Impact investing directs capital toward projects generating measurable social and environmental benefits alongside financial returns, targeting sectors like renewable energy, sustainable agriculture, and affordable housing. Green bonds finance environmentally friendly projects, such as clean energy infrastructure and pollution reduction initiatives, offering investors fixed income with a positive ecological impact. Explore the nuances and benefits of impact investing and green bonds to enhance your sustainable finance strategy.

Why it is important

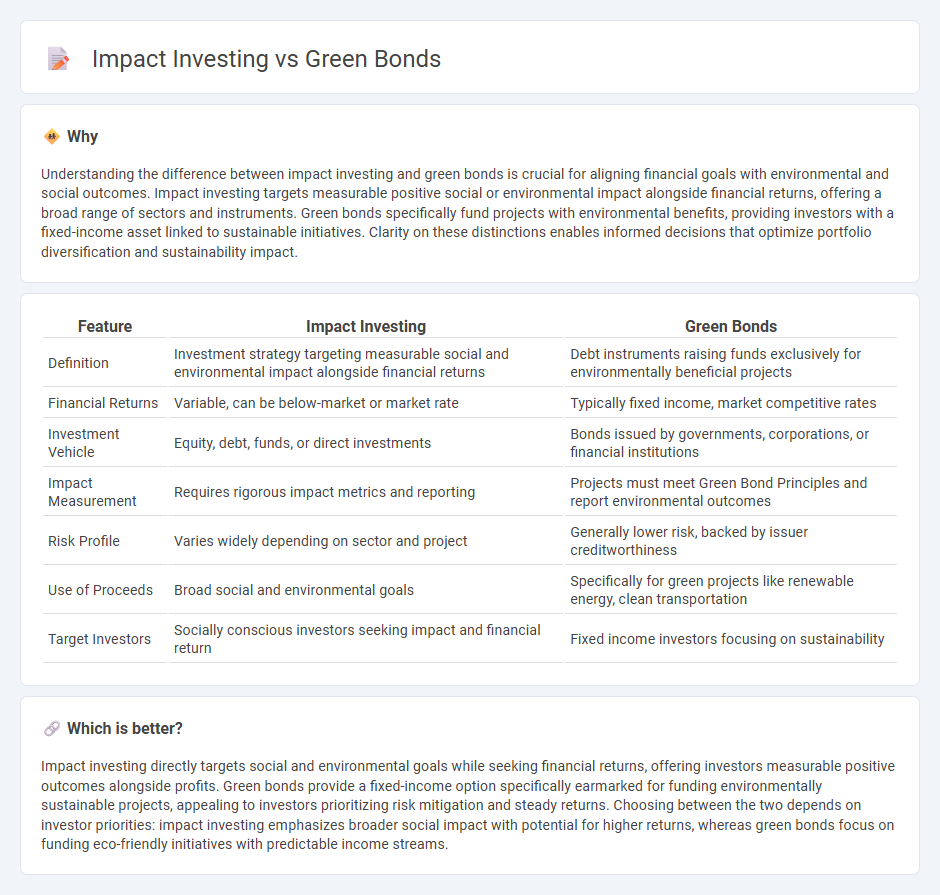

Understanding the difference between impact investing and green bonds is crucial for aligning financial goals with environmental and social outcomes. Impact investing targets measurable positive social or environmental impact alongside financial returns, offering a broad range of sectors and instruments. Green bonds specifically fund projects with environmental benefits, providing investors with a fixed-income asset linked to sustainable initiatives. Clarity on these distinctions enables informed decisions that optimize portfolio diversification and sustainability impact.

Comparison Table

| Feature | Impact Investing | Green Bonds |

|---|---|---|

| Definition | Investment strategy targeting measurable social and environmental impact alongside financial returns | Debt instruments raising funds exclusively for environmentally beneficial projects |

| Financial Returns | Variable, can be below-market or market rate | Typically fixed income, market competitive rates |

| Investment Vehicle | Equity, debt, funds, or direct investments | Bonds issued by governments, corporations, or financial institutions |

| Impact Measurement | Requires rigorous impact metrics and reporting | Projects must meet Green Bond Principles and report environmental outcomes |

| Risk Profile | Varies widely depending on sector and project | Generally lower risk, backed by issuer creditworthiness |

| Use of Proceeds | Broad social and environmental goals | Specifically for green projects like renewable energy, clean transportation |

| Target Investors | Socially conscious investors seeking impact and financial return | Fixed income investors focusing on sustainability |

Which is better?

Impact investing directly targets social and environmental goals while seeking financial returns, offering investors measurable positive outcomes alongside profits. Green bonds provide a fixed-income option specifically earmarked for funding environmentally sustainable projects, appealing to investors prioritizing risk mitigation and steady returns. Choosing between the two depends on investor priorities: impact investing emphasizes broader social impact with potential for higher returns, whereas green bonds focus on funding eco-friendly initiatives with predictable income streams.

Connection

Impact investing and green bonds are connected through their shared goal of promoting sustainable development by channeling capital into environmentally responsible projects. Green bonds provide a fixed-income investment avenue for impact investors seeking measurable environmental benefits alongside financial returns. The synergy between these financial instruments accelerates funding for renewable energy, clean transportation, and climate resilience initiatives worldwide.

Key Terms

Environmental sustainability

Green bonds finance projects explicitly aimed at environmental sustainability, such as renewable energy and pollution reduction, ensuring targeted ecological impact. Impact investing spans broader sectors, integrating environmental, social, and governance (ESG) criteria to generate measurable positive outcomes alongside financial returns. Explore how these investment strategies drive environmental innovation and sustainable development.

Social outcomes

Green bonds primarily finance environmental projects such as renewable energy and pollution reduction, while impact investing targets social outcomes like affordable housing, education, and healthcare improvements. Both approaches aim to generate measurable social and environmental benefits, but impact investing places greater emphasis on social equity and community development. Explore how these financial tools can drive sustainable social change and deliver positive community impact.

Measurable impact

Green bonds finance projects with clear environmental benefits, such as renewable energy and pollution reduction initiatives, offering investors fixed-income returns tied to sustainability goals. Impact investing targets measurable social and environmental outcomes across sectors, emphasizing transparency and performance metrics to ensure tangible positive change. Explore how these funding mechanisms drive accountability and deliver verifiable impact in sustainable finance.

Source and External Links

Green bond - Wikipedia - A green bond is a fixed-income financial instrument used exclusively to fund projects with positive environmental benefits, such as renewable energy, energy efficiency, pollution control, and climate change adaptation, following guidelines like the Green Bond Principles for transparency and impact tracking.

What are Green Bonds and what projects do they finance? - Iberdrola - Green bonds are debt instruments issued by public or private entities to finance environmentally sustainable and socially responsible projects like clean transportation, renewable energy, and waste management, committing all raised funds solely to these green initiatives.

Green Bond Principles (GBP) - ICMA - The Green Bond Principles are voluntary guidelines that help issuers finance environmentally sound projects supporting a net-zero emissions economy by promoting transparency, disclosure, and accountability in the use of green bond proceeds to ensure credible environmental impact.

dowidth.com

dowidth.com