Decentralized autonomous organization (DAO) treasuries leverage blockchain technology to enable transparent, community-driven management of digital assets, contrasting with family offices that provide personalized wealth management and investment strategies for high-net-worth families. DAO treasuries operate through smart contracts to execute decisions collectively, ensuring decentralization and immutability, while family offices focus on tailored financial planning, estate management, and succession. Explore the key differences and benefits of DAO treasuries versus family offices to optimize your financial strategy.

Why it is important

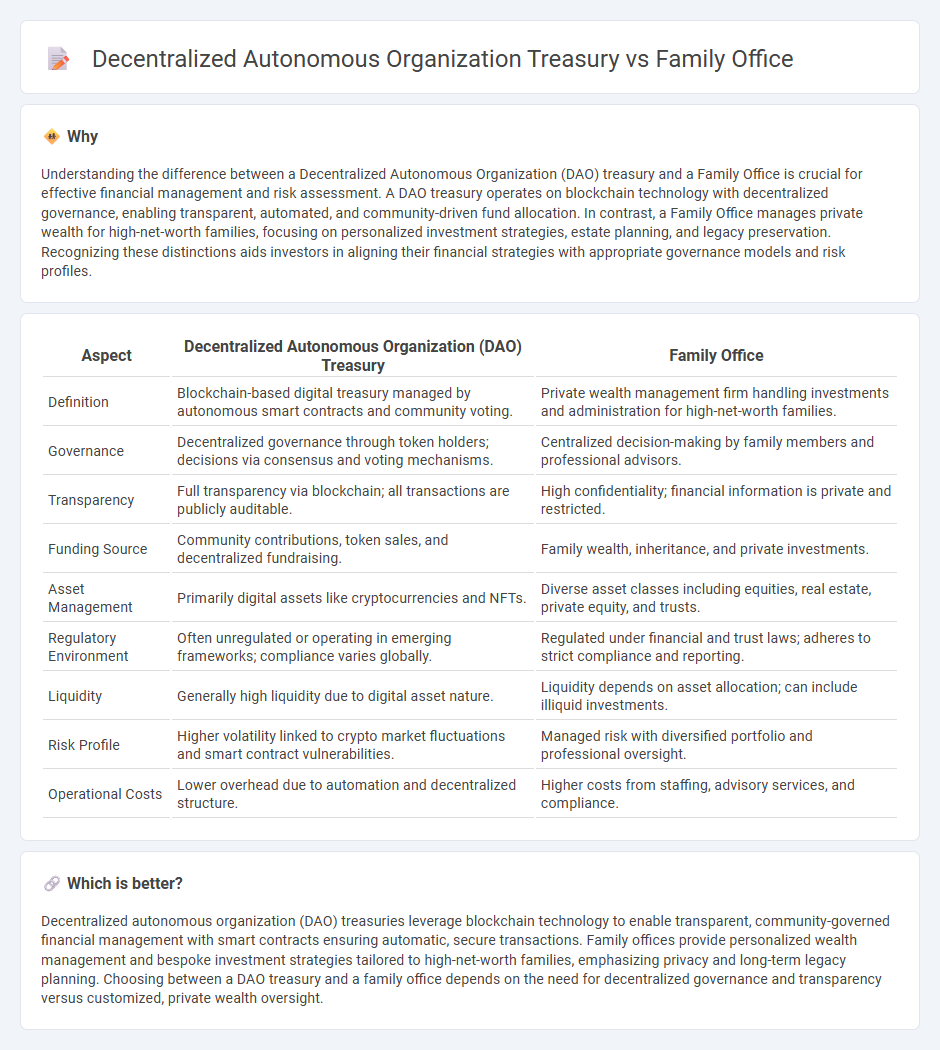

Understanding the difference between a Decentralized Autonomous Organization (DAO) treasury and a Family Office is crucial for effective financial management and risk assessment. A DAO treasury operates on blockchain technology with decentralized governance, enabling transparent, automated, and community-driven fund allocation. In contrast, a Family Office manages private wealth for high-net-worth families, focusing on personalized investment strategies, estate planning, and legacy preservation. Recognizing these distinctions aids investors in aligning their financial strategies with appropriate governance models and risk profiles.

