Dim sum bonds are renminbi-denominated bonds issued outside Mainland China, primarily in Hong Kong, allowing foreign investors access to Chinese currency assets. Panda bonds are renminbi-denominated bonds issued by foreign entities within Mainland China, offering a direct channel for international issuers to tap into China's domestic market. Explore the distinct features and benefits of Dim sum and Panda bonds to enhance your global investment strategy.

Why it is important

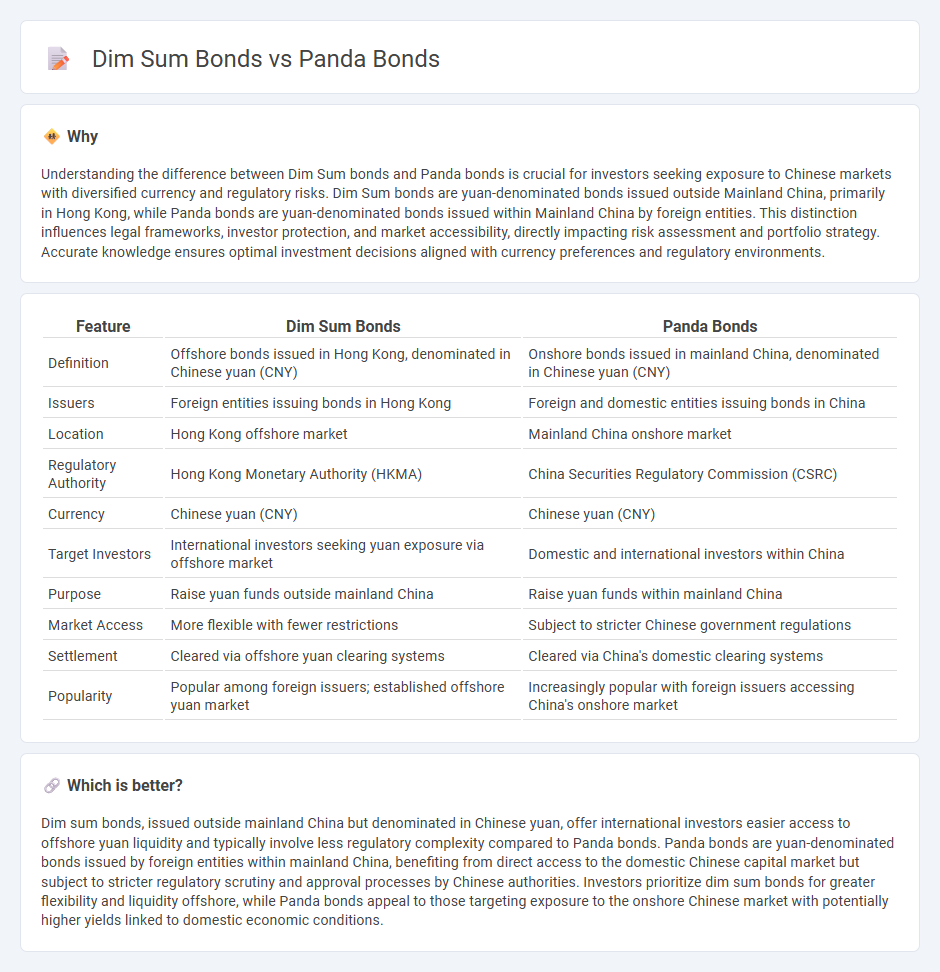

Understanding the difference between Dim Sum bonds and Panda bonds is crucial for investors seeking exposure to Chinese markets with diversified currency and regulatory risks. Dim Sum bonds are yuan-denominated bonds issued outside Mainland China, primarily in Hong Kong, while Panda bonds are yuan-denominated bonds issued within Mainland China by foreign entities. This distinction influences legal frameworks, investor protection, and market accessibility, directly impacting risk assessment and portfolio strategy. Accurate knowledge ensures optimal investment decisions aligned with currency preferences and regulatory environments.

