Liability driven investing (LDI) focuses on managing investment risks to meet future financial obligations, emphasizing strategies aligned with liabilities' timing and amount. Liability-matching portfolios specifically construct asset allocations to exactly align cash flows and durations with anticipated liabilities, ensuring coverage with minimal funding gaps. Explore the differences and benefits of these approaches to enhance financial stability and risk management.

Why it is important

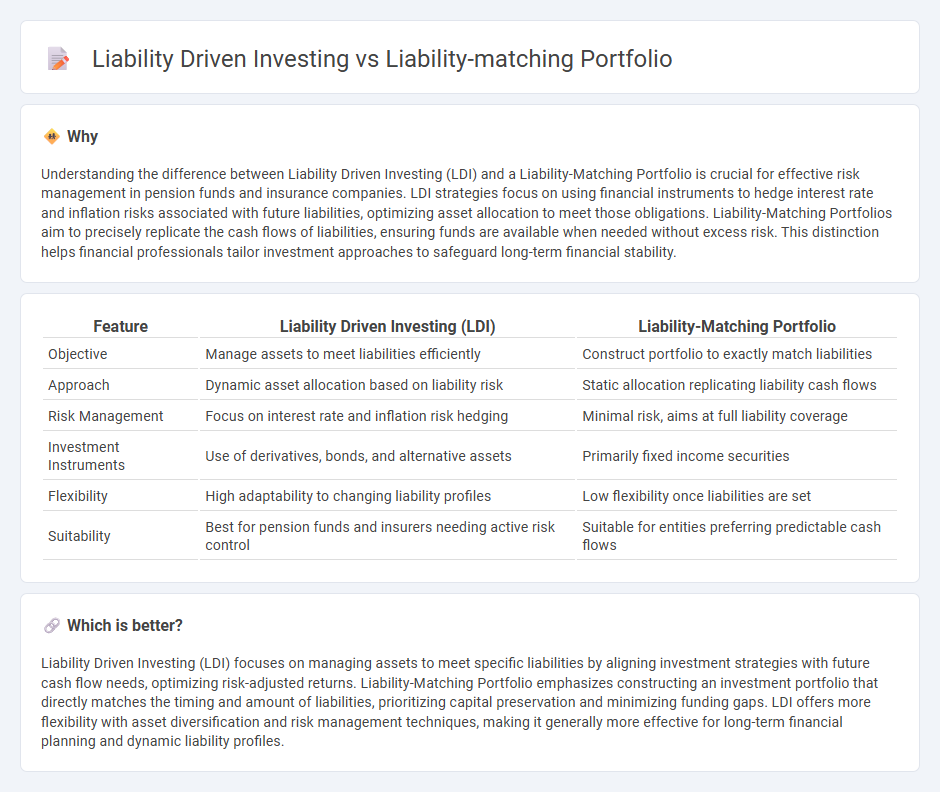

Understanding the difference between Liability Driven Investing (LDI) and a Liability-Matching Portfolio is crucial for effective risk management in pension funds and insurance companies. LDI strategies focus on using financial instruments to hedge interest rate and inflation risks associated with future liabilities, optimizing asset allocation to meet those obligations. Liability-Matching Portfolios aim to precisely replicate the cash flows of liabilities, ensuring funds are available when needed without excess risk. This distinction helps financial professionals tailor investment approaches to safeguard long-term financial stability.

Comparison Table

| Feature | Liability Driven Investing (LDI) | Liability-Matching Portfolio |

|---|---|---|

| Objective | Manage assets to meet liabilities efficiently | Construct portfolio to exactly match liabilities |

| Approach | Dynamic asset allocation based on liability risk | Static allocation replicating liability cash flows |

| Risk Management | Focus on interest rate and inflation risk hedging | Minimal risk, aims at full liability coverage |

| Investment Instruments | Use of derivatives, bonds, and alternative assets | Primarily fixed income securities |

| Flexibility | High adaptability to changing liability profiles | Low flexibility once liabilities are set |

| Suitability | Best for pension funds and insurers needing active risk control | Suitable for entities preferring predictable cash flows |

Which is better?

Liability Driven Investing (LDI) focuses on managing assets to meet specific liabilities by aligning investment strategies with future cash flow needs, optimizing risk-adjusted returns. Liability-Matching Portfolio emphasizes constructing an investment portfolio that directly matches the timing and amount of liabilities, prioritizing capital preservation and minimizing funding gaps. LDI offers more flexibility with asset diversification and risk management techniques, making it generally more effective for long-term financial planning and dynamic liability profiles.

Connection

Liability driven investing (LDI) focuses on structuring portfolios to meet future financial obligations by aligning assets with liabilities. Liability-matching portfolios specifically invest in assets whose cash flows correspond to expected liabilities, ensuring precise coverage of debt or pension commitments. This strategic alignment in LDI reduces interest rate and inflation risks, enhancing the likelihood of fulfilling long-term financial responsibilities.

Key Terms

Duration Matching

Liability-matching portfolios specifically target aligning asset durations with the timing and amount of liabilities to minimize interest rate risk and ensure cash flow sufficiency. Liability Driven Investing (LDI) encompasses a broader strategy that integrates duration matching with other risk management techniques, such as immunization and hedging, to optimize the overall risk-return profile relative to liabilities. Explore comprehensive insights on how duration matching differentiates these approaches and enhances pension fund stability.

Cash Flow Matching

Liability-matching portfolios prioritize aligning asset cash flows with future liability payments, ensuring precise timing and amounts to minimize funding shortfall risks. Liability Driven Investing (LDI) employs broader risk management strategies, including interest rate hedging and duration matching, to stabilize funded status rather than strict cash flow alignment. Explore how cash flow matching enhances portfolio resilience and reduces funding volatility in LDI frameworks.

Interest Rate Risk

Liability-matching portfolios specifically align the duration and cash flows of assets with liabilities to minimize interest rate risk exposure. Liability-driven investing (LDI) employs broader strategies, including interest rate hedging and diversification, to manage overall liability risks beyond just matching durations. Explore further to understand how LDI frameworks optimize interest rate risk management across evolving market conditions.

Source and External Links

Improve Liability-Matching With Active LDI - PIMCO - Liability-matching portfolios aim to hedge pension fund liabilities by investing mainly in long-dated bonds and swaps, but active management can add alpha with little extra risk compared to a passive approach, improving returns despite low nominal yields.

"Asset-Liability Matching" Aligns Your Money to Your Future - Liability-matching portfolio involves aligning assets to liabilities by using low-risk short-term assets to cover short-term liabilities and higher-risk assets for long-term liabilities, ensuring expenditure needs are met with appropriate asset risk profiles.

Asset-Liability Matching: Strategy & Examples - Vaia - Liability-matching portfolios use strategies like cash flow matching, duration matching, and immunization to align asset cash flows and durations with liabilities, minimizing interest rate risk and ensuring payments (e.g., insurance annuities) are met timely and reliably.

dowidth.com

dowidth.com