Comparison Table

| Aspect | Decentralized Autonomous Organization (DAO) Treasury | Family Office |

|---|---|---|

| Definition | Blockchain-based digital treasury managed by autonomous smart contracts and community voting. | Private wealth management firm handling investments and administration for high-net-worth families. |

| Governance | Decentralized governance through token holders; decisions via consensus and voting mechanisms. | Centralized decision-making by family members and professional advisors. |

| Transparency | Full transparency via blockchain; all transactions are publicly auditable. | High confidentiality; financial information is private and restricted. |

| Funding Source | Community contributions, token sales, and decentralized fundraising. | Family wealth, inheritance, and private investments. |

| Asset Management | Primarily digital assets like cryptocurrencies and NFTs. | Diverse asset classes including equities, real estate, private equity, and trusts. |

| Regulatory Environment | Often unregulated or operating in emerging frameworks; compliance varies globally. | Regulated under financial and trust laws; adheres to strict compliance and reporting. |

| Liquidity | Generally high liquidity due to digital asset nature. | Liquidity depends on asset allocation; can include illiquid investments. |

| Risk Profile | Higher volatility linked to crypto market fluctuations and smart contract vulnerabilities. | Managed risk with diversified portfolio and professional oversight. |

| Operational Costs | Lower overhead due to automation and decentralized structure. | Higher costs from staffing, advisory services, and compliance. |

Which is better?

Decentralized autonomous organization (DAO) treasuries leverage blockchain technology to enable transparent, community-governed financial management with smart contracts ensuring automatic, secure transactions. Family offices provide personalized wealth management and bespoke investment strategies tailored to high-net-worth families, emphasizing privacy and long-term legacy planning. Choosing between a DAO treasury and a family office depends on the need for decentralized governance and transparency versus customized, private wealth oversight.

Connection

Decentralized Autonomous Organization (DAO) treasuries and family offices both serve as strategic financial management entities, with DAO treasuries leveraging blockchain technology for transparent and automated asset governance. Family offices can integrate DAO treasuries to diversify investment portfolios, utilizing smart contracts to execute and monitor decentralized finance opportunities efficiently. This connection enhances asset liquidity, security, and access to innovative digital assets within traditional family office structures.

Key Terms

Governance

Family office governance typically involves centralized decision-making by a select group of family members or trusted advisors, ensuring alignment with long-term wealth preservation and legacy goals. In contrast, decentralized autonomous organization (DAO) treasuries operate on blockchain-based protocols with governance tokens that enable transparent, community-driven decision-making and automated execution of financial actions via smart contracts. Explore how these governance models impact asset management strategies and stakeholder engagement.

Asset Management

Family offices manage concentrated portfolios with personalized asset allocation strategies tailored to high-net-worth individuals, emphasizing privacy, control, and long-term wealth preservation. In contrast, decentralized autonomous organization (DAO) treasuries deploy collective asset management via blockchain technology, ensuring transparency, automatic governance through smart contracts, and diversified participation from token holders. Explore the nuanced differences in asset management approaches to optimize your investment strategy.

Decision-Making Authority

Family office treasury consolidates decision-making authority within a centralized group of trusted advisors or family members, ensuring aligned financial strategies and privacy. In contrast, decentralized autonomous organization (DAO) treasury leverages blockchain-based voting mechanisms, enabling token holders to participate directly in financial decisions, promoting transparency and distributed governance. Explore the dynamics of these structures to understand which model aligns best with your organizational goals.

Source and External Links

Family office - Wikipedia - A family office is a privately held company managing investment and wealth for a wealthy family, typically with at least $50-100 million in investable assets, aiming to grow and transfer wealth across generations and may also handle household staff, travel, legal affairs, philanthropy, and succession planning.

What is a Family Office? - Ocorian - A family office is a private wealth management entity providing tailored services to ultra-high-net-worth families, including lifestyle and luxury asset management, accounting, succession planning, and philanthropy, evolving from personal assistant roles to concierge/lifestyle management.

What Does a Family Office Do - SmartAsset - Family offices are comprehensive wealth and asset management firms for ultra-high-net-worth families, usually with $30 million or more to invest, serving either a single family or multiple families to manage and grow dynastic wealth through customized advisory services.

dowidth.com

dowidth.com