Nonfungible token (NFT) fractionalization enables multiple investors to own portions of a single digital asset, increasing liquidity and accessibility in the digital collectibles market. Collateralized debt obligations (CDOs) pool various debt instruments into tranches, redistributing risk and return profiles to investors in traditional finance. Explore the nuances of NFT fractionalization and CDOs to understand their impact on modern investment strategies and risk management.

Why it is important

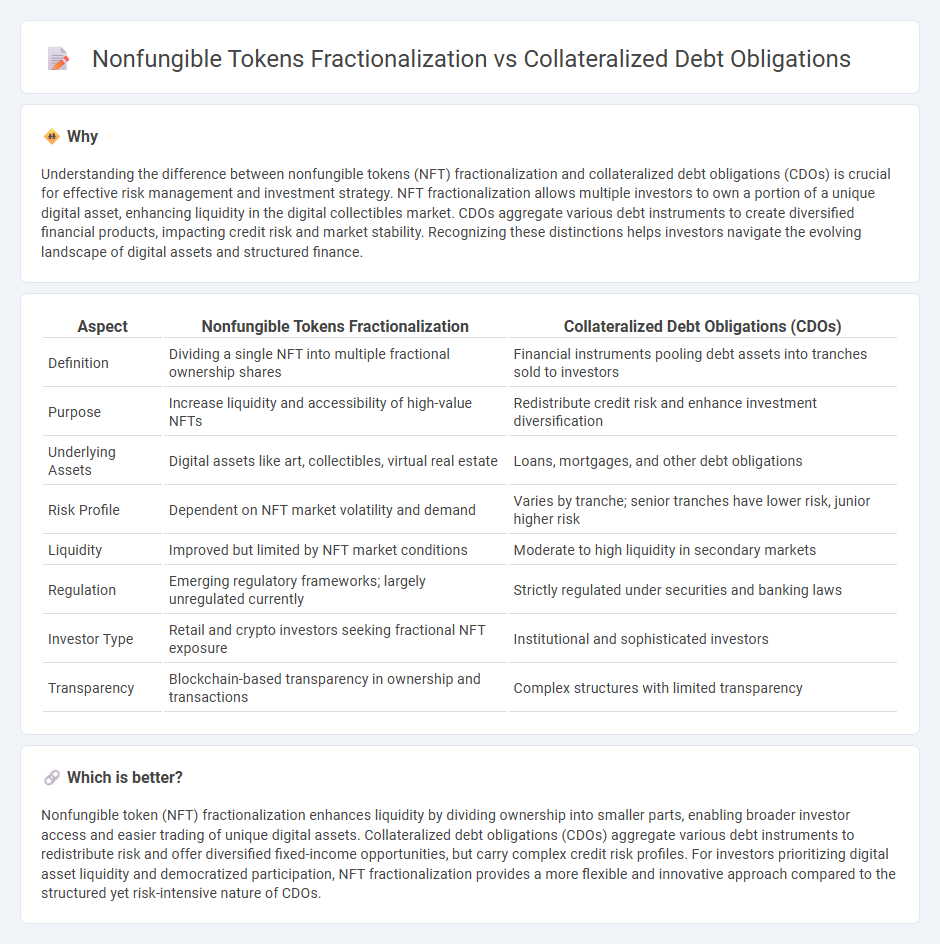

Understanding the difference between nonfungible tokens (NFT) fractionalization and collateralized debt obligations (CDOs) is crucial for effective risk management and investment strategy. NFT fractionalization allows multiple investors to own a portion of a unique digital asset, enhancing liquidity in the digital collectibles market. CDOs aggregate various debt instruments to create diversified financial products, impacting credit risk and market stability. Recognizing these distinctions helps investors navigate the evolving landscape of digital assets and structured finance.

