ESG integration incorporates environmental, social, and governance factors into investment decisions to promote sustainable long-term value. Shareholder activism involves investors using their equity stakes to influence a company's policies and practices directly. Explore how these financial strategies shape corporate responsibility and performance.

Why it is important

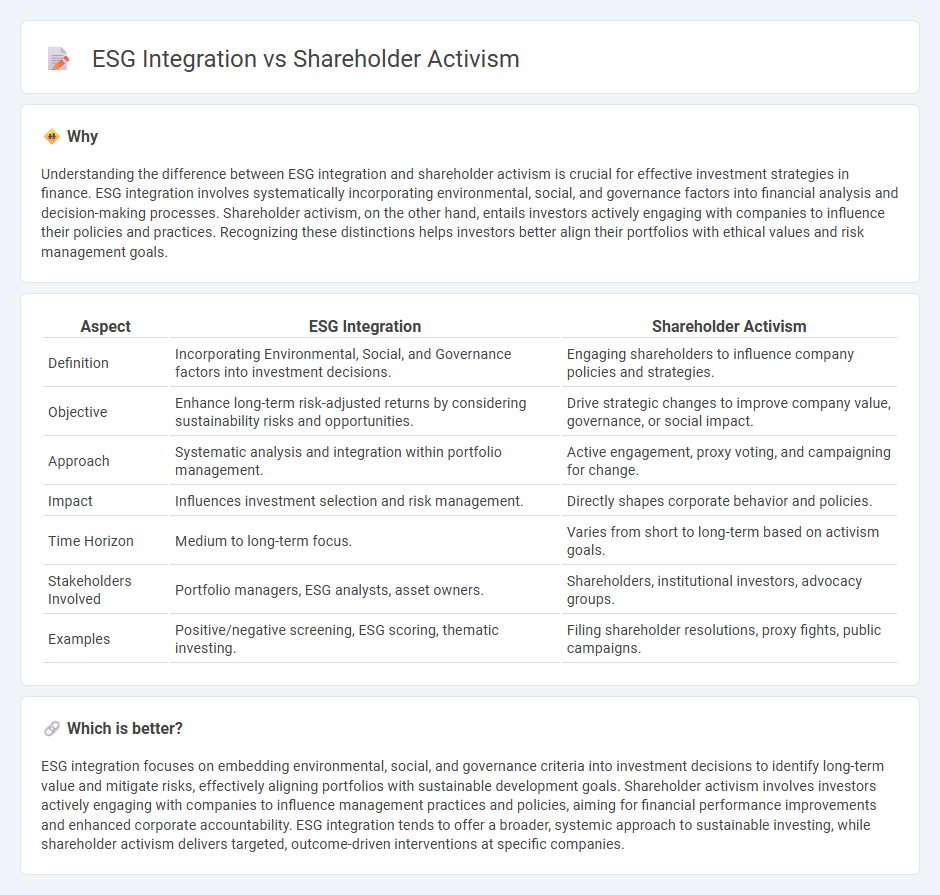

Understanding the difference between ESG integration and shareholder activism is crucial for effective investment strategies in finance. ESG integration involves systematically incorporating environmental, social, and governance factors into financial analysis and decision-making processes. Shareholder activism, on the other hand, entails investors actively engaging with companies to influence their policies and practices. Recognizing these distinctions helps investors better align their portfolios with ethical values and risk management goals.

Comparison Table

| Aspect | ESG Integration | Shareholder Activism |

|---|---|---|

| Definition | Incorporating Environmental, Social, and Governance factors into investment decisions. | Engaging shareholders to influence company policies and strategies. |

| Objective | Enhance long-term risk-adjusted returns by considering sustainability risks and opportunities. | Drive strategic changes to improve company value, governance, or social impact. |

| Approach | Systematic analysis and integration within portfolio management. | Active engagement, proxy voting, and campaigning for change. |

| Impact | Influences investment selection and risk management. | Directly shapes corporate behavior and policies. |

| Time Horizon | Medium to long-term focus. | Varies from short to long-term based on activism goals. |

| Stakeholders Involved | Portfolio managers, ESG analysts, asset owners. | Shareholders, institutional investors, advocacy groups. |

| Examples | Positive/negative screening, ESG scoring, thematic investing. | Filing shareholder resolutions, proxy fights, public campaigns. |

Which is better?

ESG integration focuses on embedding environmental, social, and governance criteria into investment decisions to identify long-term value and mitigate risks, effectively aligning portfolios with sustainable development goals. Shareholder activism involves investors actively engaging with companies to influence management practices and policies, aiming for financial performance improvements and enhanced corporate accountability. ESG integration tends to offer a broader, systemic approach to sustainable investing, while shareholder activism delivers targeted, outcome-driven interventions at specific companies.

Connection

ESG integration enhances shareholder activism by providing investors with environmental, social, and governance metrics to identify risks and opportunities within portfolio companies. Shareholders use ESG data to influence corporate behavior, demanding transparency and sustainable practices that align with long-term value creation. This connection drives better governance, risk management, and financial performance in the investment landscape.

Key Terms

Proxy Voting

Shareholder activism leverages proxy voting as a strategic tool to influence corporate governance and promote ESG (Environmental, Social, and Governance) improvements directly at annual meetings. ESG integration through proxy voting involves systematically incorporating sustainability criteria into voting decisions, impacting board composition, executive compensation, and environmental policies. Explore how leading asset managers effectively utilize proxy voting to advance ESG objectives and drive long-term value creation.

Corporate Governance

Shareholder activism drives corporate governance by pressuring companies to improve board accountability, transparency, and ethical practices, often through direct engagement and proxy voting. ESG integration incorporates environmental, social, and governance criteria systematically into investment analysis, promoting sustainable governance structures and risk management. Discover how these distinct approaches enhance corporate governance and influence long-term value creation.

Materiality

Shareholder activism targets specific corporate actions to enhance financial performance or address governance issues, often impacting material risks directly tied to shareholder value. ESG integration systematically incorporates environmental, social, and governance factors into investment decisions to assess long-term materiality affecting company sustainability and risk exposure. Explore how aligning shareholder activism with ESG materiality can drive both strategic impact and responsible investing outcomes.

Source and External Links

Shareholder Activist - Overview, How it Works, Examples - A shareholder activist uses their equity stake in a public company to pressure management for changes, which can range from financial improvements to social and environmental policies.

The director's guide to shareholder activism - Both large asset managers and smaller hedge funds engage in activism to push companies toward better governance or financial performance, often using voting power or public campaigns to drive change.

Shareholder Activism Report | Lazard - Global activism campaigns reached record levels in 2024, with frequent demands for board changes, mergers and acquisitions, operational improvements, or shifts in capital allocation strategies across regions and sectors.

dowidth.com

dowidth.com