, preserving a country's economic stability. Bankruptcy typically refers to a formal legal process for businesses or individuals that can lead to asset liquidation. Sovereign debt restructuring helps prevent default, maintain market confidence, and protect international financial relations. Recognizing these differences guides policymakers, investors, and creditors in managing risks and expectations during financial crises.

Comparison Table

| Aspect | Sovereign Debt Restructuring | Bankruptcy |

|---|---|---|

| Definition | Process where a country renegotiates debt terms with creditors. | Legal procedure where a company or individual declares inability to pay debts. |

| Applicable Entities | National governments and sovereign states. | Corporations, businesses, and individuals. |

| Legal Framework | No formal international bankruptcy system; guided by negotiations and ad hoc frameworks. | Regulated by national bankruptcy laws and courts. |

| Objective | Adjust debt terms to restore fiscal sustainability and avoid default. | Resolve debts legally, protect creditors' interests and restructure or liquidate assets. |

| Process Duration | Can be prolonged, dependent on negotiations and external politics. | Typically fixed timelines imposed by courts. |

| Impact on Creditors | Creditors may face losses or extended repayment schedules. | Creditors' claims prioritized and partially recovered through restructuring or liquidation. |

| Economic Impact | May affect national economy, currency value, and international relations. | Primarily affects business operations, employment, and creditors. |

| Examples | Argentina 2001 debt restructuring; Greece 2012 debt crisis. | Lehman Brothers 2008 bankruptcy; General Motors 2009 bankruptcy. |

Which is better?

Sovereign debt restructuring offers countries the ability to renegotiate terms with creditors, often preserving economic stability and maintaining access to international financial markets. In contrast, bankruptcy, which is typically unavailable for sovereign states, can trigger severe consequences such as asset seizures, loss of credibility, and economic isolation. Therefore, sovereign debt restructuring is generally a more viable and strategic option for managing national financial crises.

Connection

Sovereign debt restructuring and bankruptcy are connected through their roles in addressing a country's inability to meet its debt obligations. Sovereign debt restructuring involves renegotiating the terms of existing debt to avoid default, while bankruptcy provides a formal legal framework for debt resolution, typically used by corporate entities rather than nations. Effective debt restructuring can prevent bankruptcy scenarios by restoring fiscal stability and investor confidence in sovereign financial markets.

Key Terms

Insolvency

Insolvency in bankruptcy involves a formal legal process where a debtor's assets are liquidated or reorganized under court supervision to repay creditors. Sovereign debt restructuring, however, deals with renegotiating a country's external debts without formal insolvency courts, relying instead on diplomatic and financial agreements among nations and creditors. Explore more about how insolvency principles apply differently in corporate bankruptcy and sovereign debt cases.

Haircut

In bankruptcy cases, haircuts represent the percentage reduction creditors accept on outstanding claims, often determined through legal frameworks aiming for debt resolution and debtor rehabilitation. Sovereign debt restructuring haircuts typically arise during negotiations between the debtor nation and its creditors, reflecting economic constraints and political considerations influencing recovery rates on sovereign bonds. Explore more to understand how haircut strategies affect creditor recoveries and debtor sustainability in different financial contexts.

Collective Action Clause (CAC)

Collective Action Clauses (CACs) play a pivotal role in sovereign debt restructuring by enabling a supermajority of bondholders to agree on debt terms that become binding for all holders, preventing holdout creditors from obstructing restructuring efforts. Unlike bankruptcy proceedings, which are formal judicial processes allowing for creditor claims adjudication, sovereign debt restructuring relies heavily on CACs to facilitate coordinated repayment modifications without resorting to litigation. Explore the intricacies of how CACs reshape sovereign debt negotiations and enhance debt sustainability strategies.

Source and External Links

Bankruptcy - United States Courts - Bankruptcy is a legal process allowing people or businesses unable to pay debts to either liquidate assets or create a repayment plan under federal court supervision, with different chapters of the U.S. Bankruptcy Code addressing various types such as Chapter 7, 9, 11, 12, 13, and 15.

Bankruptcy - Wikipedia - Bankruptcy in the U.S. is governed federally under Title 11 of the U.S. Code, permitting debt discharge or restructuring, with state laws influencing exemptions and outcomes, while cases proceed in Bankruptcy Courts adjacent to federal district courts.

bankruptcy | Wex | US Law | LII / Legal Information Institute - Bankruptcy law provides for eliminating or reducing debts, repayment plans for nondischargeable debts, and repayment of secured debts, all supervised by Bankruptcy Courts as part of the federal judicial system under Title 11 of the U.S. Code.

dowidth.com

dowidth.com