Shadow banking involves non-bank financial intermediaries providing services similar to traditional banks but operating outside normal banking regulations, often engaging in activities like securitization and lending. Investment banking focuses on underwriting, mergers and acquisitions, and advisory services for corporations and governments, playing a key role in capital markets. Explore the differences in regulatory frameworks and risk profiles between shadow banking and investment banking to understand their impact on the financial system.

Why it is important

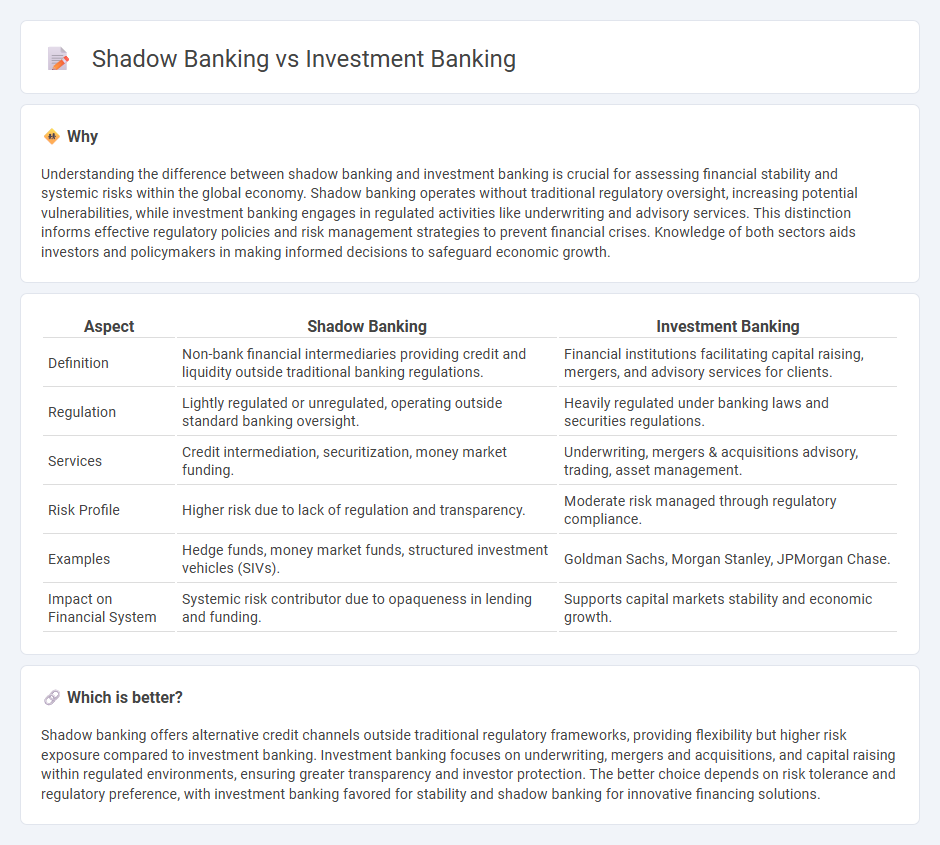

Understanding the difference between shadow banking and investment banking is crucial for assessing financial stability and systemic risks within the global economy. Shadow banking operates without traditional regulatory oversight, increasing potential vulnerabilities, while investment banking engages in regulated activities like underwriting and advisory services. This distinction informs effective regulatory policies and risk management strategies to prevent financial crises. Knowledge of both sectors aids investors and policymakers in making informed decisions to safeguard economic growth.

Comparison Table

| Aspect | Shadow Banking | Investment Banking |

|---|---|---|

| Definition | Non-bank financial intermediaries providing credit and liquidity outside traditional banking regulations. | Financial institutions facilitating capital raising, mergers, and advisory services for clients. |

| Regulation | Lightly regulated or unregulated, operating outside standard banking oversight. | Heavily regulated under banking laws and securities regulations. |

| Services | Credit intermediation, securitization, money market funding. | Underwriting, mergers & acquisitions advisory, trading, asset management. |

| Risk Profile | Higher risk due to lack of regulation and transparency. | Moderate risk managed through regulatory compliance. |

| Examples | Hedge funds, money market funds, structured investment vehicles (SIVs). | Goldman Sachs, Morgan Stanley, JPMorgan Chase. |

| Impact on Financial System | Systemic risk contributor due to opaqueness in lending and funding. | Supports capital markets stability and economic growth. |

Which is better?

Shadow banking offers alternative credit channels outside traditional regulatory frameworks, providing flexibility but higher risk exposure compared to investment banking. Investment banking focuses on underwriting, mergers and acquisitions, and capital raising within regulated environments, ensuring greater transparency and investor protection. The better choice depends on risk tolerance and regulatory preference, with investment banking favored for stability and shadow banking for innovative financing solutions.

Connection

Shadow banking and investment banking are interconnected through their roles in providing alternative financing and capital market activities outside traditional banking regulations. Shadow banking entities, such as hedge funds and money market funds, often engage in securitization and credit intermediation similar to investment banks, facilitating liquidity and risk transfer in the financial system. This symbiotic relationship influences market stability and credit availability by expanding the scope of financial services beyond conventional banking frameworks.

Key Terms

**Investment Banking:**

Investment banking specializes in underwriting, issuing, and facilitating the trading of securities for corporations, governments, and institutions, playing a crucial role in capital markets. It provides advisory services for mergers and acquisitions, restructurings, and fundraising activities, emphasizing regulatory compliance and risk management. Discover more about how investment banking drives financial markets and corporate growth.

Underwriting

Investment banking specializes in underwriting securities, facilitating capital raising through public offerings and private placements, ensuring regulatory compliance and market stability. Shadow banking, operating outside traditional regulatory frameworks, participates less in formal underwriting but often indirectly supports credit creation through non-bank financial intermediaries. Explore the detailed distinctions in underwriting processes between these sectors to deepen your understanding.

Mergers & Acquisitions (M&A)

Investment banking plays a pivotal role in Mergers & Acquisitions (M&A) by providing advisory services, underwriting, and facilitating deal financing, leveraging its regulatory oversight and market expertise. Shadow banking, operating outside traditional banking regulations, supports M&A through alternative financing options but typically lacks the transparency and risk management standards of investment banks. Explore the nuances of M&A processes and financing strategies in both investment and shadow banking sectors to optimize transaction outcomes.

Source and External Links

What is an Investment Banker? | CFA Institute - Investment bankers provide financial services such as capital raising, mergers and acquisitions advisory, and corporate restructuring, supporting clients ranging from startups to governments with complex financial transactions and requiring strong analytical and communication skills.

Investment Banking Overview - Corporate Finance Institute - Investment banking is a specialized division of banks focused on underwriting (raising capital) and advising on mergers and acquisitions, acting as intermediaries between investors and corporations needing funds for growth.

Investment banking - Wikipedia - Investment banking is an advisory financial service distinct from commercial banking, primarily earning fees by advising institutional clients and governments, with activities categorized into "sell side" (trading and underwriting) and "buy side" (investment advice to funds).

dowidth.com

dowidth.com