Structured credit involves complex financial instruments backed by pools of diversified debt assets, offering tailored risk and return profiles to investors. Collateralized loan obligations (CLOs) are specialized structured credit products that bundle corporate loans into tranches with varying risk levels and credit ratings. Explore the detailed differences and investment strategies between structured credit and CLOs to enhance your portfolio understanding.

Why it is important

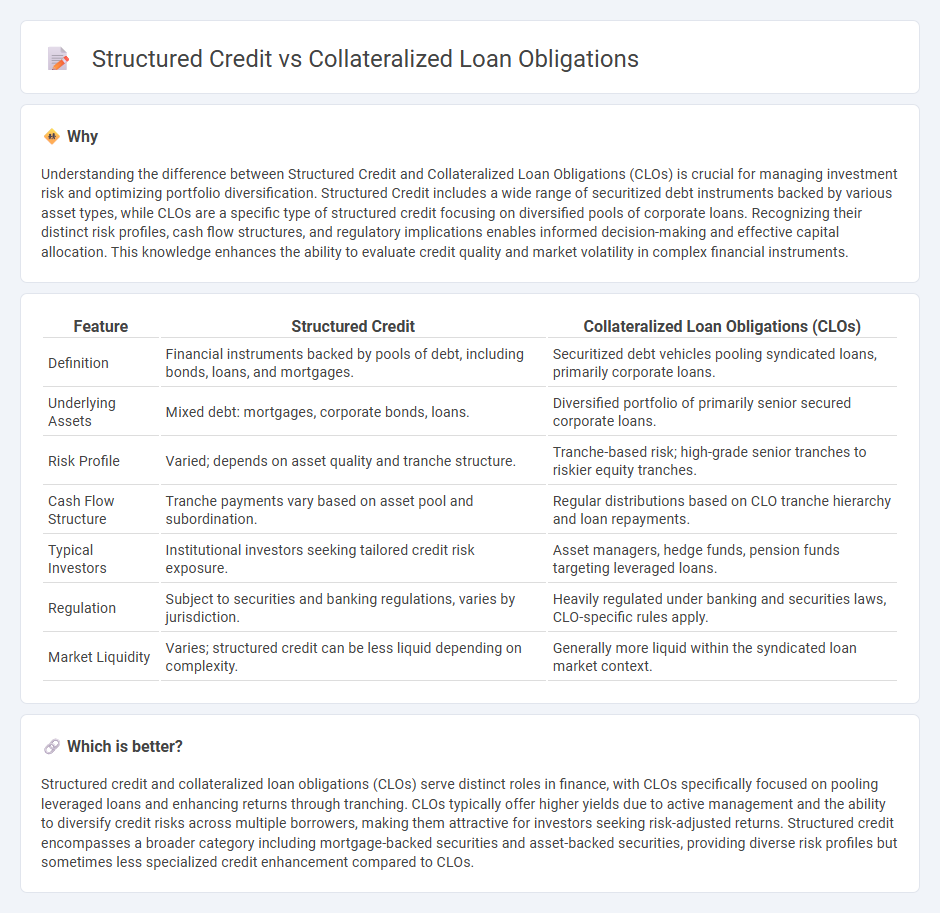

Understanding the difference between Structured Credit and Collateralized Loan Obligations (CLOs) is crucial for managing investment risk and optimizing portfolio diversification. Structured Credit includes a wide range of securitized debt instruments backed by various asset types, while CLOs are a specific type of structured credit focusing on diversified pools of corporate loans. Recognizing their distinct risk profiles, cash flow structures, and regulatory implications enables informed decision-making and effective capital allocation. This knowledge enhances the ability to evaluate credit quality and market volatility in complex financial instruments.