Comparison Table

| Aspect | Nonfungible Tokens Fractionalization | Collateralized Debt Obligations (CDOs) |

|---|---|---|

| Definition | Dividing a single NFT into multiple fractional ownership shares | Financial instruments pooling debt assets into tranches sold to investors |

| Purpose | Increase liquidity and accessibility of high-value NFTs | Redistribute credit risk and enhance investment diversification |

| Underlying Assets | Digital assets like art, collectibles, virtual real estate | Loans, mortgages, and other debt obligations |

| Risk Profile | Dependent on NFT market volatility and demand | Varies by tranche; senior tranches have lower risk, junior higher risk |

| Liquidity | Improved but limited by NFT market conditions | Moderate to high liquidity in secondary markets |

| Regulation | Emerging regulatory frameworks; largely unregulated currently | Strictly regulated under securities and banking laws |

| Investor Type | Retail and crypto investors seeking fractional NFT exposure | Institutional and sophisticated investors |

| Transparency | Blockchain-based transparency in ownership and transactions | Complex structures with limited transparency |

Which is better?

Nonfungible token (NFT) fractionalization enhances liquidity by dividing ownership into smaller parts, enabling broader investor access and easier trading of unique digital assets. Collateralized debt obligations (CDOs) aggregate various debt instruments to redistribute risk and offer diversified fixed-income opportunities, but carry complex credit risk profiles. For investors prioritizing digital asset liquidity and democratized participation, NFT fractionalization provides a more flexible and innovative approach compared to the structured yet risk-intensive nature of CDOs.

Connection

Nonfungible token (NFT) fractionalization enables the division of a single digital asset into multiple fungible shares, enhancing liquidity and accessibility for investors. Collateralized debt obligations (CDOs) pool various debt instruments and slice them into tranches with differing risk profiles, similar to how NFT fractions represent partial ownership. Both mechanisms employ asset division to optimize risk distribution and investment opportunities within financial markets.

Key Terms

Securitization

Collateralized debt obligations (CDOs) bundle diverse debt assets into tranches to redistribute risk and enhance liquidity through structured finance, while nonfungible token (NFT) fractionalization divides unique digital assets into fungible shares, enabling partial ownership and tradability on blockchain platforms. Both mechanisms improve securitization by increasing accessibility and liquidity but operate in fundamentally different markets--CDOs primarily in traditional finance, NFTs in digital asset ecosystems. Explore deeper insights on how securitization evolves with blockchain innovations and traditional financial instruments.

Tokenization

Collateralized debt obligations (CDOs) tokenize pools of debt assets, enabling risk redistribution through tranching and structured finance mechanisms, optimizing credit risk management in traditional finance. Nonfungible tokens (NFTs) fractionalization divides unique digital assets into fungible shares, democratizing ownership and liquidity in blockchain ecosystems by leveraging decentralized tokenization protocols. Explore the evolving landscape of tokenization methods and their impact on asset liquidity and investment accessibility.

Tranching

Collateralized debt obligations (CDOs) employ tranching to segment pooled debt into layers with varying risk and return profiles, optimizing capital allocation for investors. Nonfungible token (NFT) fractionalization divides a unique digital asset into smaller ownership portions but typically lacks the structured tranching mechanism seen in CDOs. Explore the distinct approaches to tranching and risk management in CDOs and NFT fractionalization for deeper insights.

Source and External Links

Fixed Income Securities (Bonds): Collateralized Debt Obligations - Collateralized debt obligations (CDOs) are complex derivative securities made by bundling assets like mortgages and bonds into tranches sold to investors, transferring loan default risk from banks to investors while generating cash for new loans.

Collateralized Debt Obligation (CDO) - Corporate Finance Institute - CDOs represent synthetic investment products bundling various loans, with income distributed to prioritized securities and a structure similar to stocks involving senior and mezzanine tranches, first being passive cash flow CDOs then increasingly actively managed.

Collateralized debt obligation - Wikipedia - CDOs are promises to pay investors sequentially from cash flows of pooled bonds or assets, with categories based on underlying assets including collateralized loan obligations (CLOs), collateralized bond obligations (CBOs), and synthetic CDOs, and they played a major role in the 2007-2009 financial losses.

dowidth.com

dowidth.com