Flash loan attacks exploit instant, uncollateralized borrowing to manipulate decentralized finance protocols, leading to significant financial exploits often involving price or oracle manipulation. Wash trading involves artificially inflating trading volumes by repeatedly buying and selling the same asset to create misleading market activity, commonly seen in stock, cryptocurrency, and NFT markets. Discover more about these financial vulnerabilities and their impact on market integrity.

Why it is important

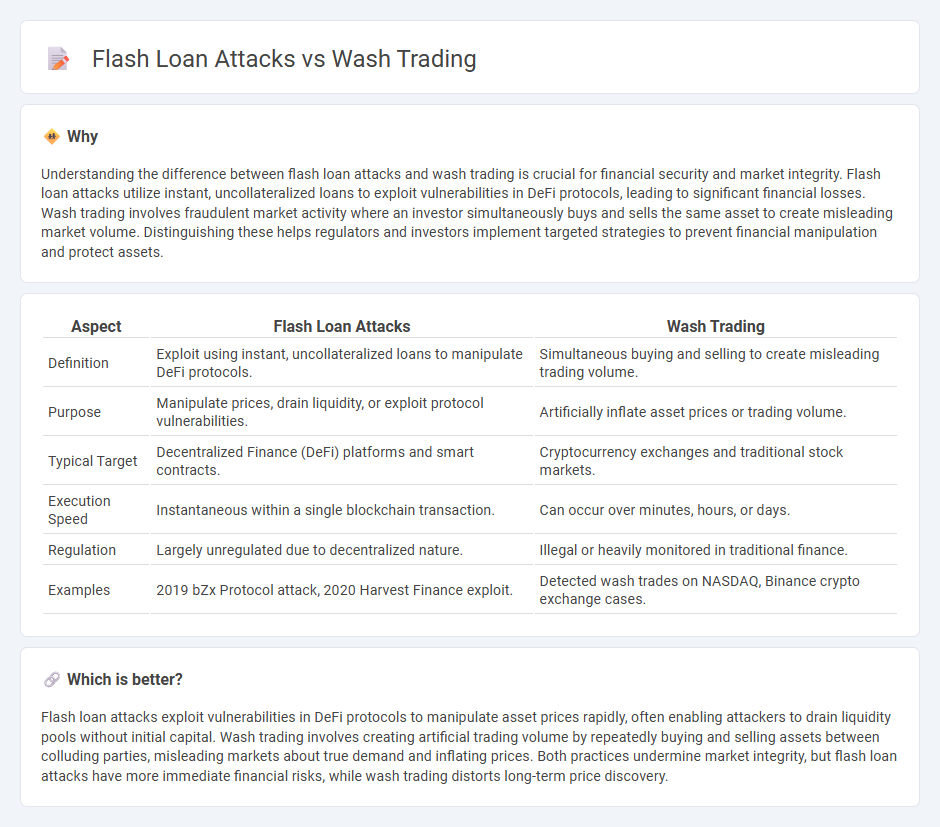

Understanding the difference between flash loan attacks and wash trading is crucial for financial security and market integrity. Flash loan attacks utilize instant, uncollateralized loans to exploit vulnerabilities in DeFi protocols, leading to significant financial losses. Wash trading involves fraudulent market activity where an investor simultaneously buys and sells the same asset to create misleading market volume. Distinguishing these helps regulators and investors implement targeted strategies to prevent financial manipulation and protect assets.

Comparison Table

| Aspect | Flash Loan Attacks | Wash Trading |

|---|---|---|

| Definition | Exploit using instant, uncollateralized loans to manipulate DeFi protocols. | Simultaneous buying and selling to create misleading trading volume. |

| Purpose | Manipulate prices, drain liquidity, or exploit protocol vulnerabilities. | Artificially inflate asset prices or trading volume. |

| Typical Target | Decentralized Finance (DeFi) platforms and smart contracts. | Cryptocurrency exchanges and traditional stock markets. |

| Execution Speed | Instantaneous within a single blockchain transaction. | Can occur over minutes, hours, or days. |

| Regulation | Largely unregulated due to decentralized nature. | Illegal or heavily monitored in traditional finance. |

| Examples | 2019 bZx Protocol attack, 2020 Harvest Finance exploit. | Detected wash trades on NASDAQ, Binance crypto exchange cases. |

Which is better?

Flash loan attacks exploit vulnerabilities in DeFi protocols to manipulate asset prices rapidly, often enabling attackers to drain liquidity pools without initial capital. Wash trading involves creating artificial trading volume by repeatedly buying and selling assets between colluding parties, misleading markets about true demand and inflating prices. Both practices undermine market integrity, but flash loan attacks have more immediate financial risks, while wash trading distorts long-term price discovery.

Connection

Flash loan attacks and wash trading share a connection through their exploitation of decentralized finance (DeFi) vulnerabilities to manipulate market prices and liquidity. Flash loan attacks leverage instant, uncollateralized loans to execute complex trades that can artificially inflate asset values, while wash trading involves repeatedly buying and selling the same asset to create misleading volume and price trends. Both tactics distort market integrity, enabling attackers to profit from skewed price signals within blockchain-based financial platforms.

Key Terms

Market manipulation

Wash trading involves repeatedly buying and selling the same asset to create artificial trading volume and deceive market participants about true demand and price levels. Flash loan attacks exploit unsecured, instant loans to manipulate asset prices quickly, often leading to significant financial losses on decentralized exchanges. Explore in-depth how these manipulative tactics impact market integrity and investor trust.

Arbitrage

Wash trading manipulates market prices through self-trading to create artificial volume, affecting arbitrage opportunities by misleading traders about true asset values. Flash loan attacks exploit instant, uncollateralized loans to execute rapid arbitrage that can disrupt market pricing and drain liquidity pools within a single transaction. Explore deeper insights into how these tactics impact decentralized finance arbitrage and market integrity.

Smart contracts

Wash trading manipulates market prices by using smart contracts to create artificial transaction volume through controlled, repetitive trades between related parties, undermining market integrity. Flash loan attacks exploit smart contracts' vulnerabilities by borrowing large amounts of capital instantly and executing complex transactions that can cause price manipulation, liquidity draining, or other economic exploits within decentralized finance (DeFi) protocols. Explore deeper into these smart contract exploits to enhance your understanding of blockchain security and prevent financial risks.

Source and External Links

What is Wash Trading? - NICE Actimize - Wash trading is a deceptive practice involving simultaneous or near-simultaneous buying and selling of the same asset to create an illusion of market activity and inflate trading volume without actual change in ownership, often for price manipulation purposes.

What is Wash Trading? - Winston & Strawn - Wash trading occurs when buyer and seller collude to mislead the market and artificially inflate the value of a security without incurring risk or changing their positions, effectively sending the security and cash back and forth.

Wash Trading - Overview, How It Works, and Example - Wash trading, also known as round-trip trading, is illegal and involves buying and selling the same financial instruments simultaneously to manipulate the market by increasing apparent trading volume.

dowidth.com

dowidth.com