Shadow banking involves non-bank financial intermediaries and activities operating outside traditional regulatory frameworks, often providing credit and liquidity without standard banking supervision. Regulatory banking comprises traditional banks governed by strict rules imposed by authorities to ensure financial stability, transparency, and customer protection. Explore further to understand the critical distinctions and implications between shadow banking and regulatory banking.

Why it is important

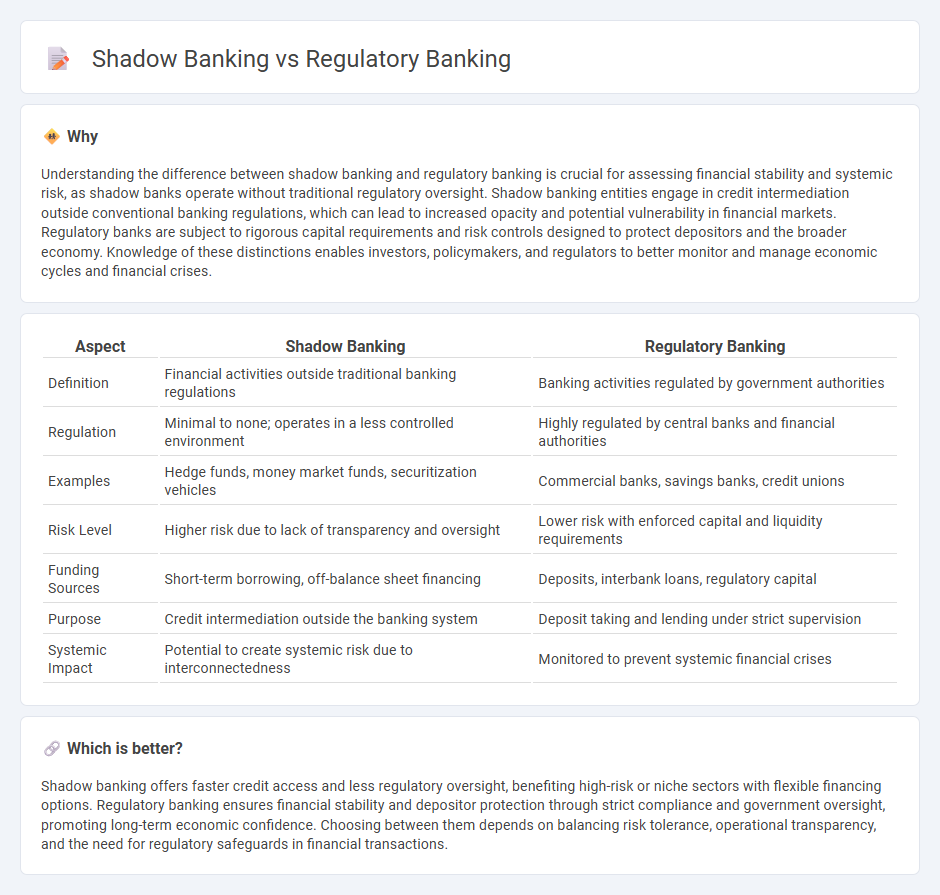

Understanding the difference between shadow banking and regulatory banking is crucial for assessing financial stability and systemic risk, as shadow banks operate without traditional regulatory oversight. Shadow banking entities engage in credit intermediation outside conventional banking regulations, which can lead to increased opacity and potential vulnerability in financial markets. Regulatory banks are subject to rigorous capital requirements and risk controls designed to protect depositors and the broader economy. Knowledge of these distinctions enables investors, policymakers, and regulators to better monitor and manage economic cycles and financial crises.

Comparison Table

| Aspect | Shadow Banking | Regulatory Banking |

|---|---|---|

| Definition | Financial activities outside traditional banking regulations | Banking activities regulated by government authorities |

| Regulation | Minimal to none; operates in a less controlled environment | Highly regulated by central banks and financial authorities |

| Examples | Hedge funds, money market funds, securitization vehicles | Commercial banks, savings banks, credit unions |

| Risk Level | Higher risk due to lack of transparency and oversight | Lower risk with enforced capital and liquidity requirements |

| Funding Sources | Short-term borrowing, off-balance sheet financing | Deposits, interbank loans, regulatory capital |

| Purpose | Credit intermediation outside the banking system | Deposit taking and lending under strict supervision |

| Systemic Impact | Potential to create systemic risk due to interconnectedness | Monitored to prevent systemic financial crises |

Which is better?

Shadow banking offers faster credit access and less regulatory oversight, benefiting high-risk or niche sectors with flexible financing options. Regulatory banking ensures financial stability and depositor protection through strict compliance and government oversight, promoting long-term economic confidence. Choosing between them depends on balancing risk tolerance, operational transparency, and the need for regulatory safeguards in financial transactions.

Connection

Shadow banking and regulatory banking are interconnected through their impact on credit markets and financial stability. Shadow banking encompasses non-bank financial intermediaries that perform bank-like activities without direct regulatory oversight, increasing systemic risk by circumventing traditional banking regulations. Regulatory banking aims to mitigate these risks through capital requirements, liquidity standards, and oversight mechanisms designed to maintain stability within the broader financial system.

Key Terms

**Regulatory Banking:**

Regulatory banking operates under strict oversight from central banks and financial authorities, ensuring compliance with capital requirements, liquidity standards, and consumer protections. These banks contribute to economic stability by providing transparent, insured deposit services and facilitating monetary policy transmission. Explore deeper insights on how regulatory frameworks shape the banking system and protect the financial ecosystem.

Capital Adequacy Ratio

Regulatory banking strictly adheres to Capital Adequacy Ratio (CAR) requirements imposed by financial authorities to ensure stability and prevent insolvency by maintaining sufficient capital reserves against risk-weighted assets. Shadow banking operates outside this regulatory framework, often lacking mandated CAR standards, which can increase systemic risk due to lower capital buffers and higher leverage. Explore further to understand the impact of CAR differences on financial system resilience and credit markets.

Basel Accords

Regulatory banking operates under strict Basel Accords guidelines, particularly Basel III, which enforces capital adequacy, stress testing, and risk management to ensure financial stability and transparency. Shadow banking, lacking such regulatory oversight, often engages in credit intermediation outside traditional banking rules, posing systemic risks due to opacity and leverage. Explore the detailed impact of Basel regulations on different banking sectors to understand their roles in global finance.

Source and External Links

Who regulates banking and financial services in your jurisdiction - In the U.S., banking is regulated by multiple agencies including the Federal Reserve System, the Office of the Comptroller of the Currency (OCC), the FDIC, and state banking agencies, each with supervisory and enforcement roles over different types of banks and financial institutions.

Bank regulation Definition, Importance & Examples - Bank regulation involves setting and enforcing rules by government and central banks worldwide to ensure banking stability, consumer protection, adequate capital, risk management, and systemic financial stability.

Banking regulation and supervision - Banking regulation enforces prudential requirements such as capital, liquidity, risk controls, consumer protection, anti-money laundering, and resolution authority to maintain safe, sound, and transparent banking systems.

dowidth.com

dowidth.com