Dim sum bonds are yuan-denominated bonds issued outside mainland China, primarily in Hong Kong, targeting international investors seeking exposure to Chinese currency. Uridashi bonds are yen-denominated bonds sold directly to Japanese retail investors, often offering higher yields through foreign currency or emerging market debt. Explore the differences in risk profiles, investor base, and market dynamics to better understand these unique fixed-income instruments.

Why it is important

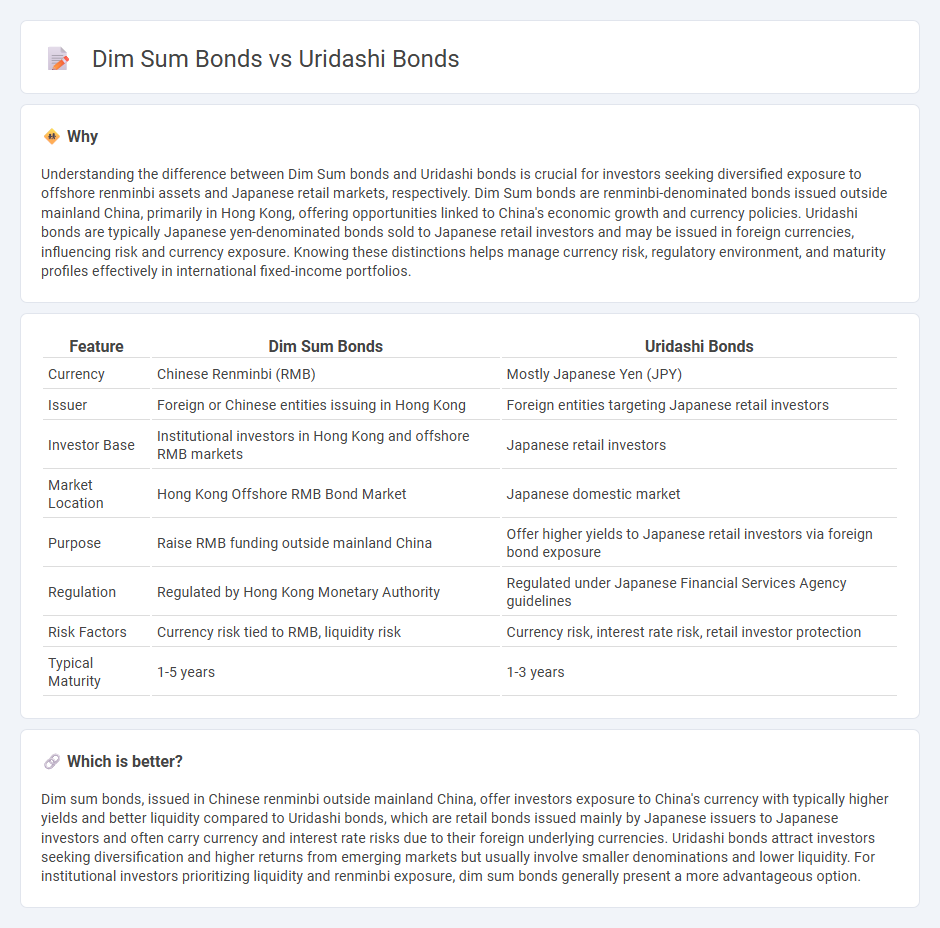

Understanding the difference between Dim Sum bonds and Uridashi bonds is crucial for investors seeking diversified exposure to offshore renminbi assets and Japanese retail markets, respectively. Dim Sum bonds are renminbi-denominated bonds issued outside mainland China, primarily in Hong Kong, offering opportunities linked to China's economic growth and currency policies. Uridashi bonds are typically Japanese yen-denominated bonds sold to Japanese retail investors and may be issued in foreign currencies, influencing risk and currency exposure. Knowing these distinctions helps manage currency risk, regulatory environment, and maturity profiles effectively in international fixed-income portfolios.

