Liquid staking enables users to earn staking rewards while maintaining liquidity by tokenizing staked assets, contrasting with centralized staking services where funds are locked and managed by third-party platforms. This decentralized approach enhances asset flexibility and reduces counterparty risks inherent in centralized systems. Explore detailed comparisons to optimize your staking strategy effectively.

Why it is important

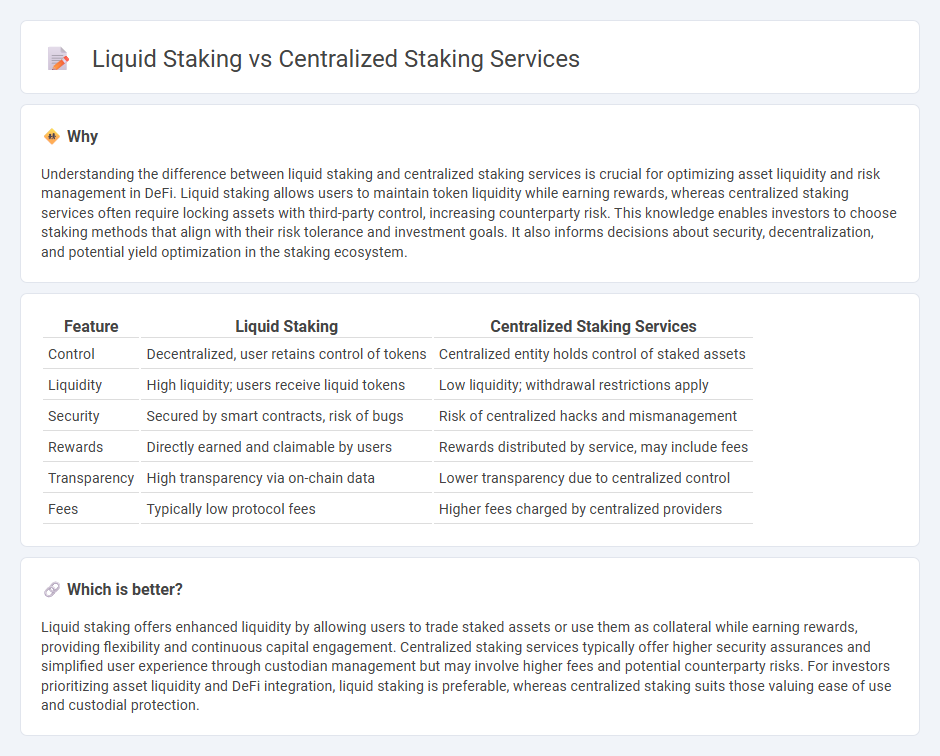

Understanding the difference between liquid staking and centralized staking services is crucial for optimizing asset liquidity and risk management in DeFi. Liquid staking allows users to maintain token liquidity while earning rewards, whereas centralized staking services often require locking assets with third-party control, increasing counterparty risk. This knowledge enables investors to choose staking methods that align with their risk tolerance and investment goals. It also informs decisions about security, decentralization, and potential yield optimization in the staking ecosystem.

Comparison Table

| Feature | Liquid Staking | Centralized Staking Services |

|---|---|---|

| Control | Decentralized, user retains control of tokens | Centralized entity holds control of staked assets |

| Liquidity | High liquidity; users receive liquid tokens | Low liquidity; withdrawal restrictions apply |

| Security | Secured by smart contracts, risk of bugs | Risk of centralized hacks and mismanagement |

| Rewards | Directly earned and claimable by users | Rewards distributed by service, may include fees |

| Transparency | High transparency via on-chain data | Lower transparency due to centralized control |

| Fees | Typically low protocol fees | Higher fees charged by centralized providers |

Which is better?

Liquid staking offers enhanced liquidity by allowing users to trade staked assets or use them as collateral while earning rewards, providing flexibility and continuous capital engagement. Centralized staking services typically offer higher security assurances and simplified user experience through custodian management but may involve higher fees and potential counterparty risks. For investors prioritizing asset liquidity and DeFi integration, liquid staking is preferable, whereas centralized staking suits those valuing ease of use and custodial protection.

Connection

Liquid staking allows users to stake assets while retaining liquidity by receiving tokenized derivatives, which can be traded or utilized in DeFi platforms. Centralized staking services manage large pools of staked assets, offering users simplified access and potentially higher rewards through economies of scale. The connection lies in centralized platforms often providing liquid staking options, combining asset security with liquidity and enabling efficient capital utilization in the financial ecosystem.

Key Terms

Custodianship

Centralized staking services rely on custodians who hold and manage users' crypto assets, providing security but introducing counterparty risk and reduced control for investors. Liquid staking allows users to retain custody of their tokens while earning staking rewards, enhancing liquidity and flexibility without sacrificing ownership. Explore detailed comparisons and security implications between custodianship models in staking services to optimize your crypto strategy.

Liquidity

Centralized staking services offer users the ability to stake cryptocurrencies with a trusted provider, but they often lock assets, limiting liquidity. Liquid staking protocols enable users to earn rewards while maintaining asset liquidity by issuing tokenized staking derivatives that can be traded or used in DeFi. Discover how these differences impact your staking strategy and asset accessibility.

Redeemability

Centralized staking services offer simplified management and consolidated rewards but often restrict immediate token redeemability due to lock-up periods and custodial control. Liquid staking enhances token liquidity by issuing derivative assets that represent staked positions, enabling users to trade or utilize these assets while still earning staking rewards. Explore these staking approaches to understand which option best matches your liquidity needs and investment strategy.

Source and External Links

Decentralized Staking vs. Centralized Staking - Trust Wallet - Centralized staking involves depositing crypto assets to a third party that manages staking on your behalf, offering convenience but requiring trust in the custodian of your assets.

15 Best Crypto Staking Platforms to Maximize Your Earnings in 2025 - Centralized staking platforms like Coinbase provide user-friendly interfaces, simplified staking processes, and strong security while maintaining control over your assets but with limited control over private keys and potential geographic restrictions.

Crypto Staking: Earn Rewards on Binance.US - Binance.US offers centralized staking services with a simple, secure, and convenient process allowing users to stake supported cryptocurrencies easily and earn rewards without needing to run nodes or technical setup.

dowidth.com

dowidth.com