Special Purpose Acquisition Companies (SPACs) and reverse mergers offer alternative routes for private companies seeking public market entry without traditional initial public offerings (IPOs). SPACs provide a faster, often more certain path by merging with a publicly traded shell, while reverse mergers enable private firms to gain immediate public status through acquisition of an existing public company. Explore these financial mechanisms to understand their strategic advantages and regulatory nuances.

Why it is important

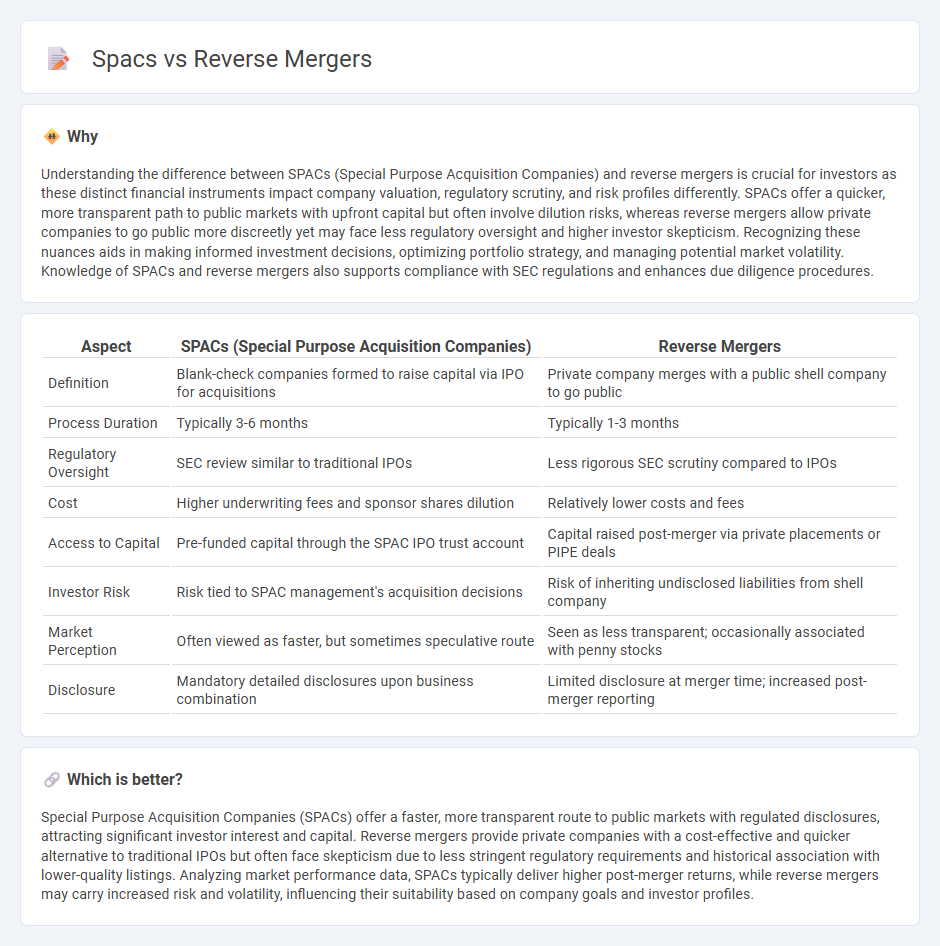

Understanding the difference between SPACs (Special Purpose Acquisition Companies) and reverse mergers is crucial for investors as these distinct financial instruments impact company valuation, regulatory scrutiny, and risk profiles differently. SPACs offer a quicker, more transparent path to public markets with upfront capital but often involve dilution risks, whereas reverse mergers allow private companies to go public more discreetly yet may face less regulatory oversight and higher investor skepticism. Recognizing these nuances aids in making informed investment decisions, optimizing portfolio strategy, and managing potential market volatility. Knowledge of SPACs and reverse mergers also supports compliance with SEC regulations and enhances due diligence procedures.

