Climate-linked derivatives offer financial instruments designed to hedge risks associated with climate change impacts, providing businesses with tailored solutions to manage environmental uncertainties. Renewable energy certificates (RECs) represent proof of generation from renewable sources, allowing companies to meet sustainability targets and support green energy markets. Explore the distinct benefits and mechanisms of these tools to enhance your climate finance strategy.

Why it is important

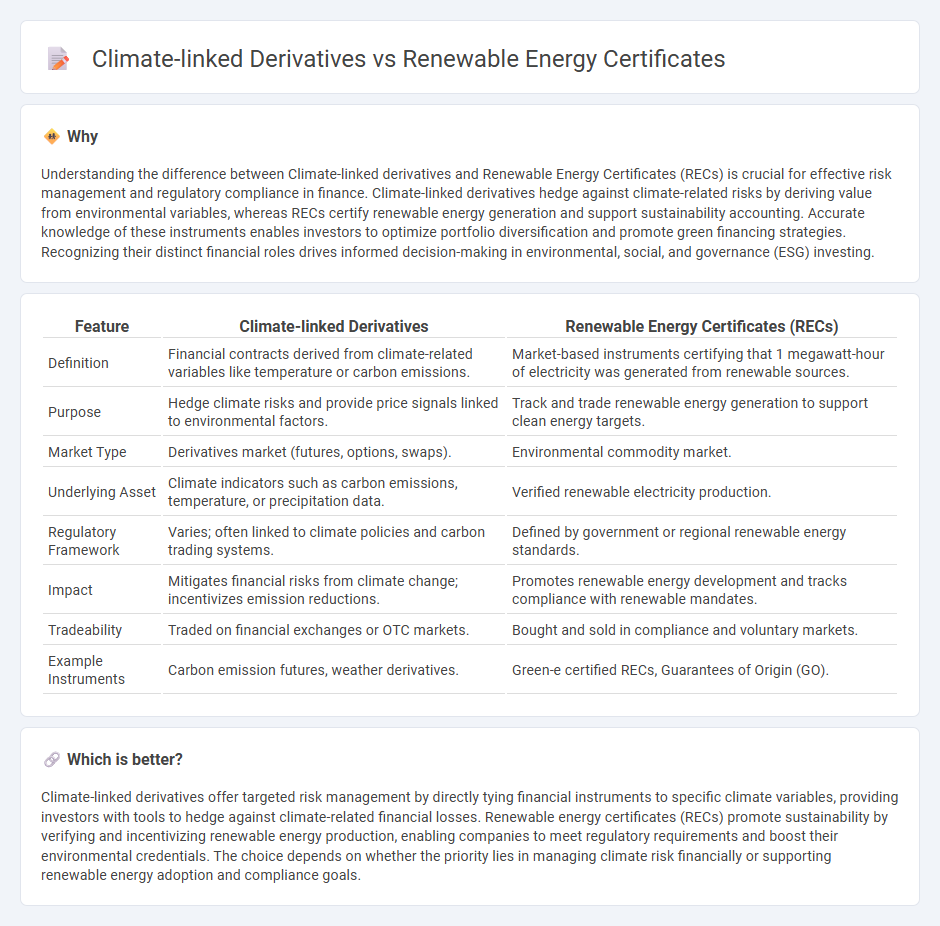

Understanding the difference between Climate-linked derivatives and Renewable Energy Certificates (RECs) is crucial for effective risk management and regulatory compliance in finance. Climate-linked derivatives hedge against climate-related risks by deriving value from environmental variables, whereas RECs certify renewable energy generation and support sustainability accounting. Accurate knowledge of these instruments enables investors to optimize portfolio diversification and promote green financing strategies. Recognizing their distinct financial roles drives informed decision-making in environmental, social, and governance (ESG) investing.

