Tokenized treasury bills transform government debt into digital assets, enhancing liquidity and accessibility for investors by enabling fractional ownership on blockchain platforms. Peer-to-peer lending connects borrowers directly with individual lenders through online platforms, offering alternative financing options with variable interest rates and risk profiles. Explore the advantages and challenges of both to understand which suits your investment strategy best.

Why it is important

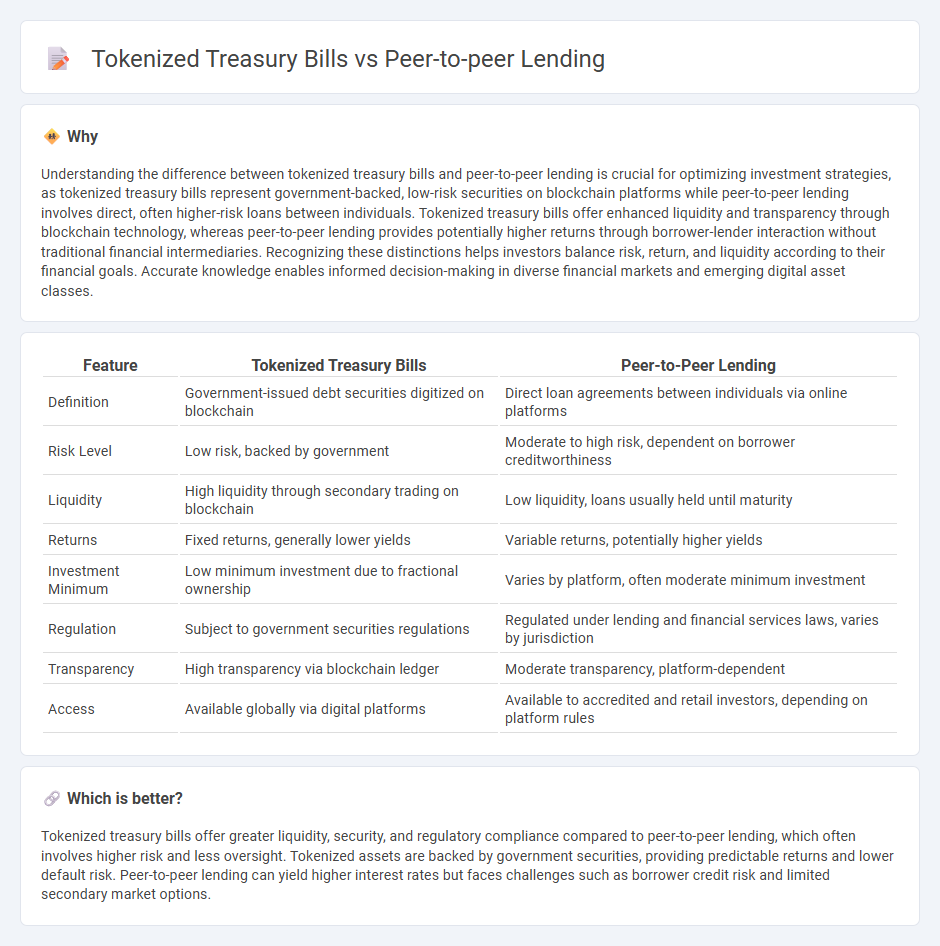

Understanding the difference between tokenized treasury bills and peer-to-peer lending is crucial for optimizing investment strategies, as tokenized treasury bills represent government-backed, low-risk securities on blockchain platforms while peer-to-peer lending involves direct, often higher-risk loans between individuals. Tokenized treasury bills offer enhanced liquidity and transparency through blockchain technology, whereas peer-to-peer lending provides potentially higher returns through borrower-lender interaction without traditional financial intermediaries. Recognizing these distinctions helps investors balance risk, return, and liquidity according to their financial goals. Accurate knowledge enables informed decision-making in diverse financial markets and emerging digital asset classes.

Comparison Table

| Feature | Tokenized Treasury Bills | Peer-to-Peer Lending |

|---|---|---|

| Definition | Government-issued debt securities digitized on blockchain | Direct loan agreements between individuals via online platforms |

| Risk Level | Low risk, backed by government | Moderate to high risk, dependent on borrower creditworthiness |

| Liquidity | High liquidity through secondary trading on blockchain | Low liquidity, loans usually held until maturity |

| Returns | Fixed returns, generally lower yields | Variable returns, potentially higher yields |

| Investment Minimum | Low minimum investment due to fractional ownership | Varies by platform, often moderate minimum investment |

| Regulation | Subject to government securities regulations | Regulated under lending and financial services laws, varies by jurisdiction |

| Transparency | High transparency via blockchain ledger | Moderate transparency, platform-dependent |

| Access | Available globally via digital platforms | Available to accredited and retail investors, depending on platform rules |

Which is better?

Tokenized treasury bills offer greater liquidity, security, and regulatory compliance compared to peer-to-peer lending, which often involves higher risk and less oversight. Tokenized assets are backed by government securities, providing predictable returns and lower default risk. Peer-to-peer lending can yield higher interest rates but faces challenges such as borrower credit risk and limited secondary market options.

Connection

Tokenized treasury bills and peer-to-peer lending both leverage blockchain technology to increase accessibility and liquidity in finance. Tokenized treasury bills represent fractional ownership of government debt, enabling investors to trade them on digital platforms similar to peer-to-peer lending marketplaces. Both mechanisms reduce intermediaries, offering lower costs and faster transaction settlements for investors and borrowers.

Key Terms

Intermediary

Peer-to-peer lending platforms directly connect borrowers and lenders, eliminating traditional financial intermediaries and reducing transaction costs while increasing transparency. Tokenized treasury bills rely on blockchain technology to digitize government securities, enabling faster settlement and fractional ownership but still often require regulatory bodies or custodians as intermediaries to ensure compliance and security. Explore the evolving roles of intermediaries in digital finance to understand their impact on efficiency and trust.

Liquidity

Peer-to-peer lending typically offers lower liquidity due to fixed loan terms and limited secondary markets, whereas tokenized treasury bills provide enhanced liquidity through blockchain-based trading platforms enabling near-instant transactions. Tokenized treasury bills benefit from regulatory backing and high credit ratings, making them attractive for investors seeking secure yet liquid assets. Explore the distinctive liquidity profiles of these investment options to optimize your portfolio strategy.

Yield

Peer-to-peer lending platforms typically offer yields ranging from 5% to 12%, driven by borrower credit risk and platform fees, whereas tokenized treasury bills provide lower but more stable yields around 2% to 3%, reflecting government backing and liquidity. Tokenized treasury bills benefit from blockchain technology, enabling fractional ownership and faster settlement times compared to traditional treasury instruments. Explore further to understand which investment aligns best with your yield expectations and risk tolerance.

Source and External Links

Peer-to-peer lending - Wikipedia - Peer-to-peer lending (P2P lending) is an online financial service that matches individual or business borrowers with lenders without traditional intermediaries, featuring unsecured or secured loans often traded as securities, managed by specialized platforms handling credit checks, loan servicing, and compliance.

Peer to peer lending: what you need to know - MoneyHelper - P2P lending is a marketplace where individuals lend money to others or businesses, earning interest, with typically higher rates and risk than savings accounts, and platforms may allow lending either by choice of borrower or automatically diversified, requiring regulation checks before investing.

Peer-to-Peer Lending - NASAA - Peer-to-peer lending is an online matchmaking process for unsecured loans, usually from $1,000 to $25,000, allowing borrowers who might struggle to get traditional bank loans to access funds from individual lenders via the internet marketplace.

dowidth.com

dowidth.com