Shadow banking operates outside traditional regulatory frameworks, providing credit through non-bank financial intermediaries such as hedge funds, money market funds, and structured investment vehicles, significantly influencing liquidity and credit availability. Central banking involves state-controlled institutions like the Federal Reserve or the European Central Bank, which regulate money supply, implement monetary policy, and serve as lenders of last resort to stabilize the economy. Explore the key differences and impacts of shadow banking versus central banking to understand their roles in the global financial system.

Why it is important

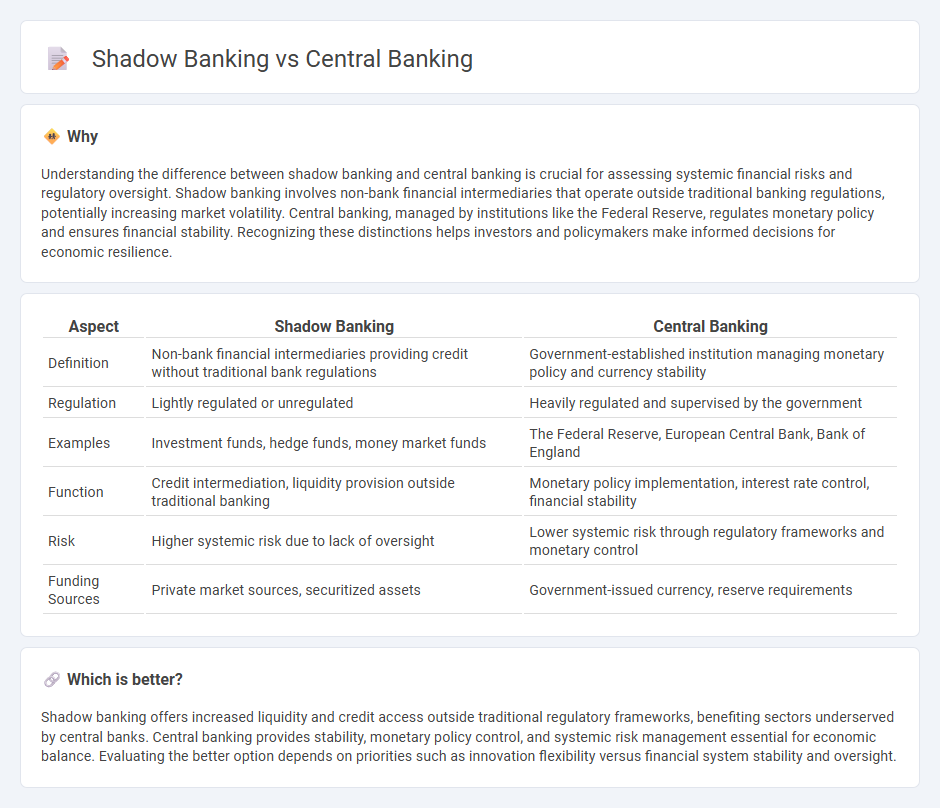

Understanding the difference between shadow banking and central banking is crucial for assessing systemic financial risks and regulatory oversight. Shadow banking involves non-bank financial intermediaries that operate outside traditional banking regulations, potentially increasing market volatility. Central banking, managed by institutions like the Federal Reserve, regulates monetary policy and ensures financial stability. Recognizing these distinctions helps investors and policymakers make informed decisions for economic resilience.

Comparison Table

| Aspect | Shadow Banking | Central Banking |

|---|---|---|

| Definition | Non-bank financial intermediaries providing credit without traditional bank regulations | Government-established institution managing monetary policy and currency stability |

| Regulation | Lightly regulated or unregulated | Heavily regulated and supervised by the government |

| Examples | Investment funds, hedge funds, money market funds | The Federal Reserve, European Central Bank, Bank of England |

| Function | Credit intermediation, liquidity provision outside traditional banking | Monetary policy implementation, interest rate control, financial stability |

| Risk | Higher systemic risk due to lack of oversight | Lower systemic risk through regulatory frameworks and monetary control |

| Funding Sources | Private market sources, securitized assets | Government-issued currency, reserve requirements |

Which is better?

Shadow banking offers increased liquidity and credit access outside traditional regulatory frameworks, benefiting sectors underserved by central banks. Central banking provides stability, monetary policy control, and systemic risk management essential for economic balance. Evaluating the better option depends on priorities such as innovation flexibility versus financial system stability and oversight.

Connection

Shadow banking and central banking are connected through their roles in liquidity provision and credit extension outside traditional banking regulations. Shadow banking entities, such as money market funds and securitization vehicles, operate in parallel with central banks by offering alternative funding channels that influence monetary policy effectiveness. Central banks monitor and sometimes intervene in shadow banking activities to manage systemic risks and maintain financial stability.

Key Terms

Monetary Policy

Central banking plays a crucial role in implementing monetary policy by regulating money supply, setting interest rates, and ensuring financial stability through transparent mechanisms. Shadow banking refers to non-bank financial intermediaries operating outside traditional regulations, which can create risks by circumventing central bank controls and affecting liquidity indirectly. Explore the impacts of both systems on monetary policy and financial markets for a deeper understanding.

Regulatory Oversight

Regulatory oversight in central banking is extensive, with institutions like central banks enforcing strict compliance standards, monetary policies, and financial stability measures to protect the economy. Shadow banking operates with minimal regulatory scrutiny, often involving non-bank financial entities that engage in credit intermediation outside traditional banking regulations, increasing systemic risk. Explore deeper insights into the contrasting regulatory frameworks and their impact on global financial stability.

Credit Intermediation

Central banking plays a pivotal role in credit intermediation by regulating the money supply, setting interest rates, and acting as a lender of last resort to maintain financial stability. Shadow banking involves non-bank financial intermediaries like hedge funds and money market funds that conduct credit intermediation outside traditional banking regulations, often increasing systemic risk due to less oversight. Explore the distinctions and impacts of these credit systems to better understand their roles in the financial ecosystem.

Source and External Links

A Brief History of Central Banks - Federal Reserve Bank of Cleveland - A central bank is the authority responsible for managing a country's money supply and credit, using monetary policy tools to influence interest rates, maintain price stability, promote high employment and economic growth, and ensure financial stability.

Central bank - Wikipedia - Central banks manage monetary policy for a country or union, maintaining institutional, goal, and operational independence to set and achieve policy targets like inflation control or currency stability.

Monetary Policy and Central Banking - IMF - Central banks use monetary policy tools to manage economic fluctuations, maintain low inflation, promote financial stability, and employ macroprudential policies to reduce systemic risks in the financial system.

dowidth.com

dowidth.com