Comparison Table

| Feature | Climate-linked Derivatives | Renewable Energy Certificates (RECs) |

|---|---|---|

| Definition | Financial contracts derived from climate-related variables like temperature or carbon emissions. | Market-based instruments certifying that 1 megawatt-hour of electricity was generated from renewable sources. |

| Purpose | Hedge climate risks and provide price signals linked to environmental factors. | Track and trade renewable energy generation to support clean energy targets. |

| Market Type | Derivatives market (futures, options, swaps). | Environmental commodity market. |

| Underlying Asset | Climate indicators such as carbon emissions, temperature, or precipitation data. | Verified renewable electricity production. |

| Regulatory Framework | Varies; often linked to climate policies and carbon trading systems. | Defined by government or regional renewable energy standards. |

| Impact | Mitigates financial risks from climate change; incentivizes emission reductions. | Promotes renewable energy development and tracks compliance with renewable mandates. |

| Tradeability | Traded on financial exchanges or OTC markets. | Bought and sold in compliance and voluntary markets. |

| Example Instruments | Carbon emission futures, weather derivatives. | Green-e certified RECs, Guarantees of Origin (GO). |

Which is better?

Climate-linked derivatives offer targeted risk management by directly tying financial instruments to specific climate variables, providing investors with tools to hedge against climate-related financial losses. Renewable energy certificates (RECs) promote sustainability by verifying and incentivizing renewable energy production, enabling companies to meet regulatory requirements and boost their environmental credentials. The choice depends on whether the priority lies in managing climate risk financially or supporting renewable energy adoption and compliance goals.

Connection

Climate-linked derivatives and Renewable Energy Certificates (RECs) both serve as financial instruments designed to support sustainable energy markets and mitigate climate risks. Climate-linked derivatives enable investors to hedge against the financial impacts of climate-related events, while Renewable Energy Certificates certify the generation of clean energy, providing a market mechanism to incentivize renewable energy production. Together, these instruments facilitate the transition to a low-carbon economy by aligning financial incentives with environmental goals.

Key Terms

Additionality

Renewable energy certificates (RECs) represent proof that one megawatt-hour of electricity was generated from a renewable energy resource, ensuring additionality by supporting new clean energy projects. Climate-linked derivatives, such as carbon futures or options, provide financial tools to hedge or speculate on climate risks but may lack direct additionality since they do not always fund new emissions reductions. Explore the distinctions between these mechanisms to understand their impact on sustainable finance and environmental integrity.

Hedging

Renewable energy certificates (RECs) enable organizations to hedge their carbon footprint by proving investment in green energy production, while climate-linked derivatives provide financial instruments to mitigate risks associated with climate variables like temperature and precipitation. RECs offer a direct mechanism to support renewable energy generation, whereas climate-linked derivatives allow firms to hedge against weather-related financial exposures, complementing sustainability strategies. Explore these tools to enhance your risk management and sustainability objectives.

Market mechanism

Renewable energy certificates (RECs) represent verified proof that electricity has been generated from renewable sources, enabling market participants to meet regulatory or voluntary environmental targets through a tradable commodity. Climate-linked derivatives, such as weather derivatives or carbon futures, offer financial instruments designed to hedge risks related to climate variability and carbon pricing, providing market-based tools for risk management and speculation. Explore the nuanced market mechanisms that differentiate these instruments and their roles in advancing sustainable finance.

Source and External Links

Renewable Energy Certificate (United States) - Wikipedia - Renewable Energy Certificates (RECs) are tradable, non-tangible certificates that prove 1 megawatt-hour of electricity was generated from eligible renewable resources and fed into the grid, used for compliance with state Renewable Portfolio Standards or voluntary renewable energy purchases.

Renewable Energy Credits (RECs): What You Need To Know - RECs represent the clean energy attributes of 1 megawatt-hour of renewable electricity generated and delivered to the grid, allowing consumers to claim that amount of their electricity use comes from renewable sources without buying the physical electricity.

Renewable Energy Certificates (RECs) | US EPA - RECs are market-based instruments representing property rights to environmental and social attributes of renewable electricity generation, issued for each megawatt-hour generated and delivered to the grid, with detailed data on the generating project included.

dowidth.com

dowidth.com