AI-driven portfolio management leverages machine learning algorithms and big data analytics to optimize investment decisions, enhance risk assessment, and adapt dynamically to market trends. Tactical asset allocation involves adjusting the investment mix periodically based on short-term market forecasts to capitalize on opportunities and manage risk. Explore our detailed comparison to understand which strategy aligns best with your financial goals and risk tolerance.

Why it is important

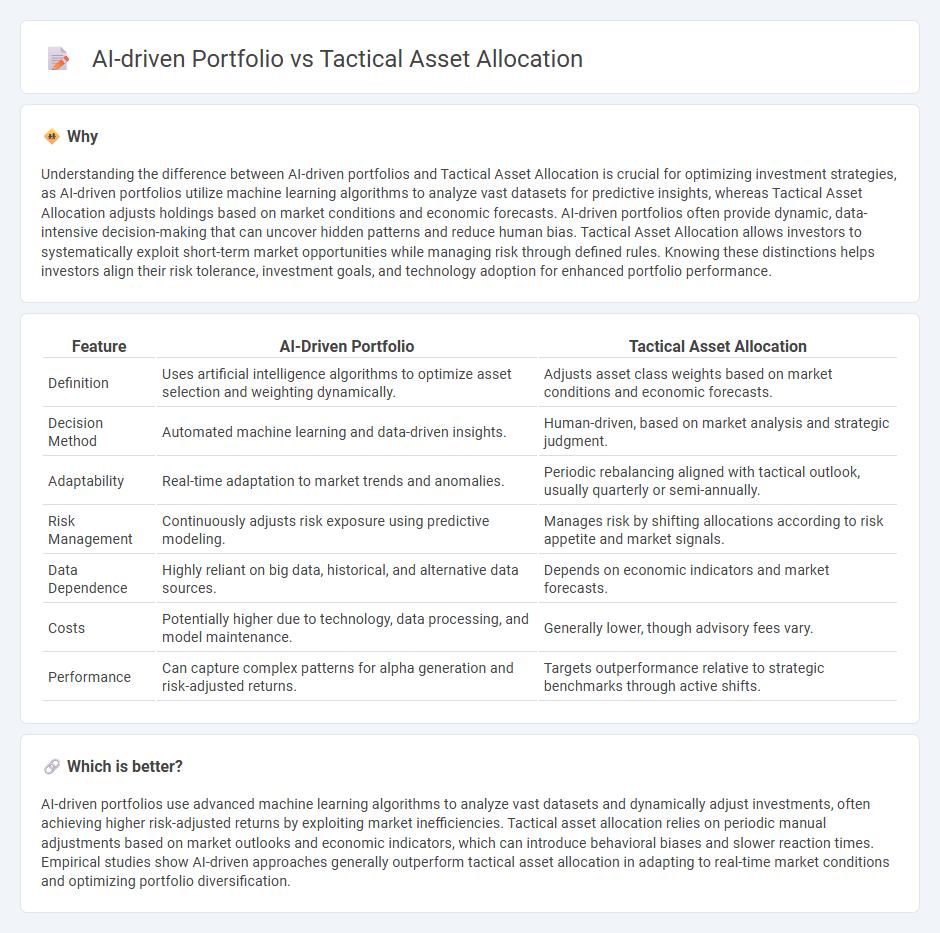

Understanding the difference between AI-driven portfolios and Tactical Asset Allocation is crucial for optimizing investment strategies, as AI-driven portfolios utilize machine learning algorithms to analyze vast datasets for predictive insights, whereas Tactical Asset Allocation adjusts holdings based on market conditions and economic forecasts. AI-driven portfolios often provide dynamic, data-intensive decision-making that can uncover hidden patterns and reduce human bias. Tactical Asset Allocation allows investors to systematically exploit short-term market opportunities while managing risk through defined rules. Knowing these distinctions helps investors align their risk tolerance, investment goals, and technology adoption for enhanced portfolio performance.

