Laddered bond ETFs offer a structured portfolio of bonds with staggered maturities, providing predictable income streams and reduced interest rate risk compared to traditional bond mutual funds, which often reinvest proceeds and may experience price volatility. These ETFs trade like stocks on exchanges, allowing for intraday liquidity and often lower expense ratios, making them an efficient choice for bond investors seeking transparency and cost-efficiency. Explore how laddered bond ETFs can enhance income stability and portfolio diversification in your fixed income strategy.

Why it is important

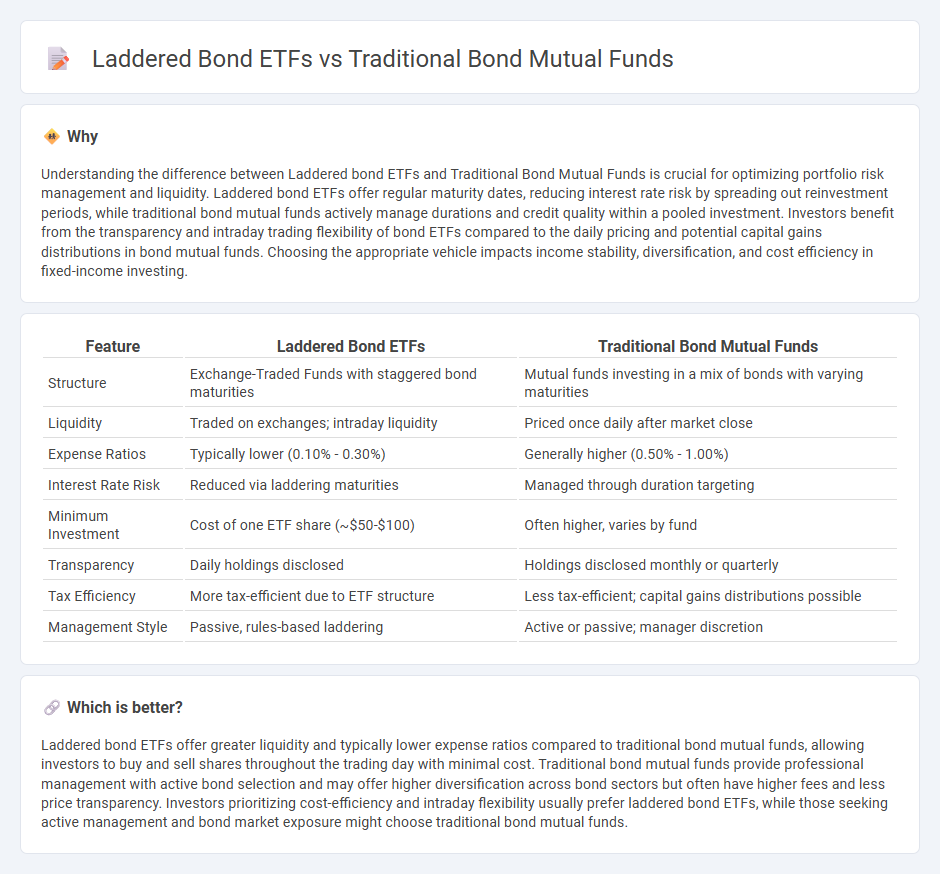

Understanding the difference between Laddered bond ETFs and Traditional Bond Mutual Funds is crucial for optimizing portfolio risk management and liquidity. Laddered bond ETFs offer regular maturity dates, reducing interest rate risk by spreading out reinvestment periods, while traditional bond mutual funds actively manage durations and credit quality within a pooled investment. Investors benefit from the transparency and intraday trading flexibility of bond ETFs compared to the daily pricing and potential capital gains distributions in bond mutual funds. Choosing the appropriate vehicle impacts income stability, diversification, and cost efficiency in fixed-income investing.

Comparison Table

| Feature | Laddered Bond ETFs | Traditional Bond Mutual Funds |

|---|---|---|

| Structure | Exchange-Traded Funds with staggered bond maturities | Mutual funds investing in a mix of bonds with varying maturities |

| Liquidity | Traded on exchanges; intraday liquidity | Priced once daily after market close |

| Expense Ratios | Typically lower (0.10% - 0.30%) | Generally higher (0.50% - 1.00%) |

| Interest Rate Risk | Reduced via laddering maturities | Managed through duration targeting |

| Minimum Investment | Cost of one ETF share (~$50-$100) | Often higher, varies by fund |

| Transparency | Daily holdings disclosed | Holdings disclosed monthly or quarterly |

| Tax Efficiency | More tax-efficient due to ETF structure | Less tax-efficient; capital gains distributions possible |

| Management Style | Passive, rules-based laddering | Active or passive; manager discretion |

Which is better?

Laddered bond ETFs offer greater liquidity and typically lower expense ratios compared to traditional bond mutual funds, allowing investors to buy and sell shares throughout the trading day with minimal cost. Traditional bond mutual funds provide professional management with active bond selection and may offer higher diversification across bond sectors but often have higher fees and less price transparency. Investors prioritizing cost-efficiency and intraday flexibility usually prefer laddered bond ETFs, while those seeking active management and bond market exposure might choose traditional bond mutual funds.

Connection

Laddered bond ETFs and traditional bond mutual funds both provide diversified fixed-income exposure by spreading investments across multiple maturities to manage interest rate risk. Laddered bond ETFs offer intraday liquidity and lower expense ratios, while traditional bond mutual funds often provide active management with opportunities for strategic credit and duration adjustments. Investors choose between these vehicles based on preferences for cost efficiency, trading flexibility, and management style within the fixed-income portfolio.

Key Terms

Interest Rate Risk

Traditional bond mutual funds often face heightened interest rate risk due to their active management and longer average maturities, which can lead to greater price volatility when rates rise. Laddered bond ETFs mitigate interest rate risk by holding bonds with staggered maturities, providing more predictable cash flows and reducing sensitivity to interest rate fluctuations. Discover how these strategies impact your investment stability and income by exploring their comparative benefits.

Liquidity

Traditional bond mutual funds offer daily liquidity but can face challenges during market stress due to valuation uncertainty and potential redemption pressures. Laddered bond ETFs provide intraday tradability on exchanges, ensuring transparent pricing and enhanced liquidity through the ability to buy or sell throughout the trading day. Explore how liquidity advantages influence portfolio strategies between these fixed-income investment options.

Maturity Structure

Traditional bond mutual funds typically maintain a managed maturity structure with active duration management, allowing flexibility in responding to interest rate changes. Laddered bond ETFs employ a fixed maturity schedule, holding bonds that mature sequentially, which can reduce interest rate risk and provide predictable cash flow. Explore the distinct advantages of each maturity structure to optimize fixed-income portfolio strategy.

Source and External Links

What Are Bond Funds? - Fidelity Investments - Traditional bond mutual funds pool investors' money to buy a diversified portfolio of bonds, managed by professionals who buy and sell bonds to achieve diversification and income, with monthly distributions and variable yields depending on the underlying bonds and market conditions.

Bond Mutual Funds - Investment Company Institute - Traditional bond mutual funds are actively managed portfolios of bonds with no fixed maturity date, offering diversification and daily liquidity, but no guarantees on returns since bond values fluctuate with market conditions.

Bond mutual funds, bond ETFs, and preferred securities - Charles Schwab - These funds invest in bonds and other fixed income securities, provide professional management, diversification, and liquidity, but their net asset value can fluctuate daily with market risks based on bond quality and interest rates.

dowidth.com

dowidth.com