Synthetic risk transfer uses derivatives like credit default swaps to shift credit risk without transferring the underlying assets, enhancing capital efficiency for banks. In contrast, securitization involves pooling assets such as loans and issuing securities backed by these assets to investors, creating liquidity and risk diversification. Explore the nuances of synthetic risk transfer and securitization to better understand their impact on financial risk management.

Why it is important

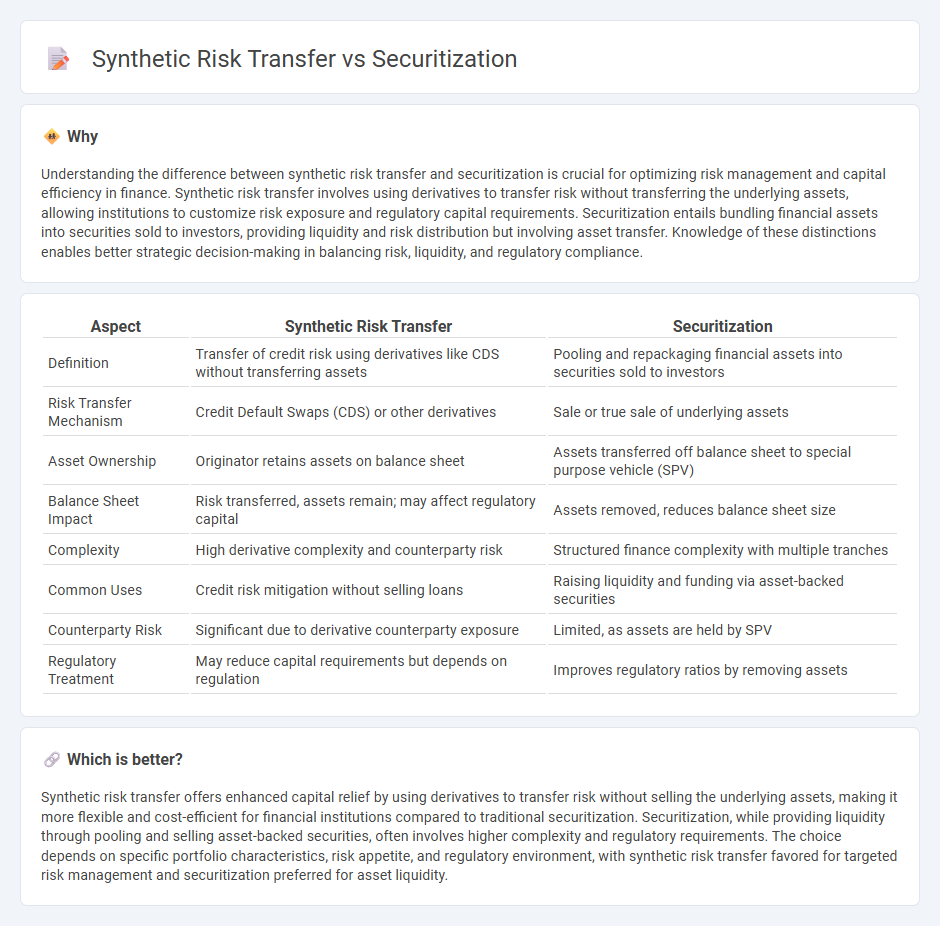

Understanding the difference between synthetic risk transfer and securitization is crucial for optimizing risk management and capital efficiency in finance. Synthetic risk transfer involves using derivatives to transfer risk without transferring the underlying assets, allowing institutions to customize risk exposure and regulatory capital requirements. Securitization entails bundling financial assets into securities sold to investors, providing liquidity and risk distribution but involving asset transfer. Knowledge of these distinctions enables better strategic decision-making in balancing risk, liquidity, and regulatory compliance.

Comparison Table

| Aspect | Synthetic Risk Transfer | Securitization |

|---|---|---|

| Definition | Transfer of credit risk using derivatives like CDS without transferring assets | Pooling and repackaging financial assets into securities sold to investors |

| Risk Transfer Mechanism | Credit Default Swaps (CDS) or other derivatives | Sale or true sale of underlying assets |

| Asset Ownership | Originator retains assets on balance sheet | Assets transferred off balance sheet to special purpose vehicle (SPV) |

| Balance Sheet Impact | Risk transferred, assets remain; may affect regulatory capital | Assets removed, reduces balance sheet size |

| Complexity | High derivative complexity and counterparty risk | Structured finance complexity with multiple tranches |

| Common Uses | Credit risk mitigation without selling loans | Raising liquidity and funding via asset-backed securities |

| Counterparty Risk | Significant due to derivative counterparty exposure | Limited, as assets are held by SPV |

| Regulatory Treatment | May reduce capital requirements but depends on regulation | Improves regulatory ratios by removing assets |

Which is better?

Synthetic risk transfer offers enhanced capital relief by using derivatives to transfer risk without selling the underlying assets, making it more flexible and cost-efficient for financial institutions compared to traditional securitization. Securitization, while providing liquidity through pooling and selling asset-backed securities, often involves higher complexity and regulatory requirements. The choice depends on specific portfolio characteristics, risk appetite, and regulatory environment, with synthetic risk transfer favored for targeted risk management and securitization preferred for asset liquidity.

Connection

Synthetic risk transfer involves using credit derivatives to shift credit risk without transferring the underlying asset, while securitization pools financial assets and issues securities backed by these assets to investors. Both techniques manage and distribute risk, enhance liquidity, and improve capital efficiency by transforming credit exposures into tradable instruments. These processes support financial institutions in optimizing balance sheets and regulatory capital requirements through innovative risk distribution mechanisms.

Key Terms

Asset-backed Securities (ABS)

Asset-backed securities (ABS) are a key element in securitization, where tangible financial assets such as loans or receivables are pooled and transformed into tradable securities, transferring credit risk to investors. Synthetic risk transfer, by contrast, involves using derivatives like credit default swaps to manage or hedge exposure without selling the underlying assets, enabling institutions to offload risk off-balance sheet. Explore deeper into the mechanisms and benefits of securitization and synthetic risk transfer to optimize risk management strategies.

Credit Default Swap (CDS)

Securitization involves pooling financial assets like loans and issuing securities backed by these assets, providing investors with credit exposure and cash flow. Synthetic risk transfer uses Credit Default Swaps (CDS) to transfer credit risk without transferring the underlying assets, enabling institutions to manage risk more flexibly and off-balance-sheet. Explore the mechanics and advantages of Credit Default Swaps within synthetic risk transfer for deeper insights.

True Sale

True sale securitization involves the legal transfer of assets from the originator to a bankruptcy-remote vehicle, ensuring off-balance-sheet treatment and risk isolation. Synthetic risk transfer, in contrast, uses credit derivatives or guarantees without transferring the underlying assets, maintaining balance sheet recognition but mitigating credit risk. Explore detailed differences and implications for risk management and regulatory capital by learning more.

Source and External Links

Securitization - Wikipedia - Securitization is a financial practice where various types of contractual debt such as mortgages or auto loans are pooled and sold as securities to investors, who are repaid from the cash flows of the underlying debts.

Back to basics: What Is Securitization? - Finance & Development - Securitization involves pooling assets and selling them as interest-bearing securities through a special purpose vehicle (SPV), allowing the original lender to remove the assets from its balance sheet and investors to receive returns from loan payments.

Introduction to Securitizations - American Bar Association - Securitization isolates assets from the originator's bankruptcy risk and enhances credit through methods like tranching, involving parties such as originators, servicers, and investors, under legal frameworks including the Dodd-Frank Act.

dowidth.com

dowidth.com