Sovereign debt restructuring involves the renegotiation of a country's outstanding public debt obligations to achieve more manageable repayment terms, often including extended maturities, reduced interest rates, or haircuts on principal. A credit event, such as a default or missed payment, triggers protection under credit default swaps and signals a severe deterioration in the issuer's creditworthiness. Explore the nuances between sovereign debt restructuring and credit events to understand their implications for global financial markets.

Why it is important

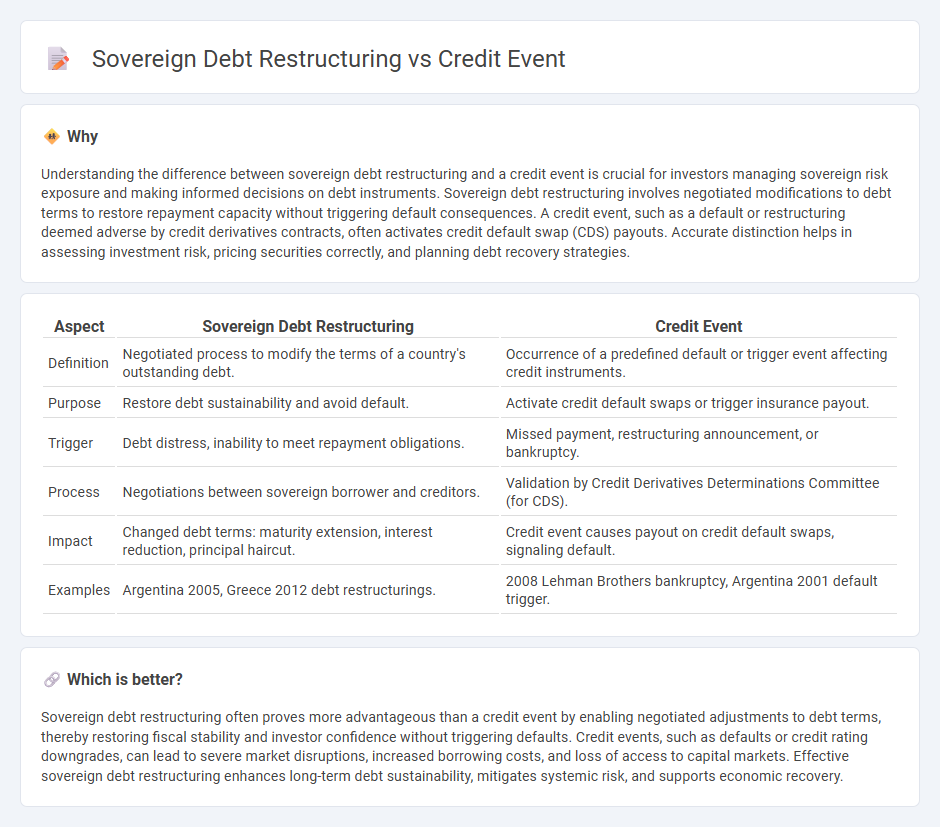

Understanding the difference between sovereign debt restructuring and a credit event is crucial for investors managing sovereign risk exposure and making informed decisions on debt instruments. Sovereign debt restructuring involves negotiated modifications to debt terms to restore repayment capacity without triggering default consequences. A credit event, such as a default or restructuring deemed adverse by credit derivatives contracts, often activates credit default swap (CDS) payouts. Accurate distinction helps in assessing investment risk, pricing securities correctly, and planning debt recovery strategies.

Comparison Table

| Aspect | Sovereign Debt Restructuring | Credit Event |

|---|---|---|

| Definition | Negotiated process to modify the terms of a country's outstanding debt. | Occurrence of a predefined default or trigger event affecting credit instruments. |

| Purpose | Restore debt sustainability and avoid default. | Activate credit default swaps or trigger insurance payout. |

| Trigger | Debt distress, inability to meet repayment obligations. | Missed payment, restructuring announcement, or bankruptcy. |

| Process | Negotiations between sovereign borrower and creditors. | Validation by Credit Derivatives Determinations Committee (for CDS). |

| Impact | Changed debt terms: maturity extension, interest reduction, principal haircut. | Credit event causes payout on credit default swaps, signaling default. |

| Examples | Argentina 2005, Greece 2012 debt restructurings. | 2008 Lehman Brothers bankruptcy, Argentina 2001 default trigger. |

Which is better?

Sovereign debt restructuring often proves more advantageous than a credit event by enabling negotiated adjustments to debt terms, thereby restoring fiscal stability and investor confidence without triggering defaults. Credit events, such as defaults or credit rating downgrades, can lead to severe market disruptions, increased borrowing costs, and loss of access to capital markets. Effective sovereign debt restructuring enhances long-term debt sustainability, mitigates systemic risk, and supports economic recovery.

Connection

Sovereign debt restructuring occurs when a country negotiates new terms to manage its debt obligations, often due to financial distress. This process can trigger a credit event, such as a default or debt repudiation, impacting credit default swaps and investor confidence. The connection between sovereign debt restructuring and credit events is critical for global financial stability and risk assessment.

Key Terms

Default

A credit event typically signifies a legally recognized default triggering credit default swaps, such as failure to pay or restructuring under predefined terms. Sovereign debt restructuring involves renegotiating payment terms with creditors to avoid outright default while addressing sovereign insolvency risks. Explore deeper insights into sovereign credit events and restructuring mechanisms for comprehensive understanding.

Haircut

A credit event in the context of sovereign debt typically triggers a significant loss to creditors, often activating credit default swaps (CDS), while sovereign debt restructuring involves negotiated changes in the debt terms to ensure sustainable repayment. The haircut represents the percentage reduction in the debt's face value creditors agree to accept during restructuring, directly impacting the recovery rate and the country's ability to regain market access. Explore further to understand how differing haircut levels shape sovereign debt outcomes and investor impacts.

Collective Action Clauses

Credit events trigger specific clauses in bond contracts, often activating credit default swaps, while sovereign debt restructuring involves a comprehensive renegotiation of terms between a country and its creditors. Collective Action Clauses (CACs) play a pivotal role in sovereign debt restructuring by allowing a supermajority of bondholders to agree on new terms, making the agreement binding for all holders and reducing the risk of holdout creditors. To explore the dynamics and implications of CACs in both contexts, dive deeper into the subject.

Source and External Links

Credit event - Wikipedia - A credit event occurs when a person or organization defaults on a significant transaction and cannot honor contractual terms, triggering protections like credit default swaps, with standard events including bankruptcy, failure to pay, and restructuring.

Credit Event - Corporate Finance Institute - A credit event is a negative change in a borrower's creditworthiness such as bankruptcy or debt restructuring that triggers a contingent payment in credit default swaps, acting as insurance against default risk.

Credit Event Auctions were designed to ensure a fair, efficient ... - ICE - Credit Event Auctions provide a transparent market process to settle credit derivative trades following a credit event like bankruptcy or restructuring by determining cash settlement prices.

dowidth.com

dowidth.com