Green bond laddering involves strategically purchasing green bonds with staggered maturities to manage risk and ensure steady income streams aligned with environmental goals. Yield curve positioning focuses on selecting bond maturities based on anticipated interest rate movements to optimize returns across different points of the yield curve. Explore detailed strategies and benefits of both approaches to enhance sustainable investment portfolios.

Why it is important

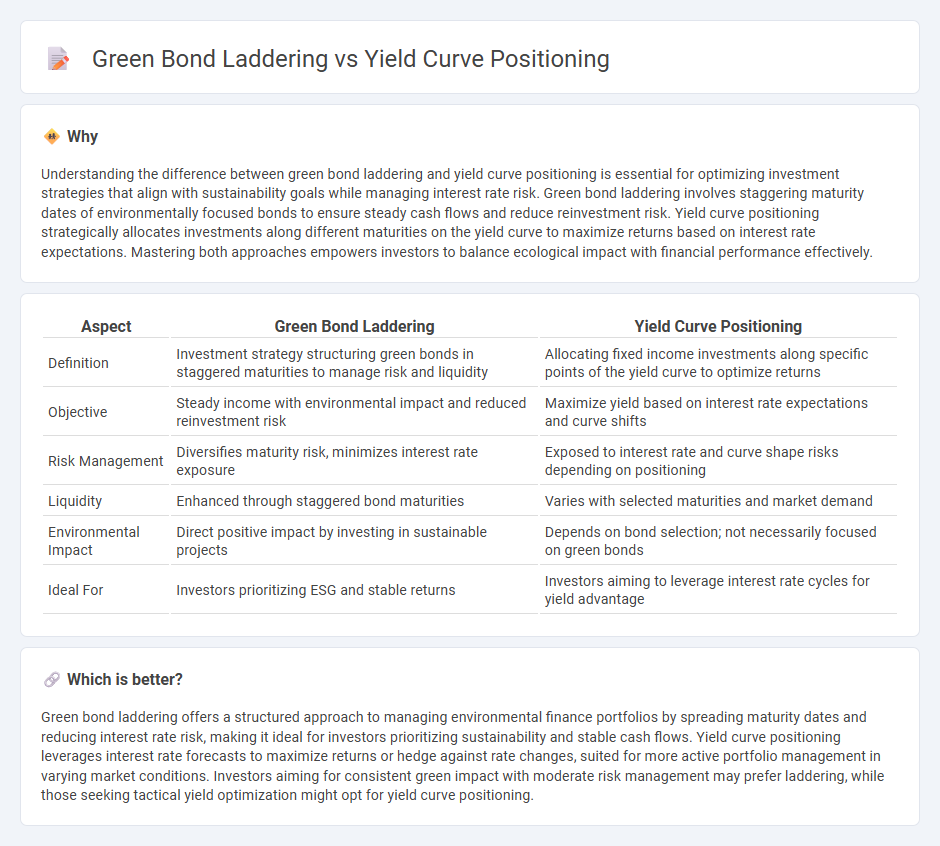

Understanding the difference between green bond laddering and yield curve positioning is essential for optimizing investment strategies that align with sustainability goals while managing interest rate risk. Green bond laddering involves staggering maturity dates of environmentally focused bonds to ensure steady cash flows and reduce reinvestment risk. Yield curve positioning strategically allocates investments along different maturities on the yield curve to maximize returns based on interest rate expectations. Mastering both approaches empowers investors to balance ecological impact with financial performance effectively.

Comparison Table

| Aspect | Green Bond Laddering | Yield Curve Positioning |

|---|---|---|

| Definition | Investment strategy structuring green bonds in staggered maturities to manage risk and liquidity | Allocating fixed income investments along specific points of the yield curve to optimize returns |

| Objective | Steady income with environmental impact and reduced reinvestment risk | Maximize yield based on interest rate expectations and curve shifts |

| Risk Management | Diversifies maturity risk, minimizes interest rate exposure | Exposed to interest rate and curve shape risks depending on positioning |

| Liquidity | Enhanced through staggered bond maturities | Varies with selected maturities and market demand |

| Environmental Impact | Direct positive impact by investing in sustainable projects | Depends on bond selection; not necessarily focused on green bonds |

| Ideal For | Investors prioritizing ESG and stable returns | Investors aiming to leverage interest rate cycles for yield advantage |

Which is better?

Green bond laddering offers a structured approach to managing environmental finance portfolios by spreading maturity dates and reducing interest rate risk, making it ideal for investors prioritizing sustainability and stable cash flows. Yield curve positioning leverages interest rate forecasts to maximize returns or hedge against rate changes, suited for more active portfolio management in varying market conditions. Investors aiming for consistent green impact with moderate risk management may prefer laddering, while those seeking tactical yield optimization might opt for yield curve positioning.

Connection

Green bond laddering involves structuring a portfolio with staggered maturities of green bonds to manage interest rate risk and ensure steady cash flow. Yield curve positioning strategically selects bonds along different maturities on the yield curve to optimize returns based on expected interest rate movements. Combining green bond laddering with yield curve positioning enhances portfolio diversification and maximizes sustainable investment returns while mitigating duration risk.

Key Terms

Interest Rate Risk

Yield curve positioning involves strategically allocating bond maturities along the yield curve to capitalize on interest rate movements and mitigate interest rate risk. Green bond laddering spreads investments across staggered maturities in environmentally-focused securities, balancing steady income with reduced duration risk in a sustainable portfolio. Explore our detailed analysis to understand how these strategies optimize interest rate risk management in fixed income investments.

Credit Quality

Yield curve positioning involves strategically allocating investments across different maturities to optimize returns relative to interest rate expectations, with credit quality influencing the risk-return tradeoff. Green bond laddering prioritizes a diversified maturity schedule within environmentally-focused fixed income instruments, ensuring steady cash flow while emphasizing high credit standards to mitigate default risk. Explore the comparative benefits and credit quality impacts of these strategies to enhance your investment approach.

Duration

Yield curve positioning optimizes bond investments by strategically targeting maturities along the yield curve to enhance returns and manage interest rate risks. Green bond laddering involves structuring a portfolio of environmentally focused bonds with staggered maturities, aiming to balance duration exposure while supporting sustainable projects. Explore the nuances of duration management in both approaches to refine your fixed income strategy.

Source and External Links

Yield Curve Strategies: Evaluating Bond Yield - Financial Pipeline - Yield curve positioning involves structuring a bond portfolio to profit from anticipated changes in the yield curve shape, such as steepening or flattening, by using strategies like barbell, bullet, or butterfly trades that focus on different maturity segments to optimize sensitivity to interest rate changes and convexity.

Bonds 102: Understanding the Yield Curve - PIMCO - Yield curve positioning relies on interpreting the yield curve shape--normal, flat, or inverted--to predict future interest rate moves and economic outlook, guiding investors on whether to favor longer or shorter maturities based on expected economic expansion or recession.

Bonds and the Yield Curve | Explainer | Education | RBA - Positioning on the yield curve is influenced by expectations of future interest rates embedded in bond yields across maturities, with the slope reflecting anticipated changes in policy rates and economic conditions, informing investment choices between short and long-term bonds.

dowidth.com

dowidth.com