Comparison Table

| Feature | Dim Sum Bonds | Panda Bonds |

|---|---|---|

| Definition | Offshore bonds issued in Hong Kong, denominated in Chinese yuan (CNY) | Onshore bonds issued in mainland China, denominated in Chinese yuan (CNY) |

| Issuers | Foreign entities issuing bonds in Hong Kong | Foreign and domestic entities issuing bonds in China |

| Location | Hong Kong offshore market | Mainland China onshore market |

| Regulatory Authority | Hong Kong Monetary Authority (HKMA) | China Securities Regulatory Commission (CSRC) |

| Currency | Chinese yuan (CNY) | Chinese yuan (CNY) |

| Target Investors | International investors seeking yuan exposure via offshore market | Domestic and international investors within China |

| Purpose | Raise yuan funds outside mainland China | Raise yuan funds within mainland China |

| Market Access | More flexible with fewer restrictions | Subject to stricter Chinese government regulations |

| Settlement | Cleared via offshore yuan clearing systems | Cleared via China's domestic clearing systems |

| Popularity | Popular among foreign issuers; established offshore yuan market | Increasingly popular with foreign issuers accessing China's onshore market |

Which is better?

Dim sum bonds, issued outside mainland China but denominated in Chinese yuan, offer international investors easier access to offshore yuan liquidity and typically involve less regulatory complexity compared to Panda bonds. Panda bonds are yuan-denominated bonds issued by foreign entities within mainland China, benefiting from direct access to the domestic Chinese capital market but subject to stricter regulatory scrutiny and approval processes by Chinese authorities. Investors prioritize dim sum bonds for greater flexibility and liquidity offshore, while Panda bonds appeal to those targeting exposure to the onshore Chinese market with potentially higher yields linked to domestic economic conditions.

Connection

Dim sum bonds and Panda bonds are connected through their role in facilitating cross-border investment between China and international markets, as both are yuan-denominated debt instruments issued outside mainland China. Dim sum bonds are issued primarily in Hong Kong by non-Chinese entities, attracting foreign investors seeking exposure to the Chinese yuan, while Panda bonds are issued by foreign entities within mainland China to tap into domestic investors. This connection highlights their strategic function in promoting the internationalization of the Chinese currency and diversifying funding sources for issuers.

Key Terms

Currency denomination

Panda bonds are yuan-denominated bonds issued by foreign entities within mainland China, enabling access to the Chinese domestic capital market. Dim sum bonds, issued outside China typically in Hong Kong, are also denominated in yuan but cater to international investors seeking exposure to the Chinese currency. Explore the distinct features and investment strategies associated with Panda and Dim Sum bonds to deepen your understanding.

Issuance location

Panda bonds are issued by foreign entities within the Chinese mainland, targeting investors in China's domestic bond market. Dim sum bonds are issued outside China, primarily in Hong Kong, and are denominated in Chinese yuan to attract offshore investors. Explore further to understand the strategic advantages of each issuance location.

Foreign issuer eligibility

Panda bonds are RMB-denominated bonds issued by foreign entities within mainland China's domestic bond market, subject to approvals from Chinese regulators such as the People's Bank of China and the China Securities Regulatory Commission. Dim sum bonds are also RMB-denominated but are issued by foreign or local entities in Hong Kong's offshore bond market, offering easier access with fewer regulatory restrictions for foreign issuers. Explore further to understand the specific eligibility requirements and market nuances between these two bond types.

Source and External Links

Panda bonds - Panda bonds are Chinese renminbi-denominated bonds issued by non-Chinese entities in China's domestic market, first launched in 2005 and initially restricted on fund repatriation, with liberalizations since allowing wider foreign issuance and use of proceeds within or outside China.

Panda Bonds explained: understanding China's growing bond market - Panda bonds enable foreign entities to raise RMB funds onshore in China, having grown due to regulatory reforms, lower costs versus USD bonds, and increasing geopolitical shifts favoring Chinese domestic financing.

Panda Bonds: Unlocking China's Debt Market for Global Investors - Issued by foreign companies in China's onshore market, panda bonds allow accessing Chinese investors with RMB-denominated debt, reducing FX risks and evolving alongside increasing international investor participation and regulatory frameworks.

dowidth.com

dowidth.com