Retail algorithmic trading leverages automated systems and pre-programmed rules to execute large volumes of trades rapidly, minimizing human emotion and error. Discretionary trading depends on individual judgment, market analysis, and experience, allowing flexibility but increasing the risk of emotional bias. Explore the benefits and challenges of each approach to optimize your trading strategy.

Why it is important

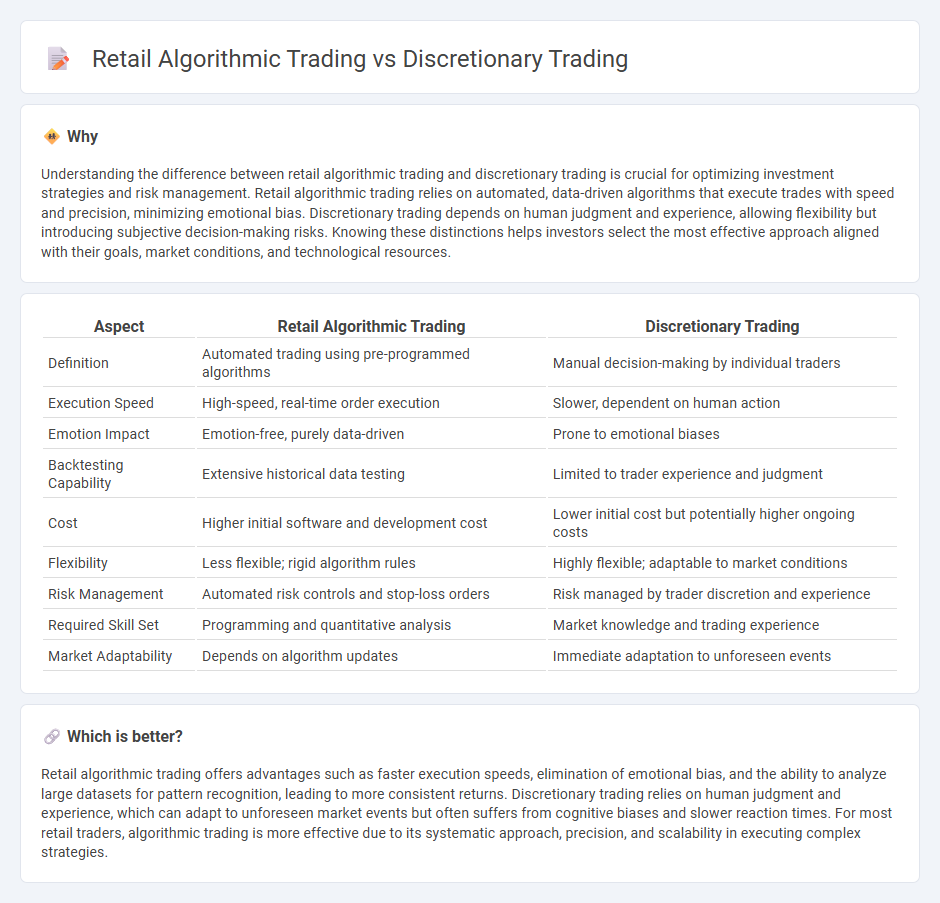

Understanding the difference between retail algorithmic trading and discretionary trading is crucial for optimizing investment strategies and risk management. Retail algorithmic trading relies on automated, data-driven algorithms that execute trades with speed and precision, minimizing emotional bias. Discretionary trading depends on human judgment and experience, allowing flexibility but introducing subjective decision-making risks. Knowing these distinctions helps investors select the most effective approach aligned with their goals, market conditions, and technological resources.

Comparison Table

| Aspect | Retail Algorithmic Trading | Discretionary Trading |

|---|---|---|

| Definition | Automated trading using pre-programmed algorithms | Manual decision-making by individual traders |

| Execution Speed | High-speed, real-time order execution | Slower, dependent on human action |

| Emotion Impact | Emotion-free, purely data-driven | Prone to emotional biases |

| Backtesting Capability | Extensive historical data testing | Limited to trader experience and judgment |

| Cost | Higher initial software and development cost | Lower initial cost but potentially higher ongoing costs |

| Flexibility | Less flexible; rigid algorithm rules | Highly flexible; adaptable to market conditions |

| Risk Management | Automated risk controls and stop-loss orders | Risk managed by trader discretion and experience |

| Required Skill Set | Programming and quantitative analysis | Market knowledge and trading experience |

| Market Adaptability | Depends on algorithm updates | Immediate adaptation to unforeseen events |

Which is better?

Retail algorithmic trading offers advantages such as faster execution speeds, elimination of emotional bias, and the ability to analyze large datasets for pattern recognition, leading to more consistent returns. Discretionary trading relies on human judgment and experience, which can adapt to unforeseen market events but often suffers from cognitive biases and slower reaction times. For most retail traders, algorithmic trading is more effective due to its systematic approach, precision, and scalability in executing complex strategies.

Connection

Retail algorithmic trading leverages automated systems to execute trades based on predetermined criteria, increasing efficiency and reducing emotional bias. Discretionary trading, driven by human judgment and intuition, often incorporates insights gained from algorithmic patterns and market signals. The integration of both approaches allows traders to harness data-driven precision while adapting to dynamic market conditions.

Key Terms

Decision-making process

Discretionary trading relies on the trader's experience, intuition, and real-time market analysis to make decisions, allowing for flexibility in response to evolving market conditions. Retail algorithmic trading automates decision-making through pre-programmed rules and quantitative models, reducing emotional bias and enabling consistent execution of strategies. Explore how these distinct decision-making approaches impact trading performance and risk management.

Human judgment

Discretionary trading relies heavily on the trader's human judgment, intuition, and experience to make decisions based on market conditions, news, and patterns. Retail algorithmic trading automates decision-making through pre-programmed rules and mathematical models, minimizing emotional bias and increasing execution speed. Explore the advantages and limitations of these strategies to determine the best fit for your trading goals.

Automated execution

Discretionary trading relies on human judgment for automated execution decisions, blending trader intuition with algorithmic order placement to optimize trade timing and price. Retail algorithmic trading employs pre-programmed rules and quantitative models to execute trades automatically, minimizing emotional bias and ensuring consistent strategy implementation. Explore deeper insights on how automated execution shapes performance in both trading styles.

Source and External Links

What is discretionary trading? | FBS Glossary - Discretionary trading allows traders to control trades directly by relying on intuition and understanding of current market conditions rather than following strict rules, enabling adaptability and potentially higher profitability but requiring experience and emotional discipline.

Mechanical Trading Strategies Vs. Discretionary Trading Strategies - Discretionary trading strategies involve decision-based trading where the trader uses judgment and current market analysis, bending or adjusting rules as necessary, unlike mechanical trading which follows fixed algorithms.

Discretionary Trading: Strategies for Savvy Investors - Discretionary trading combines market analysis with gut feeling and experience, with successful traders balancing data-driven research, backtesting, and human insight to adapt quickly to changing market conditions.

dowidth.com

dowidth.com