Decentralized Autonomous Organization (DAO) treasuries manage assets through blockchain technology, enabling transparent, community-driven financial decisions without centralized control. Sovereign wealth funds (SWFs) are state-owned investment portfolios designed to stabilize economies and generate long-term returns through diversified holdings. Explore how these innovative financial structures represent evolving strategies in asset management and governance.

Why it is important

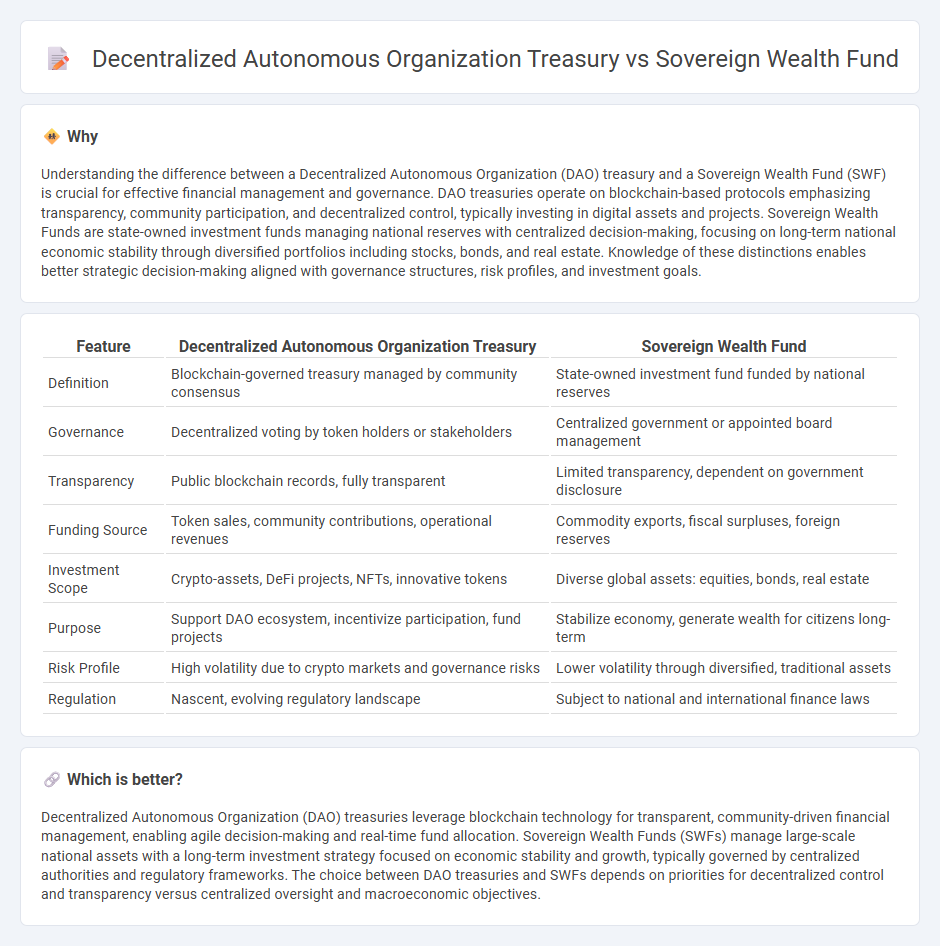

Understanding the difference between a Decentralized Autonomous Organization (DAO) treasury and a Sovereign Wealth Fund (SWF) is crucial for effective financial management and governance. DAO treasuries operate on blockchain-based protocols emphasizing transparency, community participation, and decentralized control, typically investing in digital assets and projects. Sovereign Wealth Funds are state-owned investment funds managing national reserves with centralized decision-making, focusing on long-term national economic stability through diversified portfolios including stocks, bonds, and real estate. Knowledge of these distinctions enables better strategic decision-making aligned with governance structures, risk profiles, and investment goals.

