Thematic ETFs focus on specific market trends or sectors such as technology, clean energy, or healthcare, allowing investors to target growth opportunities aligned with long-term themes. Inverse ETFs provide a strategy to profit from declining markets by delivering opposite returns of underlying benchmarks, often used for hedging or short-term speculation. Explore detailed comparisons and strategies to understand which ETF aligns best with your investment goals.

Why it is important

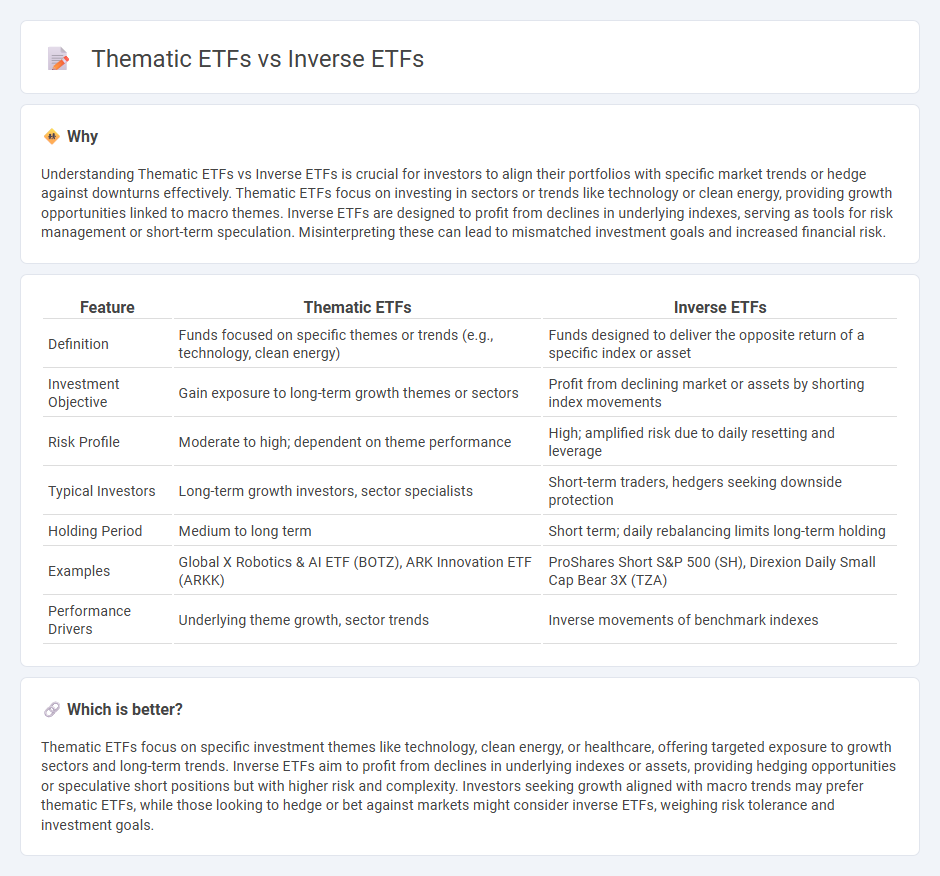

Understanding Thematic ETFs vs Inverse ETFs is crucial for investors to align their portfolios with specific market trends or hedge against downturns effectively. Thematic ETFs focus on investing in sectors or trends like technology or clean energy, providing growth opportunities linked to macro themes. Inverse ETFs are designed to profit from declines in underlying indexes, serving as tools for risk management or short-term speculation. Misinterpreting these can lead to mismatched investment goals and increased financial risk.

Comparison Table

| Feature | Thematic ETFs | Inverse ETFs |

|---|---|---|

| Definition | Funds focused on specific themes or trends (e.g., technology, clean energy) | Funds designed to deliver the opposite return of a specific index or asset |

| Investment Objective | Gain exposure to long-term growth themes or sectors | Profit from declining market or assets by shorting index movements |

| Risk Profile | Moderate to high; dependent on theme performance | High; amplified risk due to daily resetting and leverage |

| Typical Investors | Long-term growth investors, sector specialists | Short-term traders, hedgers seeking downside protection |

| Holding Period | Medium to long term | Short term; daily rebalancing limits long-term holding |

| Examples | Global X Robotics & AI ETF (BOTZ), ARK Innovation ETF (ARKK) | ProShares Short S&P 500 (SH), Direxion Daily Small Cap Bear 3X (TZA) |

| Performance Drivers | Underlying theme growth, sector trends | Inverse movements of benchmark indexes |

Which is better?

Thematic ETFs focus on specific investment themes like technology, clean energy, or healthcare, offering targeted exposure to growth sectors and long-term trends. Inverse ETFs aim to profit from declines in underlying indexes or assets, providing hedging opportunities or speculative short positions but with higher risk and complexity. Investors seeking growth aligned with macro trends may prefer thematic ETFs, while those looking to hedge or bet against markets might consider inverse ETFs, weighing risk tolerance and investment goals.

Connection

Thematic ETFs focus on specific sectors or trends, such as technology or clean energy, allowing investors to target high-growth opportunities. Inverse ETFs provide opposite exposures to underlying indices or sectors, enabling hedging against market downturns. Both ETF types offer strategic tools to diversify portfolios and manage risk within dynamic financial markets.

Key Terms

Leverage

Inverse ETFs use leverage to amplify returns by betting against the performance of underlying indexes, often employing derivatives like swaps and futures to achieve this. Thematic ETFs focus on specific trends or sectors and may include leveraged options, but typically emphasize long-term growth aligned with themes such as technology, clean energy, or consumer behavior. Explore the nuanced strategies and risk profiles of both ETF types to optimize your investment portfolio.

Sector Exposure

Inverse ETFs provide targeted sector exposure by delivering the opposite daily performance of specific market sectors, making them ideal for hedging or bearish strategies. Thematic ETFs concentrate investments within sectors aligned with emerging trends such as clean energy, technology, or healthcare innovation, enabling focused growth potential. Explore detailed comparisons to understand how sector exposure differs between inverse and thematic ETFs.

Risk Management

Inverse ETFs provide targeted risk management by offering investors the ability to profit from declining markets, serving as effective hedges against downturns. Thematic ETFs concentrate on specific sectors or trends, exposing investors to higher volatility but potential growth aligned with emerging market themes. Explore the nuances of both ETF types to better tailor your investment risk strategy.

Source and External Links

Inverse exchange-traded fund - Wikipedia - An inverse ETF is designed to perform as the inverse of a given index or benchmark, providing opposite daily performance through short selling and derivatives, and is popular for gaining in value when markets decline, while limiting losses to the purchase price unlike short selling.

What Are Inverse ETFs? - Fidelity Investments - Inverse ETFs use financial leverage to deliver daily inverse returns of an index, allowing investors, including IRA holders, to profit or hedge against market downturns by opening up long negative exposure through traditional ETF trading methods.

Leveraged, inverse, and commodity ETFs and ETNs - Vanguard - Leveraged and inverse ETFs reset daily or monthly to achieve their stated inverse returns only for those specific periods, making them unsuitable for long-term buy-and-hold as compounding and volatility can cause returns to deviate significantly from expected multiples over longer terms.

dowidth.com

dowidth.com