Collateralized reinsurance involves a reinsurer posting collateral to secure their obligations, ensuring prompt payment of claims and minimizing credit risk for cedents. Sidecars are investment vehicles that allow third-party investors to participate in reinsurance risk and returns, providing additional capital to insurers without traditional equity dilution. Discover the key differences and benefits of these financing structures in the reinsurance market.

Why it is important

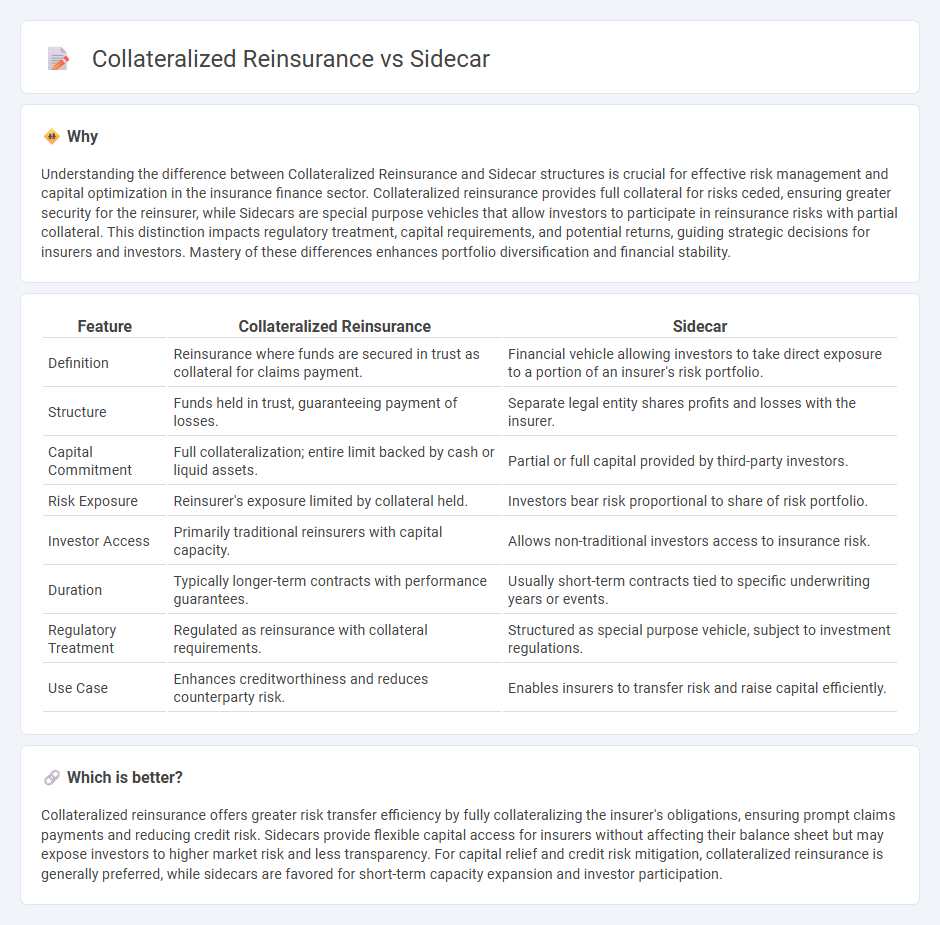

Understanding the difference between Collateralized Reinsurance and Sidecar structures is crucial for effective risk management and capital optimization in the insurance finance sector. Collateralized reinsurance provides full collateral for risks ceded, ensuring greater security for the reinsurer, while Sidecars are special purpose vehicles that allow investors to participate in reinsurance risks with partial collateral. This distinction impacts regulatory treatment, capital requirements, and potential returns, guiding strategic decisions for insurers and investors. Mastery of these differences enhances portfolio diversification and financial stability.

