Hard rug pull schemes involve fraudulent projects that abruptly disappear with investors' funds, causing significant financial losses. Pump and dump scams manipulate asset prices by artificially inflating value before orchestrators sell at a profit, leaving late investors with devalued holdings. Explore these deceptive practices further to protect your investments and understand risk management strategies.

Why it is important

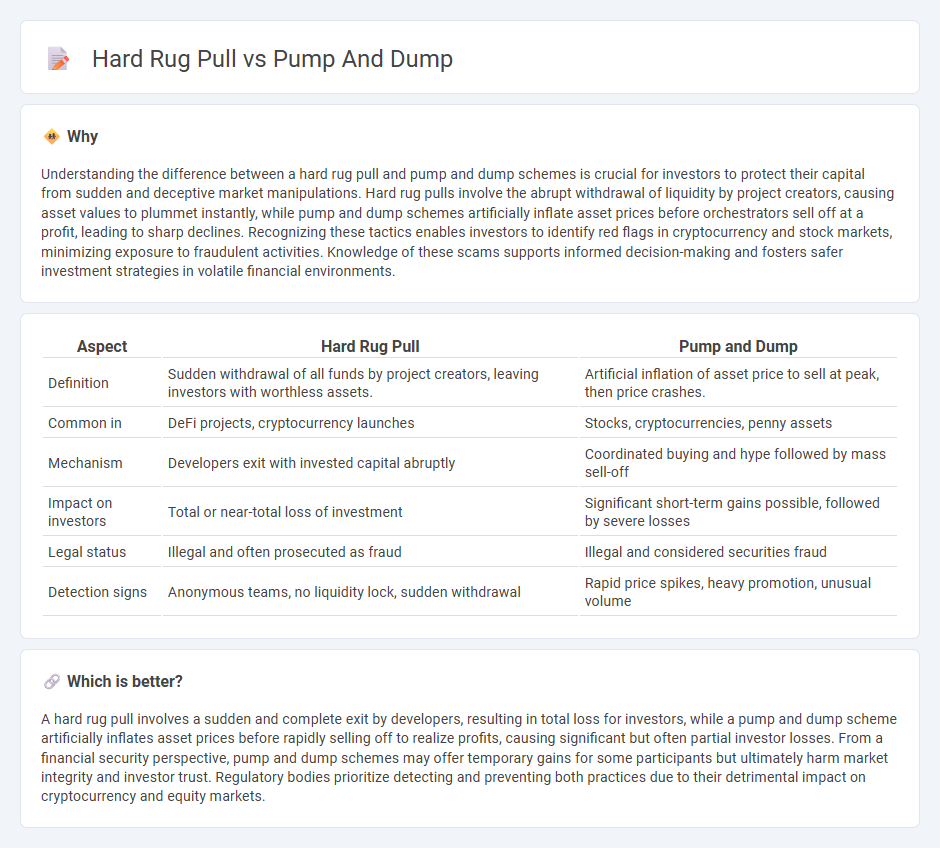

Understanding the difference between a hard rug pull and pump and dump schemes is crucial for investors to protect their capital from sudden and deceptive market manipulations. Hard rug pulls involve the abrupt withdrawal of liquidity by project creators, causing asset values to plummet instantly, while pump and dump schemes artificially inflate asset prices before orchestrators sell off at a profit, leading to sharp declines. Recognizing these tactics enables investors to identify red flags in cryptocurrency and stock markets, minimizing exposure to fraudulent activities. Knowledge of these scams supports informed decision-making and fosters safer investment strategies in volatile financial environments.

Comparison Table

| Aspect | Hard Rug Pull | Pump and Dump |

|---|---|---|

| Definition | Sudden withdrawal of all funds by project creators, leaving investors with worthless assets. | Artificial inflation of asset price to sell at peak, then price crashes. |

| Common in | DeFi projects, cryptocurrency launches | Stocks, cryptocurrencies, penny assets |

| Mechanism | Developers exit with invested capital abruptly | Coordinated buying and hype followed by mass sell-off |

| Impact on investors | Total or near-total loss of investment | Significant short-term gains possible, followed by severe losses |

| Legal status | Illegal and often prosecuted as fraud | Illegal and considered securities fraud |

| Detection signs | Anonymous teams, no liquidity lock, sudden withdrawal | Rapid price spikes, heavy promotion, unusual volume |

Which is better?

A hard rug pull involves a sudden and complete exit by developers, resulting in total loss for investors, while a pump and dump scheme artificially inflates asset prices before rapidly selling off to realize profits, causing significant but often partial investor losses. From a financial security perspective, pump and dump schemes may offer temporary gains for some participants but ultimately harm market integrity and investor trust. Regulatory bodies prioritize detecting and preventing both practices due to their detrimental impact on cryptocurrency and equity markets.

Connection

Rug pulls and pump-and-dump schemes are connected through their manipulation of cryptocurrency markets, where perpetrators artificially inflate asset prices before rapidly selling off to defraud investors. Both exploit investor greed and lack of transparency, causing significant losses during sudden market crashes. Recognizing these scams is crucial for maintaining market integrity and protecting investor assets in decentralized finance.

Key Terms

Market Manipulation

Pump and dump schemes involve artificially inflating a cryptocurrency's price through misleading hype, followed by selling off assets to profit from unsuspecting investors, directly manipulating market dynamics. Hard rug pulls occur when developers abruptly withdraw all liquidity or funds from a project, causing a sudden and irreversible market collapse. Explore detailed differences and detection methods to protect your investments.

Liquidity Withdrawal

Pump and dump schemes involve artificially inflating a token's price through coordinated buying, followed by rapid selling to withdraw liquidity and profit at the expense of other investors. Hard rug pulls occur when project developers abruptly remove all liquidity from a decentralized exchange, causing the token's value to plummet instantly. Explore detailed differences in liquidity withdrawal methods to better understand these fraudulent tactics.

Insider Trading

Pump and dump schemes involve insiders artificially inflating a stock or crypto asset price through misleading statements before selling off their holdings at a profit, exploiting unsuspecting investors. Hard rug pulls occur when project insiders abruptly withdraw all liquidity and abandon the project, causing asset prices to collapse and leaving investors with worthless tokens. Explore deeper insights into how insider trading manipulates market trust and investor security in these fraudulent schemes.

Source and External Links

Pump and dump - Wikipedia - A pump and dump scheme is a type of securities fraud where perpetrators artificially inflate a stock's price using false or misleading positive statements, then sell their own overvalued shares, causing the price to collapse and investors to lose money, commonly seen in small-cap stocks and cryptocurrencies.

Avoiding Pump-and-Dump Scams | FINRA.org - Fraudsters buy a large position in low-priced stocks, promote false positive news to "pump" the stock price, then "dump" their shares at the inflated price, often using social media or encrypted communications to manipulate demand.

Pump and Dump Schemes - Investor.gov - These schemes involve promoters boosting a stock price with misleading information to sell their own holdings at a high price before the stock price collapses, frequently spreading hype online to entice investors to buy quickly.

dowidth.com

dowidth.com