Green bonds are debt securities specifically issued to fund projects with environmental benefits, such as renewable energy or sustainable agriculture, while impact bonds focus on achieving measurable social or environmental outcomes through performance-based contracts between investors and service providers. Both instruments attract socially responsible investors aiming to align financial returns with positive societal impact, yet they differ in structure and outcome evaluation metrics. Explore further to understand how these innovative financing tools drive sustainable development and social change.

Why it is important

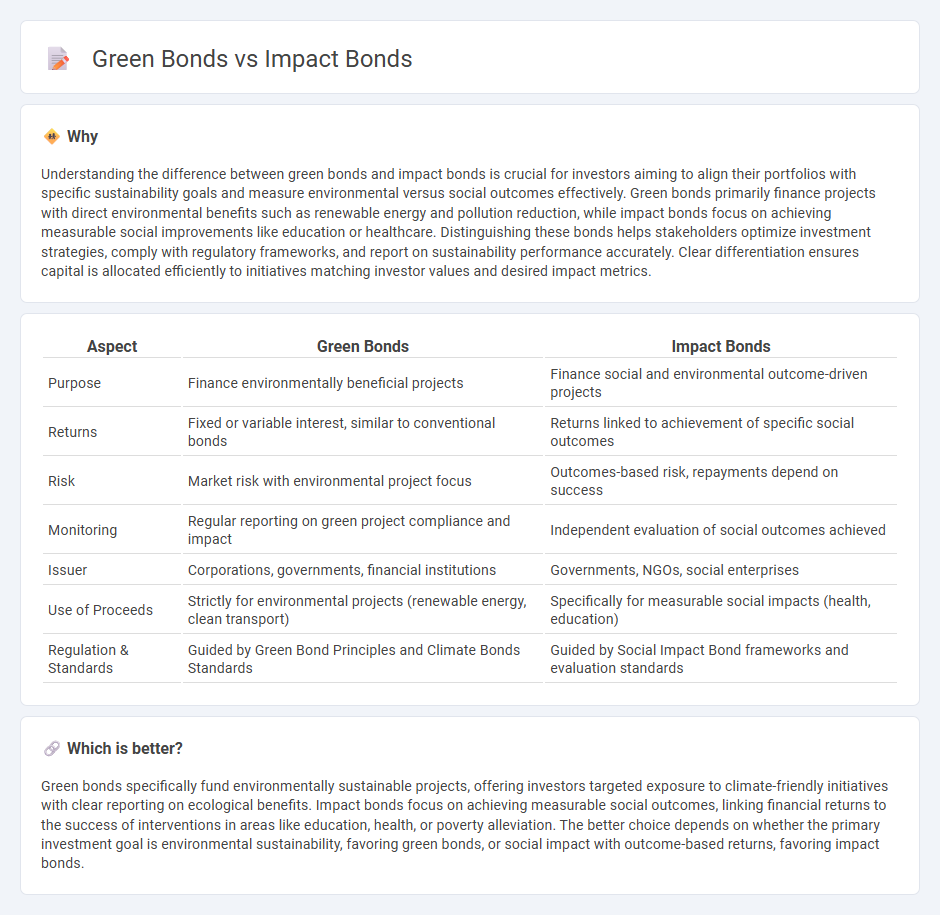

Understanding the difference between green bonds and impact bonds is crucial for investors aiming to align their portfolios with specific sustainability goals and measure environmental versus social outcomes effectively. Green bonds primarily finance projects with direct environmental benefits such as renewable energy and pollution reduction, while impact bonds focus on achieving measurable social improvements like education or healthcare. Distinguishing these bonds helps stakeholders optimize investment strategies, comply with regulatory frameworks, and report on sustainability performance accurately. Clear differentiation ensures capital is allocated efficiently to initiatives matching investor values and desired impact metrics.

Comparison Table

| Aspect | Green Bonds | Impact Bonds |

|---|---|---|

| Purpose | Finance environmentally beneficial projects | Finance social and environmental outcome-driven projects |

| Returns | Fixed or variable interest, similar to conventional bonds | Returns linked to achievement of specific social outcomes |

| Risk | Market risk with environmental project focus | Outcomes-based risk, repayments depend on success |

| Monitoring | Regular reporting on green project compliance and impact | Independent evaluation of social outcomes achieved |

| Issuer | Corporations, governments, financial institutions | Governments, NGOs, social enterprises |

| Use of Proceeds | Strictly for environmental projects (renewable energy, clean transport) | Specifically for measurable social impacts (health, education) |

| Regulation & Standards | Guided by Green Bond Principles and Climate Bonds Standards | Guided by Social Impact Bond frameworks and evaluation standards |

Which is better?

Green bonds specifically fund environmentally sustainable projects, offering investors targeted exposure to climate-friendly initiatives with clear reporting on ecological benefits. Impact bonds focus on achieving measurable social outcomes, linking financial returns to the success of interventions in areas like education, health, or poverty alleviation. The better choice depends on whether the primary investment goal is environmental sustainability, favoring green bonds, or social impact with outcome-based returns, favoring impact bonds.

Connection

Green bonds and impact bonds both serve as innovative financial instruments designed to fund projects with positive environmental and social outcomes. Green bonds specifically target investments in environmentally sustainable projects such as renewable energy and conservation, while impact bonds focus on achieving measurable social improvements, often through outcome-based contracts between investors and service providers. Both types of bonds attract investors seeking to align financial returns with ethical and sustainable development goals, reflecting a growing trend in responsible finance.

Key Terms

Social Outcomes

Impact bonds are innovative financing mechanisms designed to improve social outcomes by linking investor returns to the achievement of specific social targets, such as reducing homelessness or enhancing education quality. Green bonds primarily fund environmental projects like renewable energy or sustainable infrastructure, focusing less directly on social outcomes but potentially creating broader community benefits. Explore more to understand how these financial instruments drive social and environmental change.

Environmental Projects

Impact bonds and green bonds play crucial roles in financing environmental projects, with impact bonds focusing on measurable social and environmental outcomes, often involving private investors and pay-for-success contracts. Green bonds specifically raise capital exclusively for projects that benefit the environment, such as renewable energy, pollution reduction, and conservation efforts, backed by governments, corporations, or financial institutions. Explore the distinctions and benefits of these financing tools to enhance your understanding of sustainable investment strategies.

Performance-based Returns

Impact bonds structure returns based on achieving specific social or environmental outcomes, aligning investor profits directly with measurable performance indicators such as improved educational results or reduced recidivism rates. Green bonds, in contrast, finance environmentally friendly projects with returns typically linked to fixed interest rates rather than performance metrics, focusing on renewable energy or sustainable infrastructure development. Explore detailed comparisons to understand which bond type aligns best with your investment goals and social impact priorities.

Source and External Links

Social impact bond - Wikipedia - Social Impact Bonds (SIBs) are outcomes-based contracts where private investors provide upfront capital to fund social services and are repaid by the government only if agreed-upon social outcomes are achieved, shifting financial risk from service providers to investors and aiming to improve aid efficiency and cost-effectiveness.

Social Impact Bonds NATIONAL CONFERENCE of STATE ... - Social Impact Bonds work by allowing private entities to fund social programs with upfront capital, repaid by the government if the program achieves specific outcomes, providing a potential new way to pay for social programs that might save money and improve accountability.

Social Impact Bonds | NCHH - Social impact bonds are a financing mechanism where government agencies partner with intermediaries who raise initial capital to fund programs that improve public outcomes and deliver cost savings, with repayment contingent on success, applied in areas such as health interventions like asthma care.

dowidth.com

dowidth.com