Liability Driven Investing (LDI) focuses on aligning a portfolio's assets with its future liabilities to minimize funding risks, often used by pension funds and insurance companies. Strategic Asset Allocation (SAA) establishes a long-term target mix of asset classes based on risk tolerance and return objectives, aiming for balanced growth and diversification. Explore the differences to determine which strategy best suits your financial goals.

Why it is important

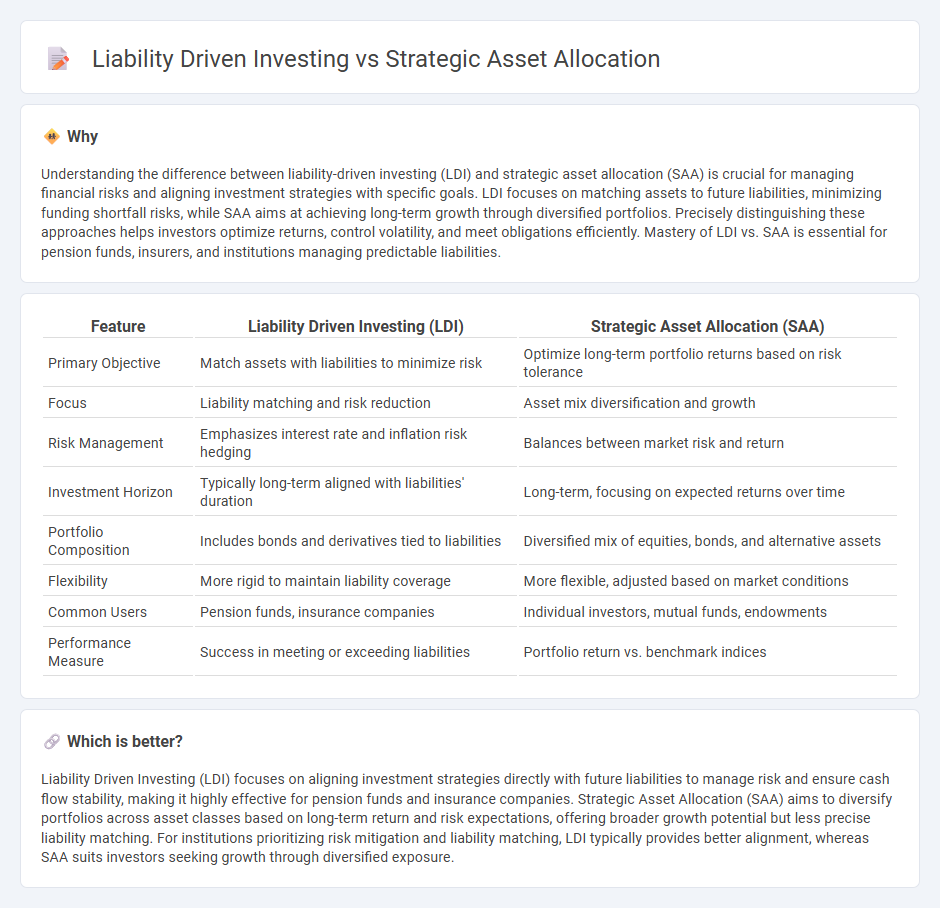

Understanding the difference between liability-driven investing (LDI) and strategic asset allocation (SAA) is crucial for managing financial risks and aligning investment strategies with specific goals. LDI focuses on matching assets to future liabilities, minimizing funding shortfall risks, while SAA aims at achieving long-term growth through diversified portfolios. Precisely distinguishing these approaches helps investors optimize returns, control volatility, and meet obligations efficiently. Mastery of LDI vs. SAA is essential for pension funds, insurers, and institutions managing predictable liabilities.

Comparison Table

| Feature | Liability Driven Investing (LDI) | Strategic Asset Allocation (SAA) |

|---|---|---|

| Primary Objective | Match assets with liabilities to minimize risk | Optimize long-term portfolio returns based on risk tolerance |

| Focus | Liability matching and risk reduction | Asset mix diversification and growth |

| Risk Management | Emphasizes interest rate and inflation risk hedging | Balances between market risk and return |

| Investment Horizon | Typically long-term aligned with liabilities' duration | Long-term, focusing on expected returns over time |

| Portfolio Composition | Includes bonds and derivatives tied to liabilities | Diversified mix of equities, bonds, and alternative assets |

| Flexibility | More rigid to maintain liability coverage | More flexible, adjusted based on market conditions |

| Common Users | Pension funds, insurance companies | Individual investors, mutual funds, endowments |

| Performance Measure | Success in meeting or exceeding liabilities | Portfolio return vs. benchmark indices |

Which is better?

Liability Driven Investing (LDI) focuses on aligning investment strategies directly with future liabilities to manage risk and ensure cash flow stability, making it highly effective for pension funds and insurance companies. Strategic Asset Allocation (SAA) aims to diversify portfolios across asset classes based on long-term return and risk expectations, offering broader growth potential but less precise liability matching. For institutions prioritizing risk mitigation and liability matching, LDI typically provides better alignment, whereas SAA suits investors seeking growth through diversified exposure.

Connection

Liability driven investing (LDI) focuses on structuring a portfolio to meet future liabilities by aligning assets with cash flow needs, while strategic asset allocation establishes long-term investment proportions to balance risk and return. The connection lies in LDI using strategic asset allocation principles to select asset classes that match liability durations and risk tolerances, ensuring funding stability. This integration helps pension funds and insurance companies optimize portfolio efficiency and minimize the risk of underfunding.

Key Terms

Risk Tolerance

Strategic asset allocation emphasizes balancing portfolio risk and return by diversifying across asset classes based on investor risk tolerance and long-term goals. Liability driven investing (LDI) centers on managing financial risks to meet future liabilities, such as pension payouts, prioritizing asset-liability matching over pure return optimization. Explore the detailed distinctions and applications of risk tolerance in these approaches to optimize your investment strategy.

Funding Ratio

Strategic asset allocation aims to maximize portfolio growth by balancing risk and return, while liability-driven investing (LDI) prioritizes matching assets to liabilities to stabilize the funding ratio. The funding ratio--a measure of assets relative to pension liabilities--serves as a critical indicator in LDI, guiding investment decisions to ensure pension obligations are met. Explore further to understand how optimizing the funding ratio influences long-term financial stability in both strategies.

Rebalancing

Strategic asset allocation involves periodic rebalancing to maintain target portfolio weights, ensuring alignment with long-term investment objectives and risk tolerance. Liability-driven investing (LDI) emphasizes rebalancing based on changes in liability profiles, matching assets closely to expected future obligations to minimize funding risk. Explore the distinct rebalancing techniques in strategic asset allocation and LDI to optimize your portfolio outcomes.

Source and External Links

Strategic Asset Allocation or the Art of Diversification - Strategic asset allocation is a long-term step in portfolio management that defines the right balance between asset classes over 5 to 10 years to maximize performance at a constant risk and is distinct from tactical allocation, which adjusts for short-term market opportunities.

Strategic Asset Allocation (SAA) - Corporate Finance Institute - Strategic asset allocation is a long-term portfolio strategy involving choosing target asset class allocations and periodic rebalancing to maintain risk and return objectives aligned with investor tolerance and time horizon.

What is strategic asset allocation? | State Street - Strategic asset allocation balances risk and return by distributing investments across a variety of asset classes based on long-term forecasts, investor risk tolerance, and time horizon, and it emphasizes diversification to reduce volatility over multiple market cycles.

dowidth.com

dowidth.com