Tokenized treasury bills represent a digital form of government debt securities, leveraging blockchain technology to enhance liquidity, transparency, and accessibility compared to traditional treasury bills issued in physical or electronic formats. Traditional treasury bills are short-term government debt instruments with highly secure and predictable returns, commonly used by investors seeking low-risk investment options. Explore how tokenized treasury bills are reshaping the finance landscape and offering new opportunities beyond conventional treasury instruments.

Why it is important

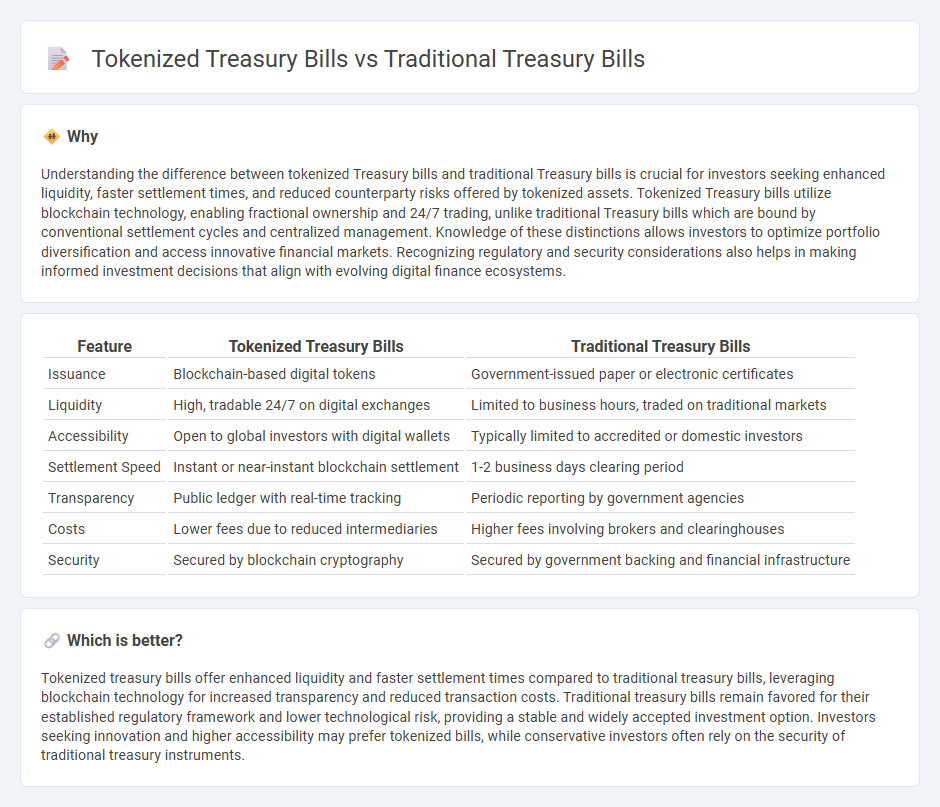

Understanding the difference between tokenized Treasury bills and traditional Treasury bills is crucial for investors seeking enhanced liquidity, faster settlement times, and reduced counterparty risks offered by tokenized assets. Tokenized Treasury bills utilize blockchain technology, enabling fractional ownership and 24/7 trading, unlike traditional Treasury bills which are bound by conventional settlement cycles and centralized management. Knowledge of these distinctions allows investors to optimize portfolio diversification and access innovative financial markets. Recognizing regulatory and security considerations also helps in making informed investment decisions that align with evolving digital finance ecosystems.

Comparison Table

| Feature | Tokenized Treasury Bills | Traditional Treasury Bills |

|---|---|---|

| Issuance | Blockchain-based digital tokens | Government-issued paper or electronic certificates |

| Liquidity | High, tradable 24/7 on digital exchanges | Limited to business hours, traded on traditional markets |

| Accessibility | Open to global investors with digital wallets | Typically limited to accredited or domestic investors |

| Settlement Speed | Instant or near-instant blockchain settlement | 1-2 business days clearing period |

| Transparency | Public ledger with real-time tracking | Periodic reporting by government agencies |

| Costs | Lower fees due to reduced intermediaries | Higher fees involving brokers and clearinghouses |

| Security | Secured by blockchain cryptography | Secured by government backing and financial infrastructure |

Which is better?

Tokenized treasury bills offer enhanced liquidity and faster settlement times compared to traditional treasury bills, leveraging blockchain technology for increased transparency and reduced transaction costs. Traditional treasury bills remain favored for their established regulatory framework and lower technological risk, providing a stable and widely accepted investment option. Investors seeking innovation and higher accessibility may prefer tokenized bills, while conservative investors often rely on the security of traditional treasury instruments.

Connection

Tokenized treasury bills represent traditional treasury bills on a blockchain, enabling digital ownership, faster settlement, and increased liquidity. Traditional treasury bills are government debt securities with fixed maturity and interest, while tokenized versions digitize these assets for more accessible trading and transfer. This connection bridges conventional finance with decentralized financial infrastructure, enhancing transparency and efficiency in government debt markets.

Key Terms

Liquidity

Traditional treasury bills offer high liquidity due to their widespread acceptance and active secondary markets, making them easy to buy and sell quickly. Tokenized treasury bills enhance liquidity further by enabling fractional ownership, 24/7 trading on blockchain platforms, and reducing settlement times from days to minutes. Explore the benefits and differences of these financial instruments to optimize your investment strategy.

Settlement

Traditional treasury bills rely on manual settlement processes that involve intermediaries and can take several days to complete, increasing counterparty risk and operational costs. Tokenized treasury bills utilize blockchain technology to enable near-instantaneous settlement with enhanced transparency, reduced intermediaries, and improved security through smart contracts. Discover more about how tokenization transforms treasury bill settlement efficiency and investor access.

Transparency

Traditional treasury bills rely on centralized institutions for issuance and tracking, often resulting in limited visibility and slower settlement processes. Tokenized treasury bills use blockchain technology to provide real-time transparency, immutable records, and improved accessibility for investors. Explore how tokenized treasury bills enhance transparency and reshape government bond markets.

Source and External Links

United States Treasury security - Wikipedia - Traditional Treasury bills, or T-bills, are short-term government debt instruments issued by the U.S. Treasury, originally sold via auction since 1929 where they are sold to the highest bidder at a discount and redeemed at face value at maturity, with maturities typically up to one year.

U.S. Treasury Securities: Bonds, Bills & More | Vanguard - Treasury bills (T-bills) are short-term government bonds sold in durations ranging from 4 to 52 weeks, issued at a discount and redeemed at face value, with the difference representing taxable interest income.

Treasury Bills: A Beginner's Guide to T-Bills & How to Buy - NerdWallet - Treasury bills are short-term U.S. debt securities sold at a discount and redeemed at par value upon maturity between four weeks to one year, effectively paying interest through this price difference rather than periodic coupon payments.

dowidth.com

dowidth.com