Altcoins staking offers higher yield potential by locking cryptocurrencies like Ethereum or Cardano to support network operations, whereas stablecoin savings prioritize capital preservation with lower but stable returns pegged to fiat currencies like USDT or USDC. Both methods provide passive income opportunities, with altcoins carrying greater volatility risk and stablecoins offering liquidity and reduced price fluctuation. Discover which strategy aligns best with your investment goals and risk tolerance by learning more about altcoins staking and stablecoin savings.

Why it is important

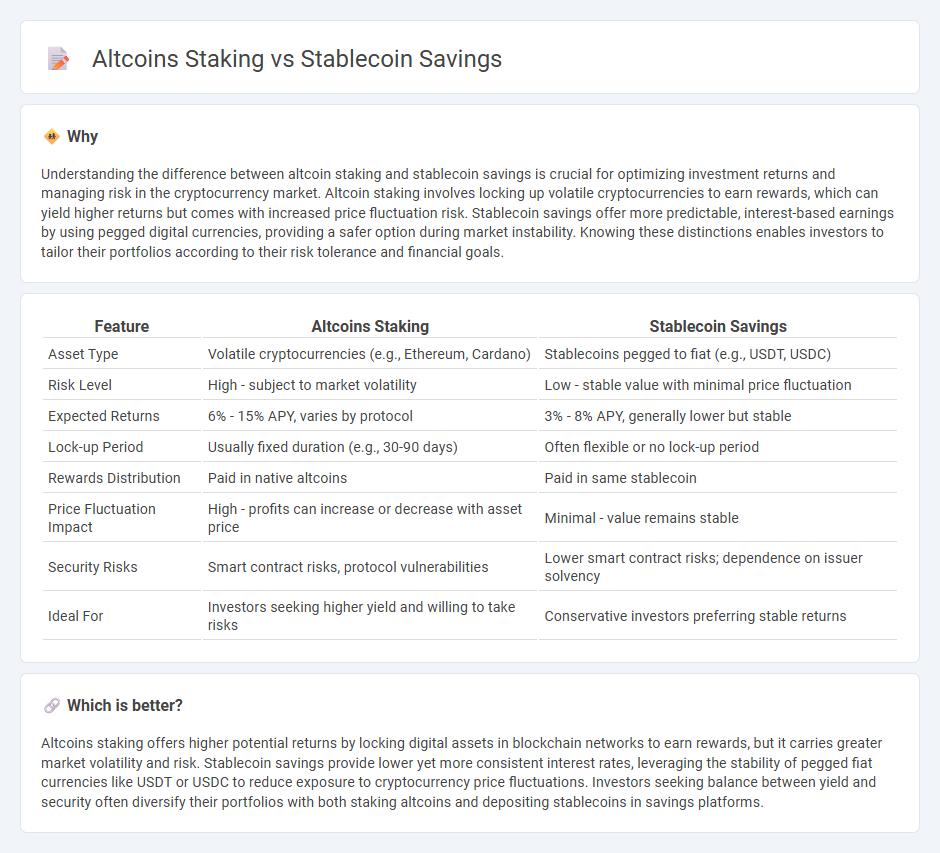

Understanding the difference between altcoin staking and stablecoin savings is crucial for optimizing investment returns and managing risk in the cryptocurrency market. Altcoin staking involves locking up volatile cryptocurrencies to earn rewards, which can yield higher returns but comes with increased price fluctuation risk. Stablecoin savings offer more predictable, interest-based earnings by using pegged digital currencies, providing a safer option during market instability. Knowing these distinctions enables investors to tailor their portfolios according to their risk tolerance and financial goals.

Comparison Table

| Feature | Altcoins Staking | Stablecoin Savings |

|---|---|---|

| Asset Type | Volatile cryptocurrencies (e.g., Ethereum, Cardano) | Stablecoins pegged to fiat (e.g., USDT, USDC) |

| Risk Level | High - subject to market volatility | Low - stable value with minimal price fluctuation |

| Expected Returns | 6% - 15% APY, varies by protocol | 3% - 8% APY, generally lower but stable |

| Lock-up Period | Usually fixed duration (e.g., 30-90 days) | Often flexible or no lock-up period |

| Rewards Distribution | Paid in native altcoins | Paid in same stablecoin |

| Price Fluctuation Impact | High - profits can increase or decrease with asset price | Minimal - value remains stable |

| Security Risks | Smart contract risks, protocol vulnerabilities | Lower smart contract risks; dependence on issuer solvency |

| Ideal For | Investors seeking higher yield and willing to take risks | Conservative investors preferring stable returns |

Which is better?

Altcoins staking offers higher potential returns by locking digital assets in blockchain networks to earn rewards, but it carries greater market volatility and risk. Stablecoin savings provide lower yet more consistent interest rates, leveraging the stability of pegged fiat currencies like USDT or USDC to reduce exposure to cryptocurrency price fluctuations. Investors seeking balance between yield and security often diversify their portfolios with both staking altcoins and depositing stablecoins in savings platforms.

Connection

Altcoins staking and stablecoin savings are connected through their shared function of generating passive income in decentralized finance (DeFi) ecosystems. Staking altcoins involves locking up tokens in a blockchain network to earn rewards, while stablecoin savings accounts provide interest by lending or staking stablecoins pegged to fiat currencies. Both strategies enable investors to maximize returns on crypto holdings with varying risk profiles and liquidity options.

Key Terms

Yield/APY

Stablecoin savings accounts typically offer annual percentage yields (APYs) ranging from 5% to 12%, providing low-risk returns backed by stable assets like USDC or USDT. In contrast, altcoin staking can yield significantly higher APYs, often between 15% and 100%, but comes with increased volatility and risk due to fluctuating token values and network dynamics. Explore detailed comparisons of yield potential and risk profiles to optimize your crypto investment strategy.

Volatility

Stablecoin savings accounts offer low-risk returns by minimizing exposure to price fluctuations, making them ideal for conservative investors seeking consistent gains. In contrast, altcoins staking involves higher volatility due to the unpredictable market value of alternative cryptocurrencies, potentially leading to greater rewards or losses. Explore the advantages and risks of both strategies to make informed investment decisions.

Smart Contract Risk

Stablecoin savings often provide lower but more predictable yields with minimal price volatility, making them an attractive option for risk-averse investors seeking steady returns. Altcoins staking can offer higher rewards but comes with significant smart contract risk due to less mature protocols and potential vulnerabilities in decentralized networks. Explore the comparative smart contract risks and yield profiles to make informed decisions tailored to your investment strategy.

Source and External Links

Stablecoin Interest Rates (up to 15%) - Coin Interest Rate - Stablecoin savings accounts can offer interest rates from 4% to 10% or more, significantly higher than traditional bank savings, with liquidity and flexibility similar to traditional accounts but without FDIC insurance, exposing investors to crypto-related risks.

Using Stablecoins as a Savings Account - Deltec Bank and Trust - Stablecoins provide a new savings option with high deposit rates and no transfer fees, enabling staking for returns such as Tether's annualized staking rate of around 6%, facilitated by crypto exchanges that often offer insurance against hacking.

The Best Way to Use Stablecoins: Earning, Saving, or Holding? | Trust - Stablecoins can be used for earning rewards, saving securely, or holding as a store of value, each fulfilling different financial goals, with an emphasis on choosing reputable stablecoins and platforms to minimize risks like value loss and reserve mismanagement.

dowidth.com

dowidth.com