Perpetual futures are derivative contracts without an expiry date, allowing traders to hold positions indefinitely while paying or receiving funding rates to keep the contract price close to the underlying asset. Forward contracts, in contrast, are customized agreements between two parties to buy or sell an asset at a predetermined price on a specific future date, lacking daily settlement and standardized exchange trading. Explore the distinct advantages and risks of perpetual futures and forward contracts to optimize your financial strategies.

Why it is important

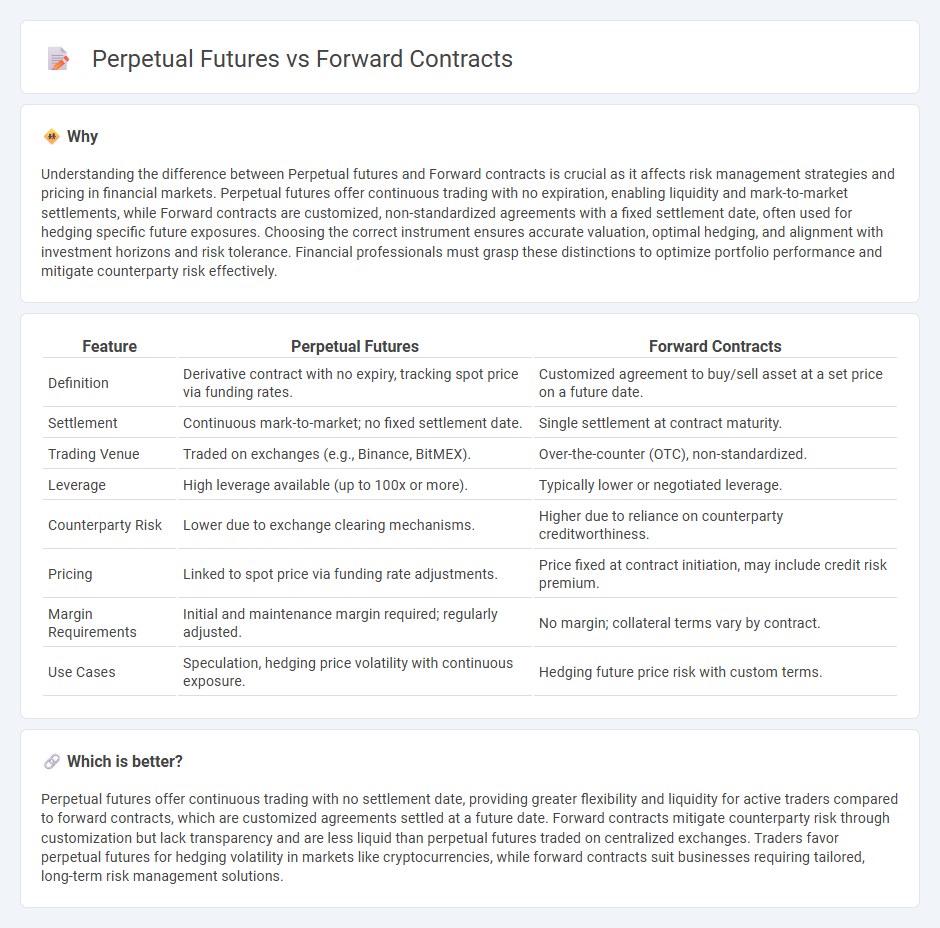

Understanding the difference between Perpetual futures and Forward contracts is crucial as it affects risk management strategies and pricing in financial markets. Perpetual futures offer continuous trading with no expiration, enabling liquidity and mark-to-market settlements, while Forward contracts are customized, non-standardized agreements with a fixed settlement date, often used for hedging specific future exposures. Choosing the correct instrument ensures accurate valuation, optimal hedging, and alignment with investment horizons and risk tolerance. Financial professionals must grasp these distinctions to optimize portfolio performance and mitigate counterparty risk effectively.

Comparison Table

| Feature | Perpetual Futures | Forward Contracts |

|---|---|---|

| Definition | Derivative contract with no expiry, tracking spot price via funding rates. | Customized agreement to buy/sell asset at a set price on a future date. |

| Settlement | Continuous mark-to-market; no fixed settlement date. | Single settlement at contract maturity. |

| Trading Venue | Traded on exchanges (e.g., Binance, BitMEX). | Over-the-counter (OTC), non-standardized. |

| Leverage | High leverage available (up to 100x or more). | Typically lower or negotiated leverage. |

| Counterparty Risk | Lower due to exchange clearing mechanisms. | Higher due to reliance on counterparty creditworthiness. |

| Pricing | Linked to spot price via funding rate adjustments. | Price fixed at contract initiation, may include credit risk premium. |

| Margin Requirements | Initial and maintenance margin required; regularly adjusted. | No margin; collateral terms vary by contract. |

| Use Cases | Speculation, hedging price volatility with continuous exposure. | Hedging future price risk with custom terms. |

Which is better?

Perpetual futures offer continuous trading with no settlement date, providing greater flexibility and liquidity for active traders compared to forward contracts, which are customized agreements settled at a future date. Forward contracts mitigate counterparty risk through customization but lack transparency and are less liquid than perpetual futures traded on centralized exchanges. Traders favor perpetual futures for hedging volatility in markets like cryptocurrencies, while forward contracts suit businesses requiring tailored, long-term risk management solutions.

Connection

Perpetual futures and forward contracts both serve as derivative instruments that enable investors to hedge risks or speculate on the future price of underlying assets. While perpetual futures feature no expiration date and are marked-to-market daily with funding rates, forward contracts are customizable agreements settled at a predetermined future date. The connection lies in their function to provide price exposure and risk management, with perpetual futures offering greater liquidity and flexibility compared to the bespoke nature of forward contracts.

Key Terms

Expiry Date

Forward contracts have a specific expiry date where the underlying asset is exchanged or settled, while perpetual futures lack an expiry date and trade indefinitely, often with funding rates to anchor prices to spot markets. The expiry in forward contracts introduces settlement risk and requires careful timing, whereas perpetual futures allow continuous exposure without the need for rollovers. Explore the advantages and risks of each to understand which aligns best with your trading strategy.

Settlement Mechanism

Forward contracts settle at a predetermined date with the actual delivery of the underlying asset or cash settlement at maturity, providing price certainty but exposing parties to counterparty risk. Perpetual futures use a funding rate mechanism to periodically exchange payments between long and short positions, allowing continuous contract existence without an expiry date or physical delivery. Explore the detailed settlement processes and risk management strategies to understand which contract best suits your trading objectives.

Funding Rate

Forward contracts feature a fixed settlement date with no funding rate, resulting in no periodic payments between counterparties. Perpetual futures use a funding rate mechanism to tether contract prices to spot prices, typically involving periodic payments exchanged to maintain price alignment. Explore how funding rates impact leverage and risk management in perpetual futures for deeper insights.

Source and External Links

Forward Contract - Defined, How to Use, Example - A forward contract is a customized, non-exchange-traded agreement between two parties to buy or sell an asset at a specified price on a future date, mainly used to hedge against price volatility and lock in prices.

Forward contract - Forward contracts are non-standardized, over-the-counter agreements distinct from exchange-traded futures, carrying higher counterparty risk but offering customized terms and no interim cash flows.

Futures Contracts Compared to Forwards - Forward contracts enable buyers and sellers to fix prices for future delivery of assets and differ from futures by being customized OTC contracts without central clearing, thus having higher default risk.

dowidth.com

dowidth.com