Decentralized exchanges (DEXs) enable peer-to-peer cryptocurrency trading without intermediaries, relying on blockchain technology to ensure security and transparency. Decentralized autonomous organizations (DAOs) function as blockchain-based entities governed by smart contracts and collective member voting, facilitating decentralized decision-making and resource management. Explore the distinctions and dynamics of DEXs and DAOs to understand their impact on the evolving financial ecosystem.

Why it is important

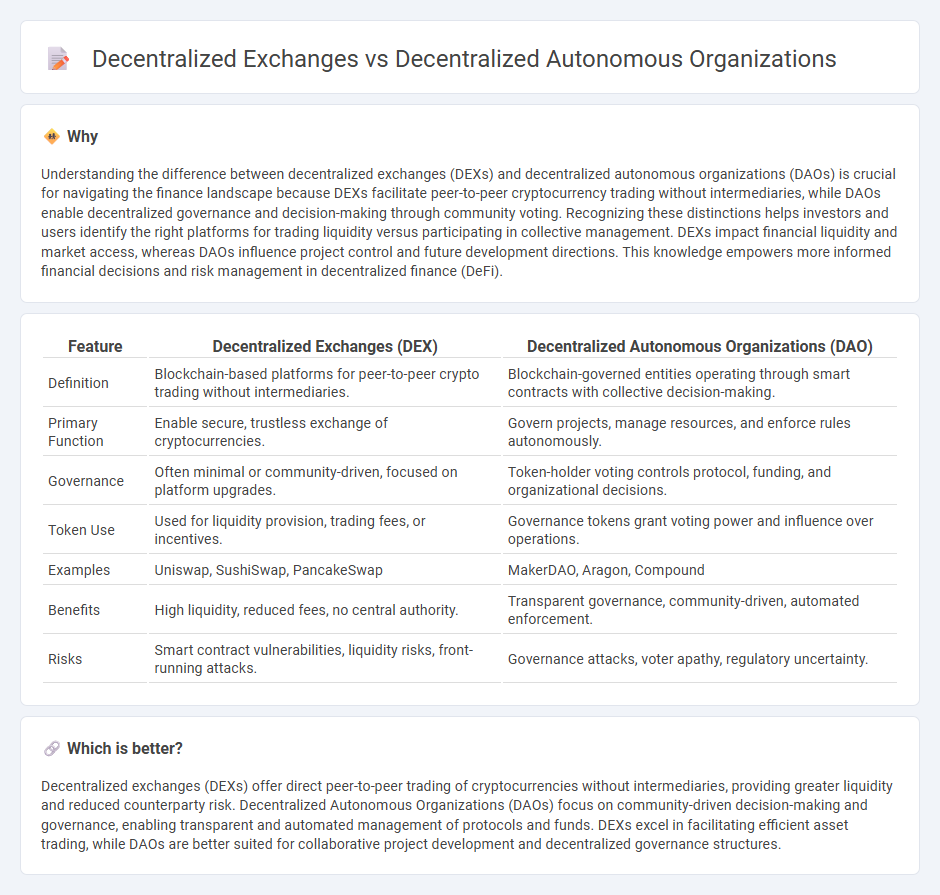

Understanding the difference between decentralized exchanges (DEXs) and decentralized autonomous organizations (DAOs) is crucial for navigating the finance landscape because DEXs facilitate peer-to-peer cryptocurrency trading without intermediaries, while DAOs enable decentralized governance and decision-making through community voting. Recognizing these distinctions helps investors and users identify the right platforms for trading liquidity versus participating in collective management. DEXs impact financial liquidity and market access, whereas DAOs influence project control and future development directions. This knowledge empowers more informed financial decisions and risk management in decentralized finance (DeFi).

Comparison Table

| Feature | Decentralized Exchanges (DEX) | Decentralized Autonomous Organizations (DAO) |

|---|---|---|

| Definition | Blockchain-based platforms for peer-to-peer crypto trading without intermediaries. | Blockchain-governed entities operating through smart contracts with collective decision-making. |

| Primary Function | Enable secure, trustless exchange of cryptocurrencies. | Govern projects, manage resources, and enforce rules autonomously. |

| Governance | Often minimal or community-driven, focused on platform upgrades. | Token-holder voting controls protocol, funding, and organizational decisions. |

| Token Use | Used for liquidity provision, trading fees, or incentives. | Governance tokens grant voting power and influence over operations. |

| Examples | Uniswap, SushiSwap, PancakeSwap | MakerDAO, Aragon, Compound |

| Benefits | High liquidity, reduced fees, no central authority. | Transparent governance, community-driven, automated enforcement. |

| Risks | Smart contract vulnerabilities, liquidity risks, front-running attacks. | Governance attacks, voter apathy, regulatory uncertainty. |

Which is better?

Decentralized exchanges (DEXs) offer direct peer-to-peer trading of cryptocurrencies without intermediaries, providing greater liquidity and reduced counterparty risk. Decentralized Autonomous Organizations (DAOs) focus on community-driven decision-making and governance, enabling transparent and automated management of protocols and funds. DEXs excel in facilitating efficient asset trading, while DAOs are better suited for collaborative project development and decentralized governance structures.

Connection

Decentralized exchanges (DEXs) operate on blockchain technology, enabling peer-to-peer trading without intermediaries, and are often governed by decentralized autonomous organizations (DAOs). DAOs provide a transparent, community-driven framework for decision-making and protocol upgrades within DEXs, fostering trust and collective management. The integration of DAOs in DEXs enhances security, governance efficiency, and user participation in the decentralized finance ecosystem.

Key Terms

Governance

Decentralized Autonomous Organizations (DAOs) operate through member-driven governance models where token holders vote on proposals, ensuring transparent and democratic decision-making. Decentralized Exchanges (DEXs) integrate governance protocols to allow users to influence platform upgrades, fee structures, and liquidity pool management while maintaining secure, peer-to-peer trading environments. Explore how governance frameworks shape the evolution of blockchain ecosystems by learning more about DAOs and DEXs.

Liquidity

Decentralized Autonomous Organizations (DAOs) operate through member-driven governance, allocating resources to manage liquidity pools within decentralized exchanges (DEXs) to enhance trading efficiency. Decentralized exchanges facilitate peer-to-peer trading without intermediaries, relying heavily on liquidity provision from DAOs and individual liquidity providers to ensure seamless asset swaps. Explore the dynamic interplay between DAOs and DEX liquidity to understand how decentralized finance is reshaping market accessibility.

Smart Contracts

Decentralized Autonomous Organizations (DAOs) utilize smart contracts to automate governance decisions, enabling collective member voting and transparent management without centralized control. Decentralized Exchanges (DEXs) rely on smart contracts to facilitate peer-to-peer trading of digital assets, ensuring secure, trustless, and censorship-resistant transactions. Explore how smart contract frameworks differentiate DAOs from DEXs and their impact on decentralized ecosystems.

Source and External Links

What are Decentralized Autonomous Organizations (DAO)? - DAOs are internet-native organizations with no central leadership, governed collectively by members through blockchain-based smart contracts that execute automatically when predefined conditions are met.

Decentralized Autonomous Organization (DAO) - A DAO is a transparent, member-controlled organization encoded as a computer program on a blockchain, using smart contracts for automated governance, decentralized decision-making, and token-based member participation.

What is a decentralized autonomous organization (DAO)? - DAOs are groups structured without traditional leadership, relying on smart contracts and member voting on a blockchain to enable transparent, efficient, and collective decision-making for various purposes.

dowidth.com

dowidth.com