Comparison Table

| Feature | Decentralized Autonomous Organization Treasury | Sovereign Wealth Fund |

|---|---|---|

| Definition | Blockchain-governed treasury managed by community consensus | State-owned investment fund funded by national reserves |

| Governance | Decentralized voting by token holders or stakeholders | Centralized government or appointed board management |

| Transparency | Public blockchain records, fully transparent | Limited transparency, dependent on government disclosure |

| Funding Source | Token sales, community contributions, operational revenues | Commodity exports, fiscal surpluses, foreign reserves |

| Investment Scope | Crypto-assets, DeFi projects, NFTs, innovative tokens | Diverse global assets: equities, bonds, real estate |

| Purpose | Support DAO ecosystem, incentivize participation, fund projects | Stabilize economy, generate wealth for citizens long-term |

| Risk Profile | High volatility due to crypto markets and governance risks | Lower volatility through diversified, traditional assets |

| Regulation | Nascent, evolving regulatory landscape | Subject to national and international finance laws |

Which is better?

Decentralized Autonomous Organization (DAO) treasuries leverage blockchain technology for transparent, community-driven financial management, enabling agile decision-making and real-time fund allocation. Sovereign Wealth Funds (SWFs) manage large-scale national assets with a long-term investment strategy focused on economic stability and growth, typically governed by centralized authorities and regulatory frameworks. The choice between DAO treasuries and SWFs depends on priorities for decentralized control and transparency versus centralized oversight and macroeconomic objectives.

Connection

Decentralized autonomous organization (DAO) treasuries and sovereign wealth funds (SWFs) both manage large pools of capital with strategic investment goals aimed at long-term value appreciation. DAO treasuries leverage blockchain technology to enable transparent, automated governance and fund allocation, mirroring SWFs' objective to stabilize national economies and generate wealth through diversified asset portfolios. The intersection lies in their shared focus on sustainable financial management, risk diversification, and maximizing returns using innovative financial models and investment strategies.

Key Terms

Ownership Structure

Sovereign wealth funds (SWFs) are state-owned investment entities managing public assets to generate returns for national development, whereas decentralized autonomous organization (DAO) treasuries are collectively owned and governed by token holders through blockchain protocols. SWFs typically have centralized decision-making aligned with government policies, while DAOs operate on decentralized consensus models promoting transparency and community control. Explore further to understand the implications of these ownership structures on governance and financial strategy.

Governance Mechanism

Sovereign wealth funds (SWFs) operate under centralized governance with state-appointed boards ensuring regulatory compliance, transparency, and strategic investment aligned with national interests. Decentralized Autonomous Organization (DAO) treasuries leverage blockchain technology for decentralized decision-making, enabling token holders to propose and vote on governance changes, thereby enhancing community participation and reducing centralized authority risks. Explore the evolving governance mechanisms shaping investment management by comparing these innovative models in depth.

Asset Management

Sovereign wealth funds (SWFs) manage vast pools of state-owned assets, focusing on long-term investments in stocks, bonds, and real estate to generate stable returns and support national economic objectives. Decentralized Autonomous Organization (DAO) treasuries, governed by blockchain-based protocols, prioritize transparency, community voting, and rapid allocation of digital assets like cryptocurrencies and tokens, enabling agile and inclusive decision-making. Explore the evolving strategies and advantages in asset management between SWFs and DAO treasuries to understand their impact on global financial ecosystems.

Source and External Links

360deg View of a US Sovereign Wealth Fund - A sovereign wealth fund (SWF) is a state-owned investment fund that manages a country's financial assets to maximize profit, stabilize the economy, preserve wealth for future generations, and support government pensions, often created from natural resource revenues such as oil and gas.

Trump's Sovereign Wealth Fund Brings High Stakes and Serious Risks - SWFs hold trillions in assets globally and are traditionally set up by resource-rich countries to manage surplus revenue, diversify economies, and secure economic leadership, with Norway's $1.8 trillion fund as a leading example.

What is a Sovereign Wealth Fund? - Sovereign wealth funds are government-owned investment funds characterized by investing in foreign financial assets for financial objectives, with mandates including savings for future generations, economic stabilization, and strategic development goals.

dowidth.com

dowidth.com