Bucket investing involves dividing assets into separate portfolios based on time horizons and risk levels to meet specific financial goals, while Core and Satellite investing combines a stable core of low-cost index funds with satellite investments in higher-risk, high-reward assets. Core and Satellite strategies aim to balance growth potential and risk, optimizing diversification and capital allocation. Explore these approaches further to determine which investment strategy aligns best with your financial objectives.

Why it is important

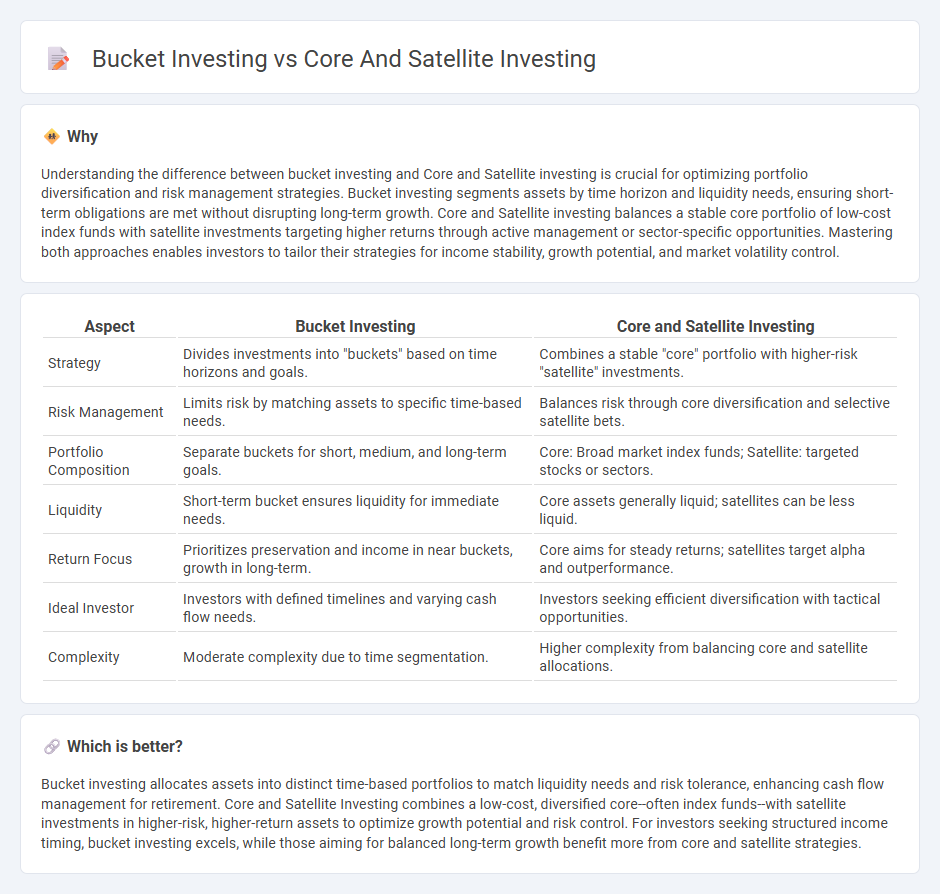

Understanding the difference between bucket investing and Core and Satellite investing is crucial for optimizing portfolio diversification and risk management strategies. Bucket investing segments assets by time horizon and liquidity needs, ensuring short-term obligations are met without disrupting long-term growth. Core and Satellite investing balances a stable core portfolio of low-cost index funds with satellite investments targeting higher returns through active management or sector-specific opportunities. Mastering both approaches enables investors to tailor their strategies for income stability, growth potential, and market volatility control.

Comparison Table

| Aspect | Bucket Investing | Core and Satellite Investing |

|---|---|---|

| Strategy | Divides investments into "buckets" based on time horizons and goals. | Combines a stable "core" portfolio with higher-risk "satellite" investments. |

| Risk Management | Limits risk by matching assets to specific time-based needs. | Balances risk through core diversification and selective satellite bets. |

| Portfolio Composition | Separate buckets for short, medium, and long-term goals. | Core: Broad market index funds; Satellite: targeted stocks or sectors. |

| Liquidity | Short-term bucket ensures liquidity for immediate needs. | Core assets generally liquid; satellites can be less liquid. |

| Return Focus | Prioritizes preservation and income in near buckets, growth in long-term. | Core aims for steady returns; satellites target alpha and outperformance. |

| Ideal Investor | Investors with defined timelines and varying cash flow needs. | Investors seeking efficient diversification with tactical opportunities. |

| Complexity | Moderate complexity due to time segmentation. | Higher complexity from balancing core and satellite allocations. |

Which is better?

Bucket investing allocates assets into distinct time-based portfolios to match liquidity needs and risk tolerance, enhancing cash flow management for retirement. Core and Satellite Investing combines a low-cost, diversified core--often index funds--with satellite investments in higher-risk, higher-return assets to optimize growth potential and risk control. For investors seeking structured income timing, bucket investing excels, while those aiming for balanced long-term growth benefit more from core and satellite strategies.

Connection

Bucket investing and Core and Satellite Investing both aim to balance risk and return by segmenting portfolios into distinct parts tailored to specific investment goals. Bucket investing divides assets into time-based segments to match liquidity needs, while Core and Satellite Investing separates a stable core portfolio from opportunistic satellite holdings to enhance diversification. This strategic segmentation in both approaches helps optimize portfolio resilience and aligns investments with varying risk tolerances and time horizons.

Key Terms

Asset Allocation

Core and satellite investing emphasizes a strategic blend of a diversified core portfolio of low-cost index funds with satellite investments targeting higher-growth opportunities, optimizing overall asset allocation for risk and return. Bucket investing segments assets into separate pools based on time horizons and spending needs, tailoring allocation to liquidity and income requirements for different life stages. Explore how each asset allocation approach can align with your financial goals and investment timeline to enhance portfolio efficiency.

Diversification

Core and Satellite Investing emphasizes diversification by combining a stable, broad-market core portfolio with satellite investments targeting specific sectors or themes to enhance returns. Bucket Investing segments assets into distinct "buckets" based on investment timeline or purpose, aiming to manage risk and ensure liquidity. Explore the advantages of both strategies to optimize your portfolio diversification and risk management.

Risk Management

Core and satellite investing combines a stable, diversified core portfolio with satellite positions in higher-risk assets to balance growth and risk, emphasizing dynamic risk management through asset allocation. Bucket investing segments investments into separate buckets based on time horizons and risk tolerance, ensuring capital is allocated to meet short-, medium-, and long-term financial needs with risk appropriately managed in each bucket. Explore more to understand which risk management strategy aligns best with your financial goals and investment personality.

Source and External Links

Core-satellite approach: A smarter way to diversify your investments - A portfolio management strategy balancing stability with growth by using a stable low-cost passive core (e.g., index funds) and smaller, more active satellite investments aimed at higher returns.

Level Up Your Portfolio: How to Build Your Core and Launch Your Satellites - Core and satellite investing combines diversified, low-risk core assets with satellite positions that target growth or defensive opportunities, offering flexibility and enhanced return potential.

Risks and Benefits of a Core-Satellite Portfolio - PAX Financial Group - The core-satellite model includes a diversified passive core and actively managed satellites, designed to grow the portfolio while managing market risks across different life phases.

dowidth.com

dowidth.com