Tax loss harvesting involves selling investments at a loss to offset capital gains taxes, reducing taxable income in the current year. The step-up in basis resets the cost basis of inherited assets to their market value at the time of death, minimizing capital gains taxes for beneficiaries. Explore how these strategies optimize tax efficiency and impact your investment portfolio.

Why it is important

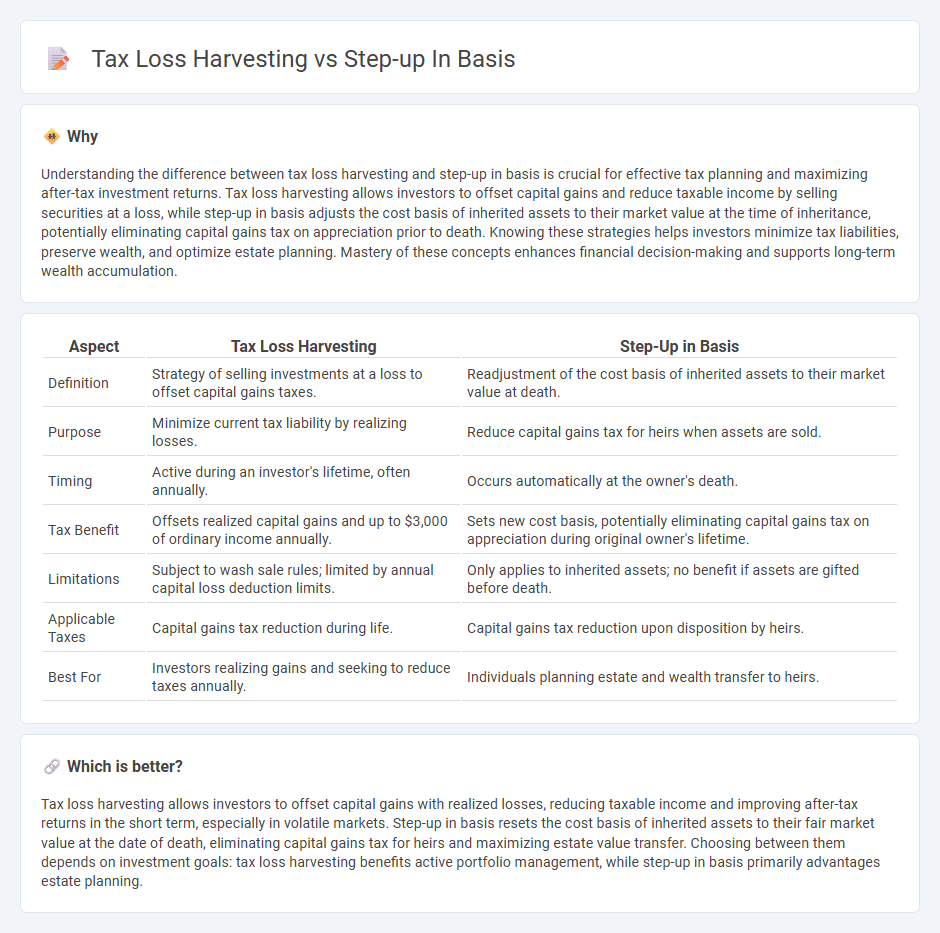

Understanding the difference between tax loss harvesting and step-up in basis is crucial for effective tax planning and maximizing after-tax investment returns. Tax loss harvesting allows investors to offset capital gains and reduce taxable income by selling securities at a loss, while step-up in basis adjusts the cost basis of inherited assets to their market value at the time of inheritance, potentially eliminating capital gains tax on appreciation prior to death. Knowing these strategies helps investors minimize tax liabilities, preserve wealth, and optimize estate planning. Mastery of these concepts enhances financial decision-making and supports long-term wealth accumulation.

Comparison Table

| Aspect | Tax Loss Harvesting | Step-Up in Basis |

|---|---|---|

| Definition | Strategy of selling investments at a loss to offset capital gains taxes. | Readjustment of the cost basis of inherited assets to their market value at death. |

| Purpose | Minimize current tax liability by realizing losses. | Reduce capital gains tax for heirs when assets are sold. |

| Timing | Active during an investor's lifetime, often annually. | Occurs automatically at the owner's death. |

| Tax Benefit | Offsets realized capital gains and up to $3,000 of ordinary income annually. | Sets new cost basis, potentially eliminating capital gains tax on appreciation during original owner's lifetime. |

| Limitations | Subject to wash sale rules; limited by annual capital loss deduction limits. | Only applies to inherited assets; no benefit if assets are gifted before death. |

| Applicable Taxes | Capital gains tax reduction during life. | Capital gains tax reduction upon disposition by heirs. |

| Best For | Investors realizing gains and seeking to reduce taxes annually. | Individuals planning estate and wealth transfer to heirs. |

Which is better?

Tax loss harvesting allows investors to offset capital gains with realized losses, reducing taxable income and improving after-tax returns in the short term, especially in volatile markets. Step-up in basis resets the cost basis of inherited assets to their fair market value at the date of death, eliminating capital gains tax for heirs and maximizing estate value transfer. Choosing between them depends on investment goals: tax loss harvesting benefits active portfolio management, while step-up in basis primarily advantages estate planning.

Connection

Tax loss harvesting involves selling securities at a loss to offset capital gains taxes, thereby reducing taxable income. Step-up in basis adjusts the asset's value to its market price at the time of inheritance, eliminating capital gains tax on the appreciation during the original owner's life. Together, these strategies optimize tax efficiency by minimizing capital gains taxes during both one's lifetime and at estate transfer.

Key Terms

Cost Basis

Step-up in basis resets an asset's cost basis to its market value at the time of inheritance, minimizing capital gains tax when sold. Tax loss harvesting involves selling investments at a loss to offset gains, thereby reducing taxable income while maintaining a similar portfolio through reinvestment. Explore how optimizing your cost basis strategies can enhance tax efficiency and maximize investment returns.

Capital Gains

Step-up in basis resets the value of an inherited asset to its market value at the time of death, effectively eliminating capital gains tax on appreciation during the decedent's lifetime. Tax loss harvesting involves selling securities at a loss to offset capital gains, thereby reducing taxable gains within an investment portfolio. Explore how these strategies can optimize your capital gains tax planning for maximum financial benefit.

Tax Efficiency

Step-up in basis allows heirs to reset the asset's cost basis to its market value at the time of inheritance, eliminating capital gains tax on appreciation before inheritance, thus enhancing tax efficiency during wealth transfer. Tax loss harvesting involves selling investments at a loss to offset capital gains and reduce taxable income, providing immediate tax benefits while maintaining portfolio balance. Explore how these strategies optimize tax efficiency in estate planning and investment management.

Source and External Links

Understanding Step-Up in Basis | Rarick & Bowden Gold, P.A. - Step-up in basis is a U.S. tax provision that adjusts the cost basis of inherited assets to their fair market value at the owner's death, helping heirs reduce capital gains taxes, commonly applied through inheritance, joint ownership, or transfer-on-death accounts.

Step-Up In Basis | TaxEDU Glossary - Tax Foundation - This provision resets the cost basis of inherited assets to their market value at the decedent's death, thereby eliminating capital gains tax on any appreciation before inheritance and reducing tax liability upon sale by the heir.

What is a step-up in cost basis and how can it affect me? | Fidelity - Under IRC Section 1014, inherited assets receive a new tax basis equal to their fair market value at death, allowing heirs to avoid capital gains taxes on prior appreciation and possibly benefit from favorable long-term capital gains rates.

dowidth.com

dowidth.com