Finfluencers leverage social media platforms to share actionable finance tips, investment strategies, and market insights, often targeting a broad audience with simplified content. Family office managers oversee the comprehensive financial affairs of high-net-worth families, focusing on wealth preservation, estate planning, and personalized investment decisions. Discover more about the distinct roles and impacts of finfluencers and family office managers in today's financial landscape.

Why it is important

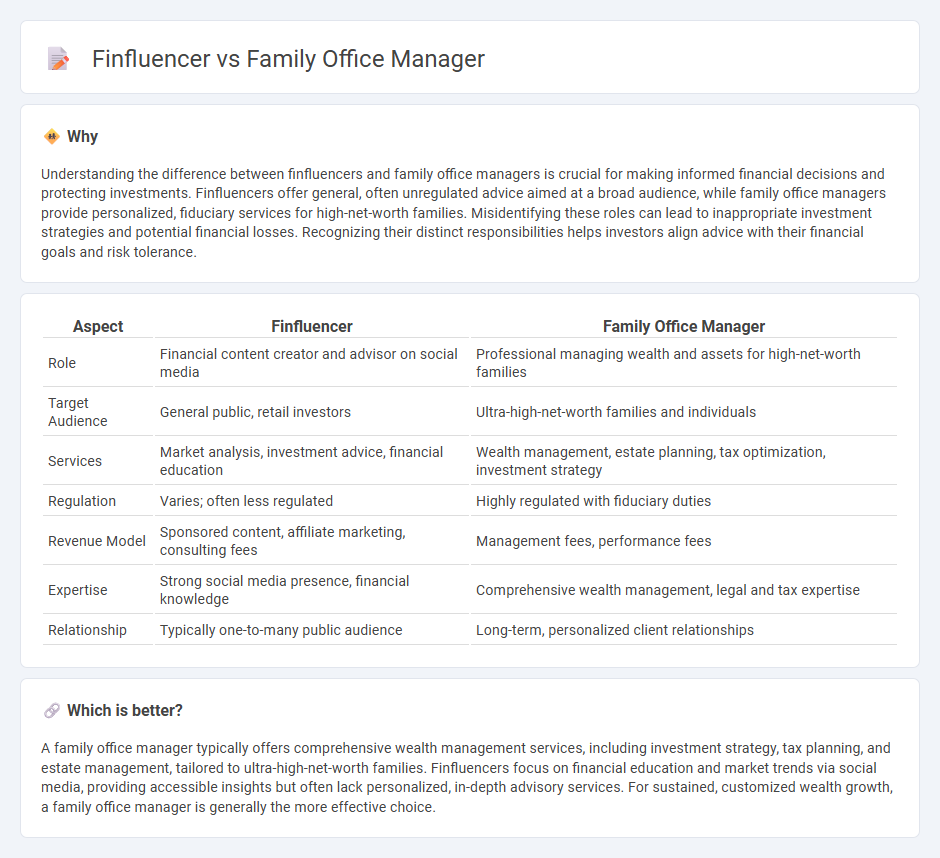

Understanding the difference between finfluencers and family office managers is crucial for making informed financial decisions and protecting investments. Finfluencers offer general, often unregulated advice aimed at a broad audience, while family office managers provide personalized, fiduciary services for high-net-worth families. Misidentifying these roles can lead to inappropriate investment strategies and potential financial losses. Recognizing their distinct responsibilities helps investors align advice with their financial goals and risk tolerance.

Comparison Table

| Aspect | Finfluencer | Family Office Manager |

|---|---|---|

| Role | Financial content creator and advisor on social media | Professional managing wealth and assets for high-net-worth families |

| Target Audience | General public, retail investors | Ultra-high-net-worth families and individuals |

| Services | Market analysis, investment advice, financial education | Wealth management, estate planning, tax optimization, investment strategy |

| Regulation | Varies; often less regulated | Highly regulated with fiduciary duties |

| Revenue Model | Sponsored content, affiliate marketing, consulting fees | Management fees, performance fees |

| Expertise | Strong social media presence, financial knowledge | Comprehensive wealth management, legal and tax expertise |

| Relationship | Typically one-to-many public audience | Long-term, personalized client relationships |

Which is better?

A family office manager typically offers comprehensive wealth management services, including investment strategy, tax planning, and estate management, tailored to ultra-high-net-worth families. Finfluencers focus on financial education and market trends via social media, providing accessible insights but often lack personalized, in-depth advisory services. For sustained, customized wealth growth, a family office manager is generally the more effective choice.

Connection

Finfluencers provide valuable financial insights and investment strategies that family office managers leverage to optimize wealth management for high-net-worth clients. Family office managers analyze finfluencer content to identify emerging market trends and innovative asset allocation techniques. This collaboration enhances tailored portfolio management, ensuring sustained financial growth and risk mitigation.

Key Terms

Family Office Manager:

A Family Office Manager oversees comprehensive wealth management, including investment strategies, estate planning, and tax optimization for high-net-worth families, ensuring long-term financial stability. They coordinate with legal, financial, and philanthropic advisors to tailor bespoke solutions that protect and grow family assets across generations. Discover the essential roles and responsibilities that define a successful Family Office Manager.

Asset Allocation

Family office managers prioritize diversified asset allocation strategies tailored to high-net-worth clients, balancing equity, fixed income, private equity, and alternative investments to optimize long-term wealth preservation and growth. Finfluencers often focus on trending investment opportunities and high-volatility assets like cryptocurrencies and meme stocks to attract and engage a broader, retail-oriented audience. Explore the differences in asset allocation approaches between professional family office managers and finfluencers to make informed investment decisions.

Wealth Preservation

Family office managers specialize in comprehensive wealth preservation strategies, leveraging personalized investment portfolios, tax planning, and risk management to safeguard high-net-worth assets across generations. Finfluencers, while influential in promoting financial literacy and investment trends, often prioritize engagement and market insights over tailored, long-term wealth preservation. Explore the nuanced approaches of family office management to better understand how expert stewardship ensures sustainable wealth growth and protection.

Source and External Links

Family Office Manager - The Estate Agency - A Family Office Manager oversees the financial, administrative, and operational needs of high-net-worth families, coordinating investments, managing household staff, handling travel, calendars, and philanthropic activities to ensure smooth family office operations.

Family office manager: functions and unique features of the profile - A family office manager administers significant family wealth, communicates closely with family heads to align on objectives and risk profiles, and designs investment strategies aiming to preserve wealth across generations within rapidly growing family office markets.

Navigating the Complexities of Family Office Management - A reputable family office manager is chosen based on a proven track record and expertise in wealth preservation, tax, and estate planning, and acts as a trusted partner and orchestrator of comprehensive wealth management strategies for affluent families.

dowidth.com

dowidth.com