Perpetual futures and swaps represent two essential derivative instruments in modern finance, allowing traders to hedge positions and speculate on asset price movements without owning the underlying asset. Perpetual futures feature no expiration date and maintain prices close to the spot market through funding rates, while swaps involve exchanging cash flows between parties based on underlying asset values or interest rates. Explore the nuances between perpetual futures and swaps to optimize your trading strategy and risk management.

Why it is important

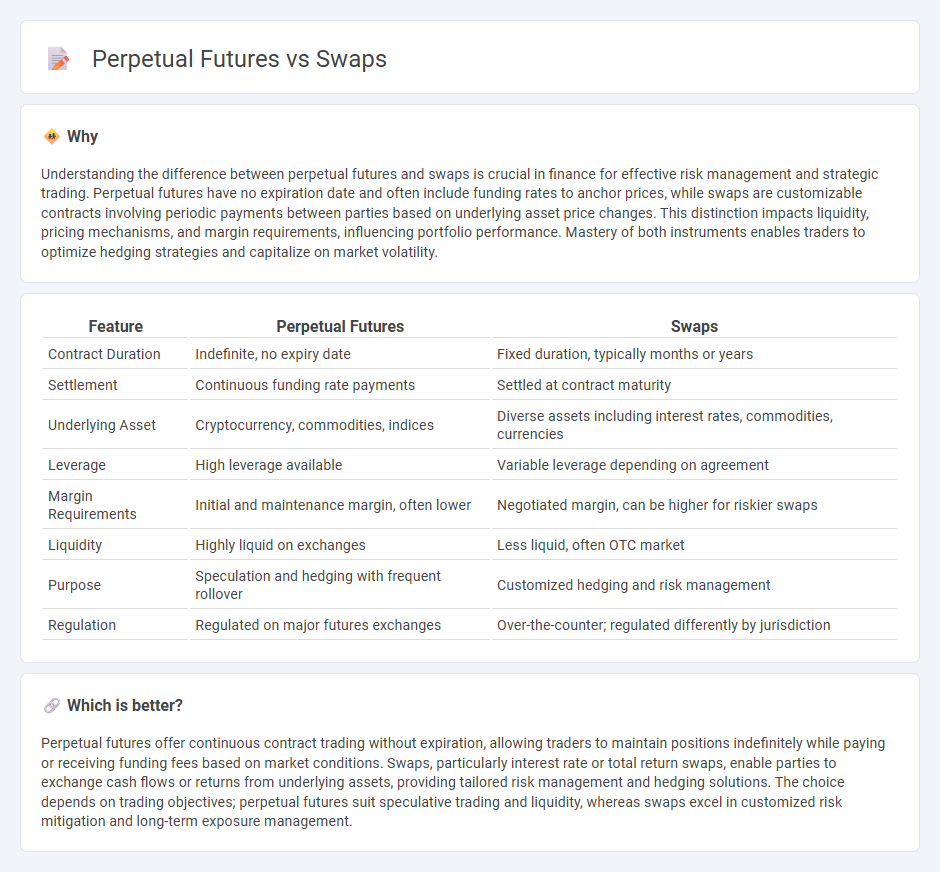

Understanding the difference between perpetual futures and swaps is crucial in finance for effective risk management and strategic trading. Perpetual futures have no expiration date and often include funding rates to anchor prices, while swaps are customizable contracts involving periodic payments between parties based on underlying asset price changes. This distinction impacts liquidity, pricing mechanisms, and margin requirements, influencing portfolio performance. Mastery of both instruments enables traders to optimize hedging strategies and capitalize on market volatility.

Comparison Table

| Feature | Perpetual Futures | Swaps |

|---|---|---|

| Contract Duration | Indefinite, no expiry date | Fixed duration, typically months or years |

| Settlement | Continuous funding rate payments | Settled at contract maturity |

| Underlying Asset | Cryptocurrency, commodities, indices | Diverse assets including interest rates, commodities, currencies |

| Leverage | High leverage available | Variable leverage depending on agreement |

| Margin Requirements | Initial and maintenance margin, often lower | Negotiated margin, can be higher for riskier swaps |

| Liquidity | Highly liquid on exchanges | Less liquid, often OTC market |

| Purpose | Speculation and hedging with frequent rollover | Customized hedging and risk management |

| Regulation | Regulated on major futures exchanges | Over-the-counter; regulated differently by jurisdiction |

Which is better?

Perpetual futures offer continuous contract trading without expiration, allowing traders to maintain positions indefinitely while paying or receiving funding fees based on market conditions. Swaps, particularly interest rate or total return swaps, enable parties to exchange cash flows or returns from underlying assets, providing tailored risk management and hedging solutions. The choice depends on trading objectives; perpetual futures suit speculative trading and liquidity, whereas swaps excel in customized risk mitigation and long-term exposure management.

Connection

Perpetual futures and swaps are both derivative contracts used in finance to hedge risk and speculate on asset price movements without owning the underlying asset. Perpetual futures feature no expiration date and utilize funding rates to anchor prices to spot markets, while swaps involve exchanging cash flows or asset returns between parties, often based on fixed and floating rates. Both instruments enable continuous exposure and price alignment mechanisms, making them integral tools in managing volatility and liquidity in financial markets.

Key Terms

Counterparty Risk

Swaps present higher counterparty risk compared to perpetual futures due to their bilateral nature and reliance on the creditworthiness of the involved parties. Perpetual futures mitigate this risk through centralized clearinghouses and daily mark-to-market settlements, reducing default probabilities. Explore how these differences impact your trading strategy and risk management.

Expiry/Maturity

Swaps are over-the-counter derivatives without a fixed expiry date, allowing continuous position holding, whereas perpetual futures have no maturity and use funding rates to anchor prices to the spot market. Perpetual futures settle funding payments periodically, incentivizing price convergence, while swaps settle at specified intervals or upon termination. Explore the nuances between swaps and perpetual futures to optimize your trading strategy.

Funding Rate

Swaps and perpetual futures are derivative contracts with differing funding rate mechanisms that maintain price stability; swaps often feature fixed funding payments, while perpetual futures use dynamic funding rates exchanged between long and short positions. The funding rate in perpetual futures is recalculated regularly based on the price difference between the perpetual contract and the underlying asset, incentivizing balance and preventing divergence. Explore how these funding rate models impact trading strategies and market efficiency to deepen your understanding.

Source and External Links

Swap - Definition, Types, Applications, Example - A swap is a derivative contract between two parties exchanging pre-agreed cash flows of financial instruments, commonly used to hedge risk and traded over-the-counter rather than on exchanges.

Swaps: What are they, definition, importance & examples - StoneX - Swaps are derivative contracts involving exchange of cash flows or liabilities based on different financial instruments, traded OTC and sometimes on regulated platforms like Swap Execution Facilities to enhance transparency.

Swap (finance) - Wikipedia - In finance, a swap is an agreement to exchange financial instruments or payments; common types include interest rate swaps, currency swaps, and credit default swaps, used to transform exposures or manage risk.

dowidth.com

dowidth.com