Comparison Table

| Feature | AI-Driven Portfolio | Tactical Asset Allocation |

|---|---|---|

| Definition | Uses artificial intelligence algorithms to optimize asset selection and weighting dynamically. | Adjusts asset class weights based on market conditions and economic forecasts. |

| Decision Method | Automated machine learning and data-driven insights. | Human-driven, based on market analysis and strategic judgment. |

| Adaptability | Real-time adaptation to market trends and anomalies. | Periodic rebalancing aligned with tactical outlook, usually quarterly or semi-annually. |

| Risk Management | Continuously adjusts risk exposure using predictive modeling. | Manages risk by shifting allocations according to risk appetite and market signals. |

| Data Dependence | Highly reliant on big data, historical, and alternative data sources. | Depends on economic indicators and market forecasts. |

| Costs | Potentially higher due to technology, data processing, and model maintenance. | Generally lower, though advisory fees vary. |

| Performance | Can capture complex patterns for alpha generation and risk-adjusted returns. | Targets outperformance relative to strategic benchmarks through active shifts. |

Which is better?

AI-driven portfolios use advanced machine learning algorithms to analyze vast datasets and dynamically adjust investments, often achieving higher risk-adjusted returns by exploiting market inefficiencies. Tactical asset allocation relies on periodic manual adjustments based on market outlooks and economic indicators, which can introduce behavioral biases and slower reaction times. Empirical studies show AI-driven approaches generally outperform tactical asset allocation in adapting to real-time market conditions and optimizing portfolio diversification.

Connection

AI-driven portfolio management leverages machine learning algorithms to analyze vast datasets and identify optimal Tactical Asset Allocation (TAA) strategies, enhancing return potential while managing risk. By dynamically adjusting asset weights based on real-time market signals, AI enables more precise execution of TAA, aligning portfolios with evolving economic conditions and investor objectives. This integration improves portfolio diversification and responsiveness, leading to more efficient capital allocation across asset classes.

Key Terms

Market Timing

Tactical asset allocation (TAA) adjusts portfolio weights based on short-term market forecasts to capitalize on market timing opportunities and improve returns. AI-driven portfolios leverage machine learning algorithms to analyze vast datasets, identify patterns, and make dynamic investment decisions with higher accuracy and reduced human bias. Discover how AI enhances traditional market timing strategies by optimizing asset allocation through sophisticated data-driven techniques.

Algorithmic Optimization

Tactical asset allocation strategically adjusts portfolio weights based on market trends and economic cycles to maximize returns and manage risk. AI-driven portfolios leverage algorithmic optimization techniques, using machine learning models to analyze vast datasets and dynamically rebalance assets for enhanced performance and risk mitigation. Explore how cutting-edge algorithmic optimization transforms portfolio management by visiting our detailed analysis.

Risk Adjustment

Tactical asset allocation adjusts portfolio weights based on short-term market forecasts to optimize risk-adjusted returns, while AI-driven portfolios employ machine learning algorithms to analyze vast datasets and dynamically rebalance assets for enhanced risk management. Both methods aim to improve the Sharpe ratio but differ in data processing and adaptability, with AI offering superior predictive capabilities under volatile market conditions. Discover how integrating AI can revolutionize risk adjustment strategies in portfolio management.

Source and External Links

Tactical Asset Allocation (TAA) - Overview, Reasons, Example - Tactical asset allocation is an active portfolio management strategy that adjusts asset allocations to capitalize on macroeconomic conditions, aiming to shift investments toward stronger-performing asset classes to increase returns and manage risk.

What is Tactical Asset Allocation? - SmartAsset - Tactical asset allocation involves dynamically adjusting a portfolio's asset mix in response to market trends and economic indicators, allowing investors to capitalize on short-term opportunities as opposed to the fixed long-term targets of strategic asset allocation.

Tactical asset allocation - Wikipedia - Tactical asset allocation is a dynamic investment strategy, either discretionary or systematic, that actively modifies asset allocations to improve risk-adjusted returns by anticipating changes in market valuations and exploiting temporary inefficiencies among asset classes.

dowidth.com

dowidth.com