Comparison Table

| Feature | Collateralized Reinsurance | Sidecar |

|---|---|---|

| Definition | Reinsurance where funds are secured in trust as collateral for claims payment. | Financial vehicle allowing investors to take direct exposure to a portion of an insurer's risk portfolio. |

| Structure | Funds held in trust, guaranteeing payment of losses. | Separate legal entity shares profits and losses with the insurer. |

| Capital Commitment | Full collateralization; entire limit backed by cash or liquid assets. | Partial or full capital provided by third-party investors. |

| Risk Exposure | Reinsurer's exposure limited by collateral held. | Investors bear risk proportional to share of risk portfolio. |

| Investor Access | Primarily traditional reinsurers with capital capacity. | Allows non-traditional investors access to insurance risk. |

| Duration | Typically longer-term contracts with performance guarantees. | Usually short-term contracts tied to specific underwriting years or events. |

| Regulatory Treatment | Regulated as reinsurance with collateral requirements. | Structured as special purpose vehicle, subject to investment regulations. |

| Use Case | Enhances creditworthiness and reduces counterparty risk. | Enables insurers to transfer risk and raise capital efficiently. |

Which is better?

Collateralized reinsurance offers greater risk transfer efficiency by fully collateralizing the insurer's obligations, ensuring prompt claims payments and reducing credit risk. Sidecars provide flexible capital access for insurers without affecting their balance sheet but may expose investors to higher market risk and less transparency. For capital relief and credit risk mitigation, collateralized reinsurance is generally preferred, while sidecars are favored for short-term capacity expansion and investor participation.

Connection

Collateralized reinsurance and sidecars are connected through their use in transferring insurance risk to the capital markets, providing insurers with alternative funding sources. Both mechanisms involve investors funding reinsurance transactions, with collateralized reinsurance requiring full collateral to secure obligations, while sidecars typically operate as special purpose vehicles allowing investors to assume a portion of an insurer's underwriting risk and returns. These structures enhance liquidity and risk management in the insurance industry by linking traditional reinsurance with capital market investors.

Key Terms

Risk Transfer

Sidecar reinsurance structures enable insurers to cede specific risks to third-party investors in exchange for a share of premiums and losses, creating a selective risk transfer mechanism. Collateralized reinsurance involves posting collateral to secure claims-paying ability, ensuring a higher degree of credit risk mitigation for the ceding insurer. Explore the intricacies of these models to understand their impact on risk management strategies.

Special Purpose Vehicle (SPV)

Special Purpose Vehicles (SPVs) in collateralized reinsurance serve as bankruptcy-remote entities that isolate risk and capital, ensuring security and transparency for both cedents and investors. Sidecars, on the other hand, allow investors to share underwriting risk directly through a quota share agreement without establishing an SPV, thus offering more flexibility but potentially less structural insulation. Explore the distinctive roles and benefits of SPVs in collateralized reinsurance to optimize risk management strategies.

Loss Reserve

Sidecar reinsurance involves a third-party investor assuming a portion of premiums and losses, allowing direct exposure to underwriting results, while collateralized reinsurance requires posting collateral to secure potential claims payments, enhancing credit protection for cedants. Loss reserves in sidecars are influenced by negotiated Terms of Participation, impacting investor return through shared underwriting risks, whereas collateralized reinsurance maintains loss reserves on the cedant's balance sheet, supported by collateral to cover claim liabilities. Explore the nuances of sidecar and collateralized reinsurance structures to optimize risk transfer and capital efficiency in loss reserve management.

Source and External Links

Sidecar pattern - Azure Architecture Center - The Sidecar pattern is a software architecture approach where components are deployed in separate processes or containers alongside the main application, providing isolation and supporting features while sharing the same lifecycle as the parent app, similar to how a sidecar attaches to a motorcycle.

Sidecar (cocktail) - Wikipedia - The Sidecar is a classic cocktail made with brandy (usually cognac), orange liqueur, and lemon juice, believed to have originated around World War I in London or Paris, named after the motorcycle sidecar attachment.

Sidecar - A classic cocktail recipe balancing brandy, citrus juice, and sweetness, considered a stylish vintage drink popularized in the 1920s, with debated origins in Paris or London and named after the motorcycle sidecar.

dowidth.com

dowidth.com