Comparison Table

| Feature | Structured Credit | Collateralized Loan Obligations (CLOs) |

|---|---|---|

| Definition | Financial instruments backed by pools of debt, including bonds, loans, and mortgages. | Securitized debt vehicles pooling syndicated loans, primarily corporate loans. |

| Underlying Assets | Mixed debt: mortgages, corporate bonds, loans. | Diversified portfolio of primarily senior secured corporate loans. |

| Risk Profile | Varied; depends on asset quality and tranche structure. | Tranche-based risk; high-grade senior tranches to riskier equity tranches. |

| Cash Flow Structure | Tranche payments vary based on asset pool and subordination. | Regular distributions based on CLO tranche hierarchy and loan repayments. |

| Typical Investors | Institutional investors seeking tailored credit risk exposure. | Asset managers, hedge funds, pension funds targeting leveraged loans. |

| Regulation | Subject to securities and banking regulations, varies by jurisdiction. | Heavily regulated under banking and securities laws, CLO-specific rules apply. |

| Market Liquidity | Varies; structured credit can be less liquid depending on complexity. | Generally more liquid within the syndicated loan market context. |

Which is better?

Structured credit and collateralized loan obligations (CLOs) serve distinct roles in finance, with CLOs specifically focused on pooling leveraged loans and enhancing returns through tranching. CLOs typically offer higher yields due to active management and the ability to diversify credit risks across multiple borrowers, making them attractive for investors seeking risk-adjusted returns. Structured credit encompasses a broader category including mortgage-backed securities and asset-backed securities, providing diverse risk profiles but sometimes less specialized credit enhancement compared to CLOs.

Connection

Structured credit products involve pooling various debt instruments to redistribute risk, with collateralized loan obligations (CLOs) being a prime example that securitize diversified loan portfolios. CLOs slice these loan pools into tranches with varying risk and return profiles, enhancing investment customization and risk management for institutional investors. The performance of CLOs depends heavily on structured credit principles, including credit analysis, cash flow prioritization, and tranche structuring.

Key Terms

Tranches

Collateralized loan obligations (CLOs) are a type of structured credit that securitize pools of corporate loans into tranches with varying risk and return profiles, ranging from senior tranches with higher credit ratings to equity tranches absorbing initial losses. Structured credit encompasses a broader category including CLOs, asset-backed securities, and mortgage-backed securities, all of which are divided into tranches to allocate cash flow and credit risk among investors. Explore the intricacies of tranche structures within CLOs and other structured credit products to understand risk distribution and investment opportunities.

Credit enhancement

Collateralized loan obligations (CLOs) utilize credit enhancement techniques such as subordination, overcollateralization, and reserve accounts to protect senior tranches from losses in underlying leveraged loans. Structured credit products broadly employ similar credit enhancement strategies but vary widely, including excess spread, third-party guarantees, and cash collateral reserves, tailored to asset classes like mortgages or bonds. Explore the nuances of credit enhancement methods to understand risk mitigation in CLOs versus other structured credit instruments.

Securitization

Collateralized loan obligations (CLOs) represent a form of structured credit that pools diversified corporate loans into tranches with varying risk levels, offering investors tailored exposure to credit risk and cash flow. Structured credit encompasses a broader category that includes CLOs, collateralized debt obligations (CDOs), and asset-backed securities (ABS), all relying on securitization to transform illiquid assets into tradable securities. Explore more about how securitization enhances risk management and investment strategies within these financial instruments.

Source and External Links

Understanding Collateralized Loan Obligations (CLOs) - CLOs are securitized pools of middle and large business loans structured in tranches with coverage tests to protect senior investors and concentration limits to reduce collateral risk.

Collateralized loan obligation - Wikipedia - CLOs are securitizations of syndicated leveraged loans, offering tranches with different risk and yield profiles where senior tranches are safer and equity tranches bear the first losses.

What are collateralized loan obligations (CLOs)? - BlackRock - CLOs issue tranches ranging from low-risk AAA senior debt to unrated high-risk equity, with returns reflecting their risk levels and losses allocated in order of junior to senior tranches.

dowidth.com

dowidth.com