Comparison Table

| Aspect | SPACs (Special Purpose Acquisition Companies) | Reverse Mergers |

|---|---|---|

| Definition | Blank-check companies formed to raise capital via IPO for acquisitions | Private company merges with a public shell company to go public |

| Process Duration | Typically 3-6 months | Typically 1-3 months |

| Regulatory Oversight | SEC review similar to traditional IPOs | Less rigorous SEC scrutiny compared to IPOs |

| Cost | Higher underwriting fees and sponsor shares dilution | Relatively lower costs and fees |

| Access to Capital | Pre-funded capital through the SPAC IPO trust account | Capital raised post-merger via private placements or PIPE deals |

| Investor Risk | Risk tied to SPAC management's acquisition decisions | Risk of inheriting undisclosed liabilities from shell company |

| Market Perception | Often viewed as faster, but sometimes speculative route | Seen as less transparent; occasionally associated with penny stocks |

| Disclosure | Mandatory detailed disclosures upon business combination | Limited disclosure at merger time; increased post-merger reporting |

Which is better?

Special Purpose Acquisition Companies (SPACs) offer a faster, more transparent route to public markets with regulated disclosures, attracting significant investor interest and capital. Reverse mergers provide private companies with a cost-effective and quicker alternative to traditional IPOs but often face skepticism due to less stringent regulatory requirements and historical association with lower-quality listings. Analyzing market performance data, SPACs typically deliver higher post-merger returns, while reverse mergers may carry increased risk and volatility, influencing their suitability based on company goals and investor profiles.

Connection

SPACs (Special Purpose Acquisition Companies) and reverse mergers are connected through their shared role in facilitating private companies' public market entry without traditional IPO processes. A SPAC merges with a private company via a reverse merger, allowing the target to become publicly traded quickly and with fewer regulatory hurdles. This streamlined process attracts companies seeking faster capital access and market liquidity compared to conventional initial public offerings.

Key Terms

Shell Company

Shell companies play a crucial role in reverse mergers by serving as inactive entities that facilitate private companies' entry into public markets without traditional IPO processes. In contrast, SPACs, or Special Purpose Acquisition Companies, are publicly traded shell companies formed explicitly to acquire or merge with private firms, enabling faster capitalization and liquidity. Explore in-depth how shell companies differ functionally in reverse mergers and SPAC transactions.

De-SPAC Transaction

De-SPAC transactions occur when a Special Purpose Acquisition Company (SPAC) merges with a private company to take it public without a traditional initial public offering (IPO). Reverse mergers also provide a faster route to public markets by merging a private company with a publicly traded shell company, but they typically lack the capital raise component of SPACs. Explore the differences and strategic benefits of De-SPAC transactions to understand their growing impact on the market.

Public Listing

Reverse mergers provide a faster and often more cost-effective route to public listing by enabling private companies to merge with an existing public shell corporation, bypassing the lengthy IPO process. SPACs (Special Purpose Acquisition Companies) raise capital through an initial public offering specifically to acquire a private company, offering a streamlined path to public markets but with regulatory considerations and shareholder approval requirements. Explore the detailed differences in public listing strategies between reverse mergers and SPACs to determine the best option for your company's growth.

Source and External Links

Reverse Merger | M&A Definition + Examples - Wall Street Prep - A reverse merger is when a privately-held company acquires a majority stake in a publicly-traded company, usually a shell company, enabling the private company to bypass the traditional IPO process and become public through a stock swap.

Reverse takeover - Wikipedia - In a reverse takeover, the private company's shareholders acquire control of a public shell company and merge it with the private company, transforming the private company into a public one without undergoing an extensive IPO process.

Investor Bulletin: Reverse Mergers - SEC.gov - A reverse merger involves a public shell company acquiring a private operating company, with the private company's shareholders gaining controlling interest and management control, facilitating access to capital markets more quickly than a traditional IPO.

dowidth.com

dowidth.com