Catastrophe bonds transfer risk from insurers to investors by paying high yields in exchange for potential principal loss during major natural disasters like hurricanes or earthquakes. Weather derivatives, on the other hand, are financial instruments that help businesses hedge against adverse weather conditions by providing payouts based on temperature, rainfall, or other meteorological indices. Explore the nuanced differences between catastrophe bonds and weather derivatives to better manage financial risks related to natural events.

Why it is important

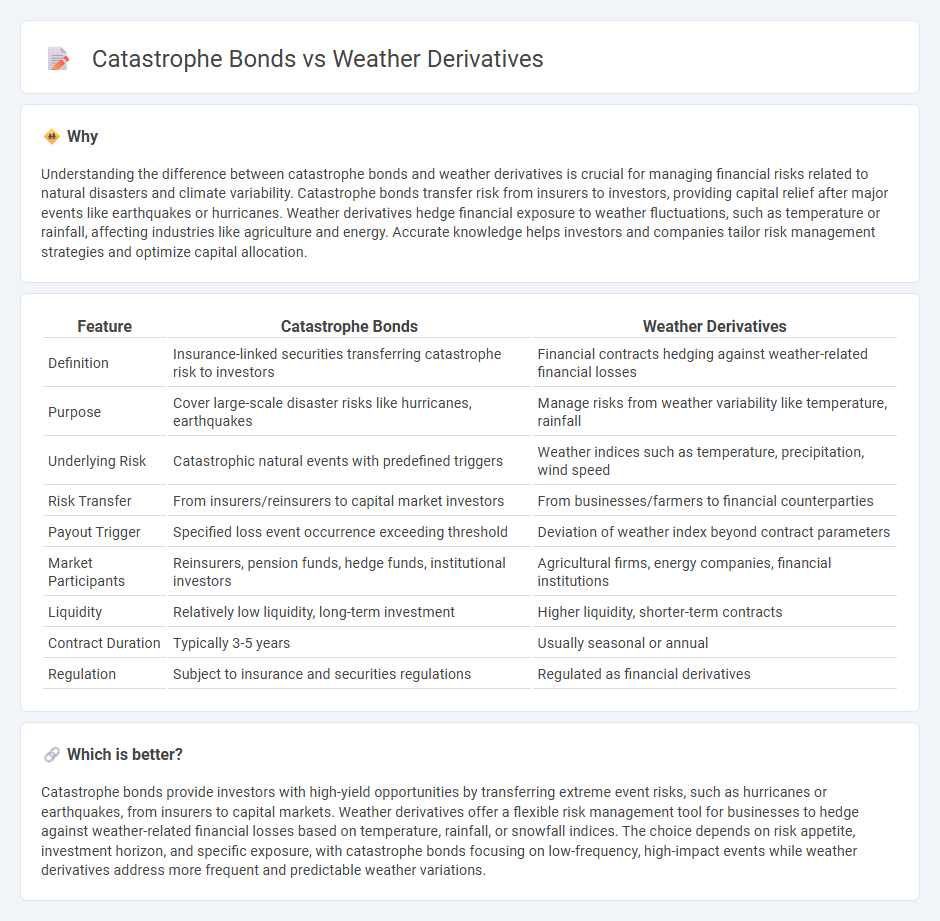

Understanding the difference between catastrophe bonds and weather derivatives is crucial for managing financial risks related to natural disasters and climate variability. Catastrophe bonds transfer risk from insurers to investors, providing capital relief after major events like earthquakes or hurricanes. Weather derivatives hedge financial exposure to weather fluctuations, such as temperature or rainfall, affecting industries like agriculture and energy. Accurate knowledge helps investors and companies tailor risk management strategies and optimize capital allocation.

Comparison Table

| Feature | Catastrophe Bonds | Weather Derivatives |

|---|---|---|

| Definition | Insurance-linked securities transferring catastrophe risk to investors | Financial contracts hedging against weather-related financial losses |

| Purpose | Cover large-scale disaster risks like hurricanes, earthquakes | Manage risks from weather variability like temperature, rainfall |

| Underlying Risk | Catastrophic natural events with predefined triggers | Weather indices such as temperature, precipitation, wind speed |

| Risk Transfer | From insurers/reinsurers to capital market investors | From businesses/farmers to financial counterparties |

| Payout Trigger | Specified loss event occurrence exceeding threshold | Deviation of weather index beyond contract parameters |

| Market Participants | Reinsurers, pension funds, hedge funds, institutional investors | Agricultural firms, energy companies, financial institutions |

| Liquidity | Relatively low liquidity, long-term investment | Higher liquidity, shorter-term contracts |

| Contract Duration | Typically 3-5 years | Usually seasonal or annual |

| Regulation | Subject to insurance and securities regulations | Regulated as financial derivatives |

Which is better?

Catastrophe bonds provide investors with high-yield opportunities by transferring extreme event risks, such as hurricanes or earthquakes, from insurers to capital markets. Weather derivatives offer a flexible risk management tool for businesses to hedge against weather-related financial losses based on temperature, rainfall, or snowfall indices. The choice depends on risk appetite, investment horizon, and specific exposure, with catastrophe bonds focusing on low-frequency, high-impact events while weather derivatives address more frequent and predictable weather variations.

Connection

Catastrophe bonds and weather derivatives are financial instruments designed to transfer and manage weather-related risks, primarily for insurance companies and corporations exposed to natural disasters. Both instruments rely on underlying weather data and indices to determine payouts, enabling risk diversification and protection against financial losses from hurricanes, storms, or extreme weather events. These products contribute to improving market liquidity and stability by allowing investors to hedge meteorological risks effectively.

Key Terms

Hedging

Weather derivatives provide businesses with financial protection against adverse weather conditions by offering payouts based on specific weather indices like temperature or rainfall, thereby reducing revenue volatility. Catastrophe bonds transfer catastrophic event risks, such as hurricanes or earthquakes, from insurers to investors, providing capital relief and risk diversification by triggering payouts only when predefined disaster thresholds are met. Explore the distinct mechanisms of weather derivatives and catastrophe bonds to enhance strategic risk hedging.

Payout Triggers

Weather derivatives payout triggers are based on quantifiable weather indices such as temperature, rainfall, or snowfall levels, allowing for precise and transparent payout determination. Catastrophe bonds, on the other hand, rely on predefined catastrophe events like hurricanes or earthquakes, with triggers typically linked to loss thresholds, event occurrence, or parametric measurements. Explore further to understand how these distinctive payout triggers impact risk management strategies in insurance and financial markets.

Risk Transfer

Weather derivatives provide a financial tool to hedge against specific weather-related risks such as temperature fluctuations or rainfall levels, allowing companies to manage cash flow uncertainty. Catastrophe bonds transfer extreme event risks, like hurricanes or earthquakes, from insurers to investors, offering high-yield returns in exchange for potential principal loss if a predefined event occurs. Explore further to understand how these instruments optimize risk transfer in diverse industries.

Source and External Links

Adverse Weather - Weather derivatives are financial instruments that provide compensation if adverse or suboptimal weather conditions occur, allowing companies to manage weather risks without needing to prove actual damage.

What are weather derivatives? - Artemis - Weather derivatives hedge the financial risks from unusual weather, triggered by measurable weather parameters, and examples include heating/cooling degree days or snowfall contracts used by industries like farming, ski resorts, and energy companies.

Weather derivative - Wikipedia - Weather derivatives are index-based instruments using observed weather data to create payout indices such as heating or cooling degree days, and their values are modeled statistically, often incorporating physical weather phenomena like El Nino for better predictive accuracy.

dowidth.com

dowidth.com