Risk parity portfolios allocate capital based on risk contribution, aiming to balance volatility across asset classes for stable returns. Factor investing portfolios focus on specific drivers like value, momentum, or size to capture systematic risk premia. Explore the nuances and performance implications comparing risk parity and factor investing strategies.

Why it is important

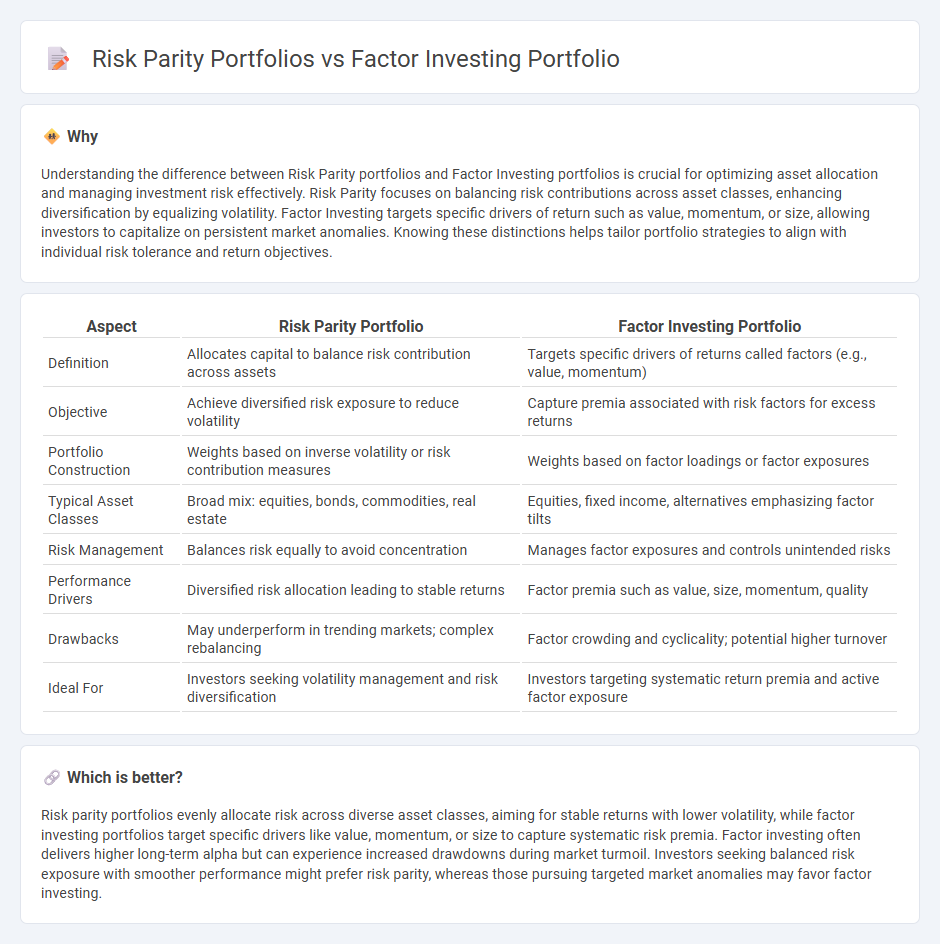

Understanding the difference between Risk Parity portfolios and Factor Investing portfolios is crucial for optimizing asset allocation and managing investment risk effectively. Risk Parity focuses on balancing risk contributions across asset classes, enhancing diversification by equalizing volatility. Factor Investing targets specific drivers of return such as value, momentum, or size, allowing investors to capitalize on persistent market anomalies. Knowing these distinctions helps tailor portfolio strategies to align with individual risk tolerance and return objectives.

Comparison Table

| Aspect | Risk Parity Portfolio | Factor Investing Portfolio |

|---|---|---|

| Definition | Allocates capital to balance risk contribution across assets | Targets specific drivers of returns called factors (e.g., value, momentum) |

| Objective | Achieve diversified risk exposure to reduce volatility | Capture premia associated with risk factors for excess returns |

| Portfolio Construction | Weights based on inverse volatility or risk contribution measures | Weights based on factor loadings or factor exposures |

| Typical Asset Classes | Broad mix: equities, bonds, commodities, real estate | Equities, fixed income, alternatives emphasizing factor tilts |

| Risk Management | Balances risk equally to avoid concentration | Manages factor exposures and controls unintended risks |

| Performance Drivers | Diversified risk allocation leading to stable returns | Factor premia such as value, size, momentum, quality |

| Drawbacks | May underperform in trending markets; complex rebalancing | Factor crowding and cyclicality; potential higher turnover |

| Ideal For | Investors seeking volatility management and risk diversification | Investors targeting systematic return premia and active factor exposure |

Which is better?

Risk parity portfolios evenly allocate risk across diverse asset classes, aiming for stable returns with lower volatility, while factor investing portfolios target specific drivers like value, momentum, or size to capture systematic risk premia. Factor investing often delivers higher long-term alpha but can experience increased drawdowns during market turmoil. Investors seeking balanced risk exposure with smoother performance might prefer risk parity, whereas those pursuing targeted market anomalies may favor factor investing.

Connection

Risk parity portfolios and factor investing portfolios are connected through their focus on diversification and risk management by allocating assets based on risk factors rather than capital weights. Both strategies emphasize exposure to systematic factors such as value, momentum, volatility, and size, allowing for optimized portfolio construction that balances risk contributions. By integrating factor-based risk measures, risk parity approaches enhance performance stability and reduce drawdowns across varying market environments.

Key Terms

Factor Exposure

Factor investing portfolios emphasize targeted exposure to specific risk factors such as value, momentum, size, and quality, enabling investors to capture systematic return premia. Risk parity portfolios allocate risk equally across different asset classes, prioritizing balanced risk contributions rather than factor tilts, which may dilute pure factor exposures. Explore the nuances of factor exposure and risk distribution to optimize investment strategies.

Risk Allocation

Factor investing portfolios allocate capital based on systematic risk factors such as value, momentum, size, and quality, targeting specific drivers of return with varying risk exposures. Risk parity portfolios emphasize balanced risk allocation across asset classes by equalizing the contribution of each asset to overall portfolio volatility, enhancing diversification and mitigating concentration risk. Explore further to understand how these strategies optimize risk allocation for improved portfolio resilience and performance.

Leverage

Factor investing portfolios leverage targeted exposures to specific risk premia such as value, momentum, and quality, often employing moderate leverage to enhance returns while maintaining factor diversification. Risk parity portfolios allocate risk equally across asset classes, frequently using leverage to balance risk contributions and achieve target volatility, especially in fixed income and equity markets. Explore deeper insights on how leverage strategies impact portfolio risk and return dynamics.

Source and External Links

What are factor based funds? | Vanguard - Factor investing involves tilting portfolios toward stock characteristics such as momentum, value, quality, or low volatility, with multifactor funds combining several of these for diversified exposure aimed at long-term capital appreciation.

What is Factor Investing? - NEPC - Factor investing seeks to capture premiums linked to specific risks via diversified multi-factor portfolios, aiming to reduce risk while enhancing returns over the long term by deliberately tilting exposure to these factors.

Guide to factor investing in equity markets - Factor investing improves portfolio return-risk profiles by targeting proven factors like value, momentum, low volatility, and quality, often combining multiple factors in strategies to reduce downside risk and boost long-term returns.

dowidth.com

dowidth.com