Tokenization of real-world assets transforms physical investments into digital tokens, enabling fractional ownership, enhanced liquidity, and increased transparency on blockchain platforms. Custodial banking traditionally offers secure asset management and regulatory compliance but often lacks the speed and accessibility found in decentralized tokenized systems. Explore how these innovative financial solutions reshape asset management and investment strategies.

Why it is important

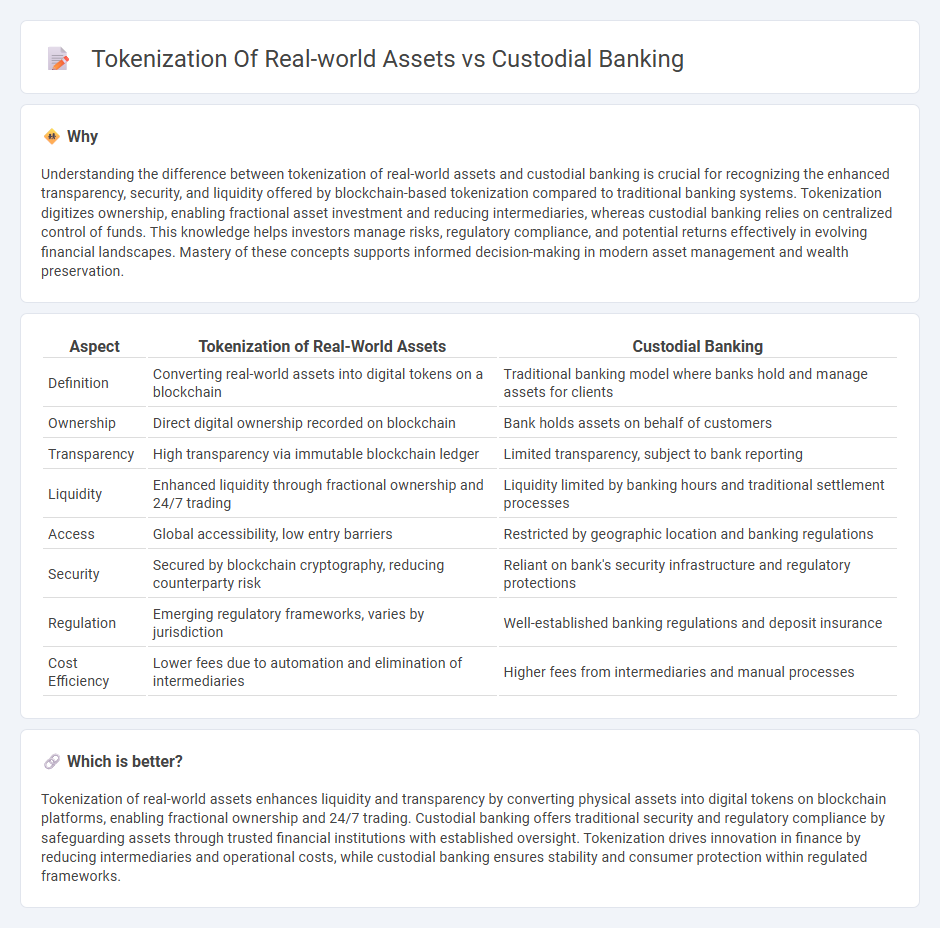

Understanding the difference between tokenization of real-world assets and custodial banking is crucial for recognizing the enhanced transparency, security, and liquidity offered by blockchain-based tokenization compared to traditional banking systems. Tokenization digitizes ownership, enabling fractional asset investment and reducing intermediaries, whereas custodial banking relies on centralized control of funds. This knowledge helps investors manage risks, regulatory compliance, and potential returns effectively in evolving financial landscapes. Mastery of these concepts supports informed decision-making in modern asset management and wealth preservation.

Comparison Table

| Aspect | Tokenization of Real-World Assets | Custodial Banking |

|---|---|---|

| Definition | Converting real-world assets into digital tokens on a blockchain | Traditional banking model where banks hold and manage assets for clients |

| Ownership | Direct digital ownership recorded on blockchain | Bank holds assets on behalf of customers |

| Transparency | High transparency via immutable blockchain ledger | Limited transparency, subject to bank reporting |

| Liquidity | Enhanced liquidity through fractional ownership and 24/7 trading | Liquidity limited by banking hours and traditional settlement processes |

| Access | Global accessibility, low entry barriers | Restricted by geographic location and banking regulations |

| Security | Secured by blockchain cryptography, reducing counterparty risk | Reliant on bank's security infrastructure and regulatory protections |

| Regulation | Emerging regulatory frameworks, varies by jurisdiction | Well-established banking regulations and deposit insurance |

| Cost Efficiency | Lower fees due to automation and elimination of intermediaries | Higher fees from intermediaries and manual processes |

Which is better?

Tokenization of real-world assets enhances liquidity and transparency by converting physical assets into digital tokens on blockchain platforms, enabling fractional ownership and 24/7 trading. Custodial banking offers traditional security and regulatory compliance by safeguarding assets through trusted financial institutions with established oversight. Tokenization drives innovation in finance by reducing intermediaries and operational costs, while custodial banking ensures stability and consumer protection within regulated frameworks.

Connection

Tokenization of real-world assets transforms physical properties into digital tokens, facilitating seamless ownership transfer and enhanced liquidity within financial markets. Custodial banking plays a crucial role by securely managing these digital assets, ensuring compliance with regulatory standards and safeguarding investor interests. This integration accelerates asset diversification and democratizes access to traditionally illiquid investments through blockchain technology.

Key Terms

Asset Safekeeping

Custodial banking involves traditional financial institutions holding and safeguarding assets on behalf of clients, ensuring legal compliance and security through regulated frameworks. Tokenization of real-world assets converts physical assets into digital tokens on a blockchain, providing enhanced transparency, liquidity, and real-time asset tracking while maintaining secure ownership records. Explore the evolving landscape of asset safekeeping and compare the benefits of custodial custody versus blockchain tokenization.

Digital Ownership

Custodial banking centralizes asset control in third-party institutions, limiting direct user ownership and increasing counterparty risk, while tokenization of real-world assets leverages blockchain technology to enable fractional ownership, transparency, and direct user control over digital assets. This shift toward decentralized digital ownership enhances liquidity and accessibility in markets such as real estate, art, and commodities by converting tangible assets into tradable digital tokens. Explore the evolving landscape of digital asset custody and tokenization to understand the future of ownership and investment.

Settlement Mechanism

Custodial banking relies on intermediaries to hold and manage assets, ensuring settlement through traditional financial networks that can be slower and less transparent. Tokenization of real-world assets leverages blockchain technology for direct, immutable transactions, enhancing speed, transparency, and security in the settlement process. Explore how tokenization revolutionizes asset settlement and its implications for the future of finance.

Source and External Links

What is a Custodian in Finance? - Custodians in finance provide safekeeping and administrative services for assets like securities, cash, and valuables, serving primarily institutional clients.

Custodian and Depositary Banks - Custodian banks act as high-security warehouses for financial assets, offering services such as account administration and transaction settlement.

Bank Custodians - Bank custodians physically possess and safeguard clients' financial assets, including cash, stocks, and bonds, and provide services like trade settlement and record-keeping.

dowidth.com

dowidth.com