Finfluencers leverage social media platforms to provide accessible financial insights and investment advice, often emphasizing trends and personal experiences. Stockbrokers offer professional, regulated services focused on executing trades, portfolio management, and personalized financial planning. Explore the distinct roles and benefits of finfluencers and stockbrokers to optimize your investment strategy.

Why it is important

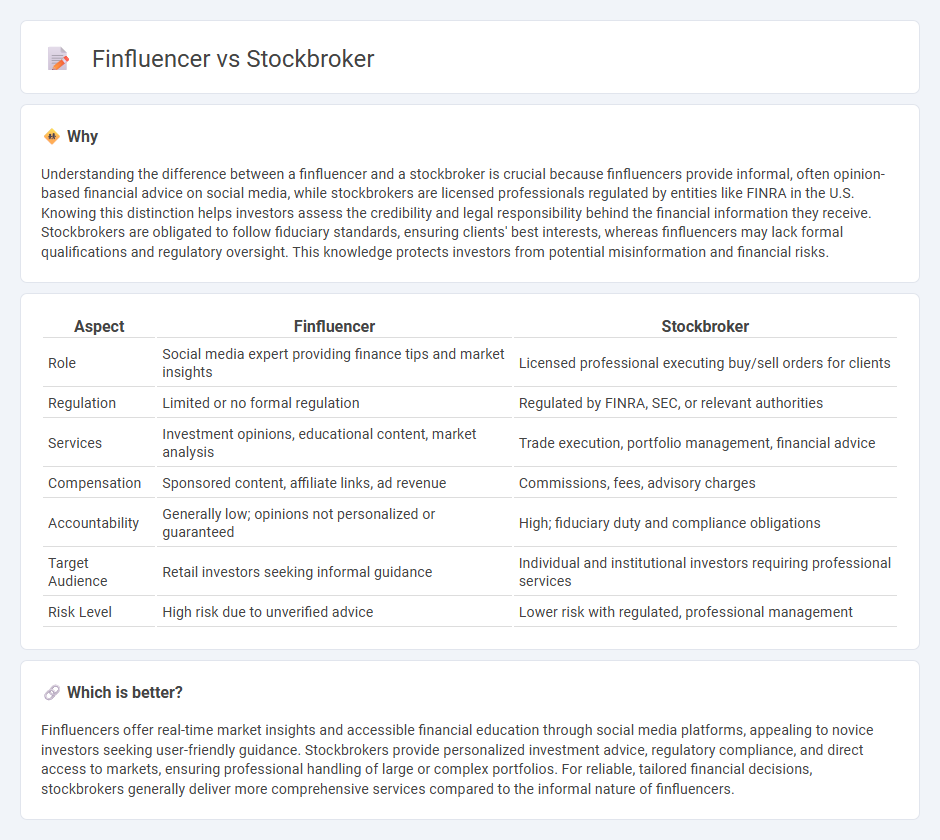

Understanding the difference between a finfluencer and a stockbroker is crucial because finfluencers provide informal, often opinion-based financial advice on social media, while stockbrokers are licensed professionals regulated by entities like FINRA in the U.S. Knowing this distinction helps investors assess the credibility and legal responsibility behind the financial information they receive. Stockbrokers are obligated to follow fiduciary standards, ensuring clients' best interests, whereas finfluencers may lack formal qualifications and regulatory oversight. This knowledge protects investors from potential misinformation and financial risks.

Comparison Table

| Aspect | Finfluencer | Stockbroker |

|---|---|---|

| Role | Social media expert providing finance tips and market insights | Licensed professional executing buy/sell orders for clients |

| Regulation | Limited or no formal regulation | Regulated by FINRA, SEC, or relevant authorities |

| Services | Investment opinions, educational content, market analysis | Trade execution, portfolio management, financial advice |

| Compensation | Sponsored content, affiliate links, ad revenue | Commissions, fees, advisory charges |

| Accountability | Generally low; opinions not personalized or guaranteed | High; fiduciary duty and compliance obligations |

| Target Audience | Retail investors seeking informal guidance | Individual and institutional investors requiring professional services |

| Risk Level | High risk due to unverified advice | Lower risk with regulated, professional management |

Which is better?

Finfluencers offer real-time market insights and accessible financial education through social media platforms, appealing to novice investors seeking user-friendly guidance. Stockbrokers provide personalized investment advice, regulatory compliance, and direct access to markets, ensuring professional handling of large or complex portfolios. For reliable, tailored financial decisions, stockbrokers generally deliver more comprehensive services compared to the informal nature of finfluencers.

Connection

Finfluencers and stockbrokers both play pivotal roles in financial markets by influencing investor behavior and facilitating trades. Finfluencers leverage social media platforms to share stock tips, market analysis, and investment strategies, often shaping market sentiment and driving retail investor decisions. Stockbrokers execute trades on behalf of clients, providing professional guidance and access to financial products, thereby converting finfluencer-driven interest into actionable market participation.

Key Terms

Stockbroker: License, Commission, Securities

A stockbroker is a licensed professional authorized to buy and sell securities such as stocks, bonds, and mutual funds on behalf of clients, often operating under regulatory bodies like FINRA or the SEC. Their income primarily comes from commissions or fees based on transaction volume or asset management, ensuring compliance with fiduciary standards. Discover how stockbrokers differ from finfluencers in expertise, regulation, and service by exploring detailed comparisons.

Finfluencer: Social Media, Content, Followers

Finfluencers leverage social media platforms such as Instagram, TikTok, and YouTube to create engaging financial content that educates and influences their followers' investment decisions. Unlike stockbrokers who provide personalized financial services and investment advice within regulated environments, finfluencers reach mass audiences with accessible tips, market analyses, and trending stock discussions. Explore how finfluencers are reshaping investment education and democratizing financial knowledge on social networks.

Regulation

Stockbrokers operate under strict regulatory frameworks such as the SEC in the U.S. or FCA in the UK, ensuring compliance with financial laws and fiduciary duties to protect investors. Finfluencers, often social media-based financial advisors, exist in a less regulated space with evolving guidelines that lag behind traditional market oversight, raising concerns about reliability and accountability. Explore more on how regulation impacts trust and safety in stock trading and financial advice.

Source and External Links

Learn About Being a Stockbroker | Indeed.com - Stockbrokers buy and trade financial securities for clients, manage portfolios, provide market advice, and typically earn a base salary plus commissions, requiring at least a bachelor's degree and licensing (e.g., FINRA) in the US.

How to Become a Stockbroker - CFA Institute - Stockbrokers handle client transactions, usually require a bachelor's degree in finance or related fields, and work in a fast-paced environment, with salaries varying by experience and institution, though technology is changing traditional brokerage roles.

Average Salary of Stockbrokers (And Factors That Affect It) - Indeed - Stockbrokers work by buying and selling stocks for clients, research market trends, and their earnings depend on location, client income, and skill, with salaries ranging broadly from $14,000 up to $194,000+ annually in the US.

dowidth.com

dowidth.com