Comparison Table

| Feature | Dim Sum Bonds | Uridashi Bonds |

|---|---|---|

| Currency | Chinese Renminbi (RMB) | Mostly Japanese Yen (JPY) |

| Issuer | Foreign or Chinese entities issuing in Hong Kong | Foreign entities targeting Japanese retail investors |

| Investor Base | Institutional investors in Hong Kong and offshore RMB markets | Japanese retail investors |

| Market Location | Hong Kong Offshore RMB Bond Market | Japanese domestic market |

| Purpose | Raise RMB funding outside mainland China | Offer higher yields to Japanese retail investors via foreign bond exposure |

| Regulation | Regulated by Hong Kong Monetary Authority | Regulated under Japanese Financial Services Agency guidelines |

| Risk Factors | Currency risk tied to RMB, liquidity risk | Currency risk, interest rate risk, retail investor protection |

| Typical Maturity | 1-5 years | 1-3 years |

Which is better?

Dim sum bonds, issued in Chinese renminbi outside mainland China, offer investors exposure to China's currency with typically higher yields and better liquidity compared to Uridashi bonds, which are retail bonds issued mainly by Japanese issuers to Japanese investors and often carry currency and interest rate risks due to their foreign underlying currencies. Uridashi bonds attract investors seeking diversification and higher returns from emerging markets but usually involve smaller denominations and lower liquidity. For institutional investors prioritizing liquidity and renminbi exposure, dim sum bonds generally present a more advantageous option.

Connection

Dim sum bonds and Uridashi bonds are both types of foreign bonds issued in markets outside the issuer's home country to attract international investors. Dim sum bonds are yuan-denominated bonds issued in the offshore Chinese market, while Uridashi bonds are typically non-yen denominated bonds sold to Japanese retail investors. Both bond types facilitate cross-border investment and currency diversification, connecting Chinese and Japanese capital markets within the global finance ecosystem.

Key Terms

Currency denomination

Uridashi bonds are typically issued in non-Japanese currencies and sold to Japanese retail investors seeking higher yields outside the yen, while Dim Sum bonds are renminbi-denominated bonds issued in the offshore Chinese market, primarily targeting foreign investors. The key distinction lies in currency denomination, with Uridashi bonds offering exposure to various major global currencies and Dim Sum bonds providing access to the Chinese yuan in international markets. Explore detailed analyses to understand how currency denomination impacts risk and return profiles for these bond types.

Issuer location

Uridashi bonds are typically issued by Japanese entities targeting retail investors in Japan, while Dim Sum bonds are issued by companies outside mainland China but denominated in Chinese yuan and traded in Hong Kong. The issuer's location is crucial in distinguishing these instruments, as Uridashi bonds primarily originate from Japan, whereas Dim Sum bonds are associated with offshore Chinese yuan financing. Explore further to understand the nuances of issuer location and market impact on these bond types.

Target investor base

Uridashi bonds primarily target retail investors in Japan, offering foreign currency-denominated bonds that provide higher yields than domestic savings options. Dim sum bonds are issued in the offshore Chinese market, mainly attracting institutional investors seeking RMB exposure outside mainland China. Explore the distinct features and investment opportunities of Uridashi and Dim sum bonds to enhance your portfolio strategy.

Source and External Links

Uridashi bonds - Wikipedia - Uridashi bonds are secondary offerings outside Japan, usually issued in high-yield foreign currencies and sold to Japanese household investors seeking higher returns than domestic yen bonds, with currency risk involved.

Uridashi Bonds - Moneyzine - Uridashi bonds are foreign-currency-denominated bonds issued outside Japan and sold to Japanese investors to capture yield differentials, exposing them to currency exchange risk.

Uridashi - Cbonds - Uridashi bonds give Japanese retail investors access to foreign currency bonds, typically issued in higher-yield currencies like AUD or NZD to benefit from interest rate differentials versus low Japanese rates.

dowidth.com

dowidth.com