Private credit involves loans extended by non-bank entities to corporations or individuals, often offering higher yields with greater flexibility compared to traditional financing. Sovereign debt refers to the bonds or loans issued by national governments to fund public spending, typically characterized by varying risk profiles based on the country's economic stability. Explore the key differences and investment opportunities between private credit and sovereign debt to optimize your financial strategies.

Why it is important

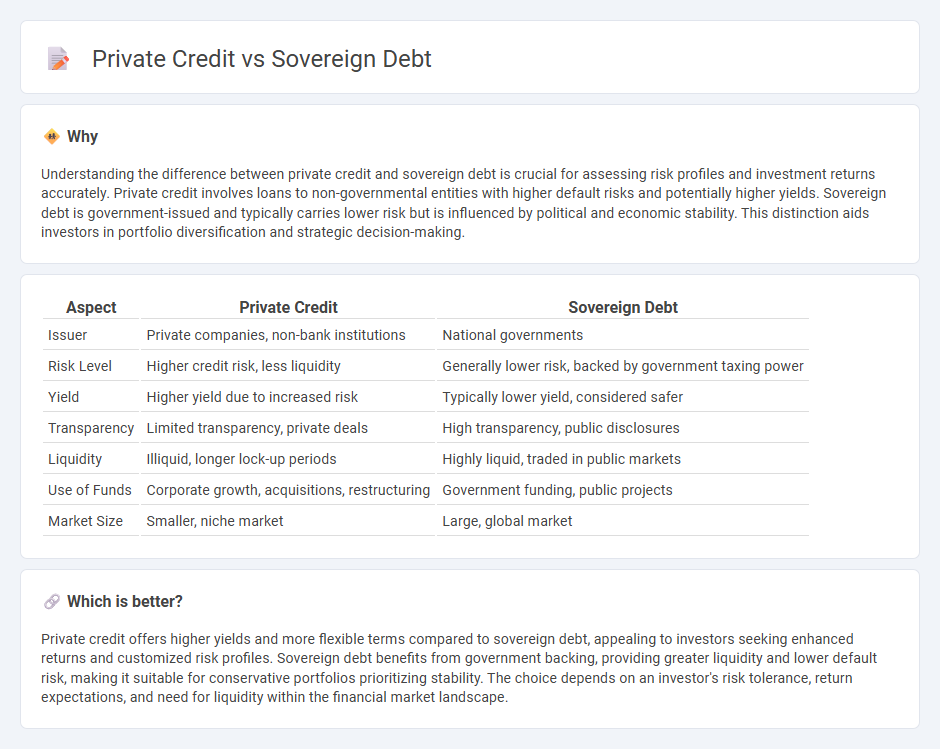

Understanding the difference between private credit and sovereign debt is crucial for assessing risk profiles and investment returns accurately. Private credit involves loans to non-governmental entities with higher default risks and potentially higher yields. Sovereign debt is government-issued and typically carries lower risk but is influenced by political and economic stability. This distinction aids investors in portfolio diversification and strategic decision-making.

Comparison Table

| Aspect | Private Credit | Sovereign Debt |

|---|---|---|

| Issuer | Private companies, non-bank institutions | National governments |

| Risk Level | Higher credit risk, less liquidity | Generally lower risk, backed by government taxing power |

| Yield | Higher yield due to increased risk | Typically lower yield, considered safer |

| Transparency | Limited transparency, private deals | High transparency, public disclosures |

| Liquidity | Illiquid, longer lock-up periods | Highly liquid, traded in public markets |

| Use of Funds | Corporate growth, acquisitions, restructuring | Government funding, public projects |

| Market Size | Smaller, niche market | Large, global market |

Which is better?

Private credit offers higher yields and more flexible terms compared to sovereign debt, appealing to investors seeking enhanced returns and customized risk profiles. Sovereign debt benefits from government backing, providing greater liquidity and lower default risk, making it suitable for conservative portfolios prioritizing stability. The choice depends on an investor's risk tolerance, return expectations, and need for liquidity within the financial market landscape.

Connection

Private credit and sovereign debt intersect through their influence on global capital markets and risk assessment frameworks. Sovereign debt levels impact country credit ratings, which in turn affect the risk premiums that private credit investors demand when lending to corporations within those countries. Fluctuations in sovereign debt sustainability can trigger shifts in private credit spreads, reflecting broader macroeconomic stability and investment risk perceptions.

Key Terms

Credit Risk

Sovereign debt entails credit risk related to a country's ability to meet its financial obligations, influenced by political stability, economic policies, and external factors like global markets. Private credit carries credit risk stemming from corporate borrower defaults, heavily dependent on business performance, cash flow stability, and sector-specific dynamics. Explore further to understand the nuanced credit risk profiles of sovereign debt versus private credit investments.

Interest Rate

Sovereign debt interest rates are influenced by national economic stability, monetary policies, and credit ratings, often resulting in lower yields due to government backing and perceived lower risk. Private credit typically carries higher interest rates reflecting greater risk exposure, limited liquidity, and borrower-specific factors within corporate or personal lending contexts. Explore the detailed dynamics that shape interest rate differences between sovereign debt and private credit markets.

Default Probability

Sovereign debt typically exhibits a lower default probability than private credit due to government backing and the ability to raise taxes or monetize debt, although geopolitical risks and macroeconomic instability can significantly impact sovereign default rates. Private credit default probability varies widely depending on borrower creditworthiness, industry sector, and economic conditions, often resulting in higher risk premiums compared to sovereign bonds. Explore further to understand the nuanced risk profiles and default dynamics between sovereign debt and private credit markets.

Source and External Links

Who holds sovereign debt and why it matters - Sovereign debt ownership varies by country and includes foreign and domestic investors, with central banks increasingly holding government bonds in advanced economies, reflecting their role in monetary policy and reserve management.

Government debt - Sovereign debt is the total financial liabilities of a government, issued to finance deficits and investments, owed to domestic and foreign creditors, and influences economic growth and fiscal policy.

Sovereign Debt - Sovereign debt is critical for government financing but requires sustainable debt management to avoid distress, with international support from institutions like the IMF to manage risks and restructuring if needed.

dowidth.com

dowidth.com